Question: Please need help with this question - I need assistance with solving the formula- for Scenario B #2 $1499.80(1+0.12/12)^5*12 2. SCENARIO A: Assume a 10%

Please need help with this question - I need assistance with solving the formula- for Scenario B #2 $1499.80(1+0.12/12)^5*12

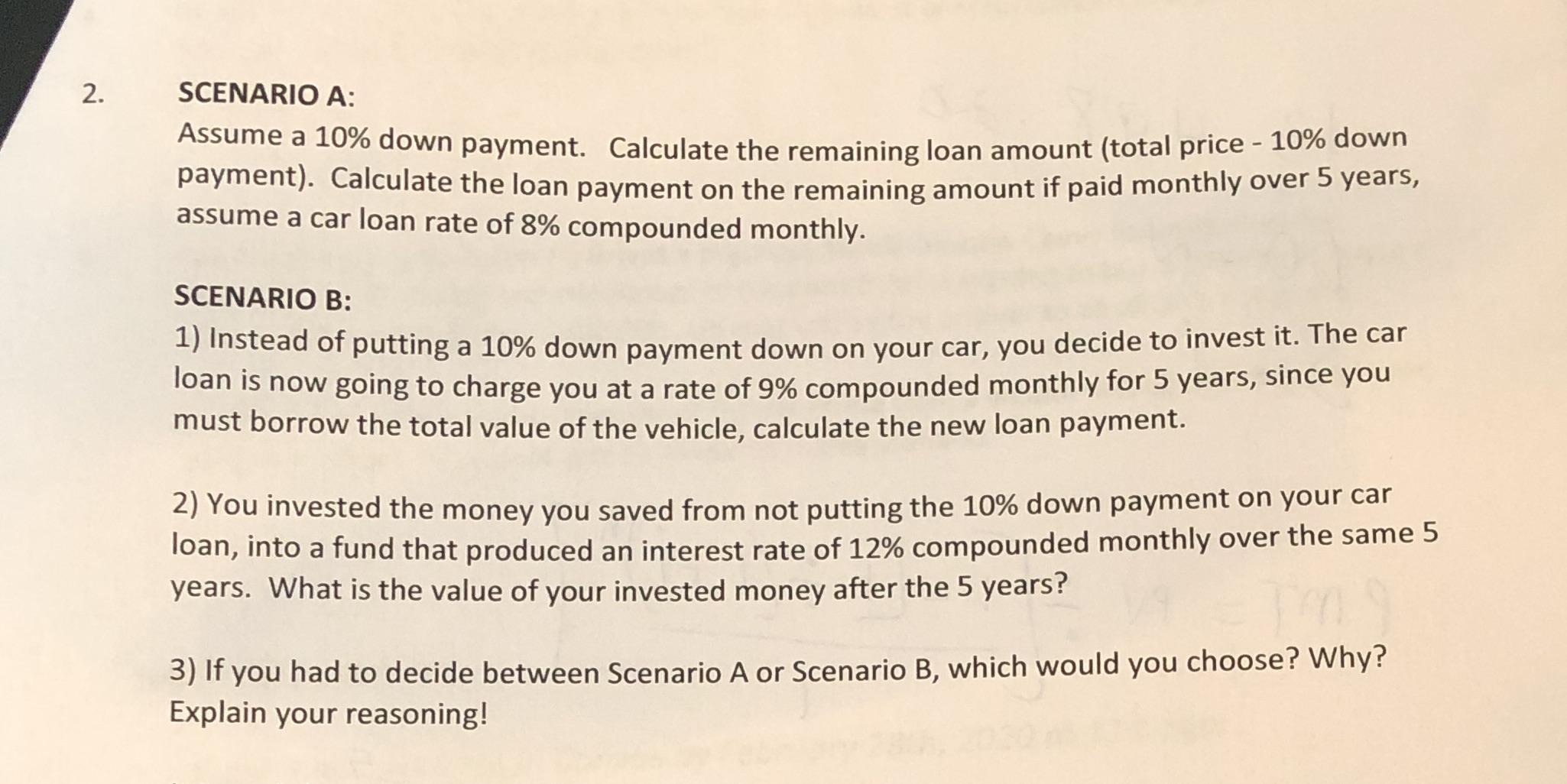

2. SCENARIO A: Assume a 10% down payment. Calculate the remaining loan amount (total price - 10% down payment). Calculate the loan payment on the remaining amount if paid monthly over 5 years, assume a car loan rate of 8% compounded monthly. SCENARIO B: 1) Instead of putting a 10% down payment down on your car, you decide to invest it. The car loan is now going to charge you at a rate of 9% compounded monthly for 5 years, since you must borrow the total value of the vehicle, calculate the new loan payment. 2) You invested the money you saved from not putting the 10% down payment on your car loan, into a fund that produced an interest rate of 12% compounded monthly over the same 5 years. What is the value of your invested money after the 5 years? 3) If you had to decide between Scenario A or Scenario B, which would you choose? Why? Explain your reasoning

2. SCENARIO A: Assume a 10% down payment. Calculate the remaining loan amount (total price - 10% down payment). Calculate the loan payment on the remaining amount if paid monthly over 5 years, assume a car loan rate of 8% compounded monthly. SCENARIO B: 1) Instead of putting a 10% down payment down on your car, you decide to invest it. The car loan is now going to charge you at a rate of 9% compounded monthly for 5 years, since you must borrow the total value of the vehicle, calculate the new loan payment. 2) You invested the money you saved from not putting the 10% down payment on your car loan, into a fund that produced an interest rate of 12% compounded monthly over the same 5 years. What is the value of your invested money after the 5 years? 3) If you had to decide between Scenario A or Scenario B, which would you choose? Why? Explain your reasoning Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts