Question: Please need some help with part G. The data you need to complete this question is in part f. Thank you. g. How would the

Please need some help with part G. The data you need to complete this question is in part f. Thank you.

Please need some help with part G. The data you need to complete this question is in part f. Thank you.

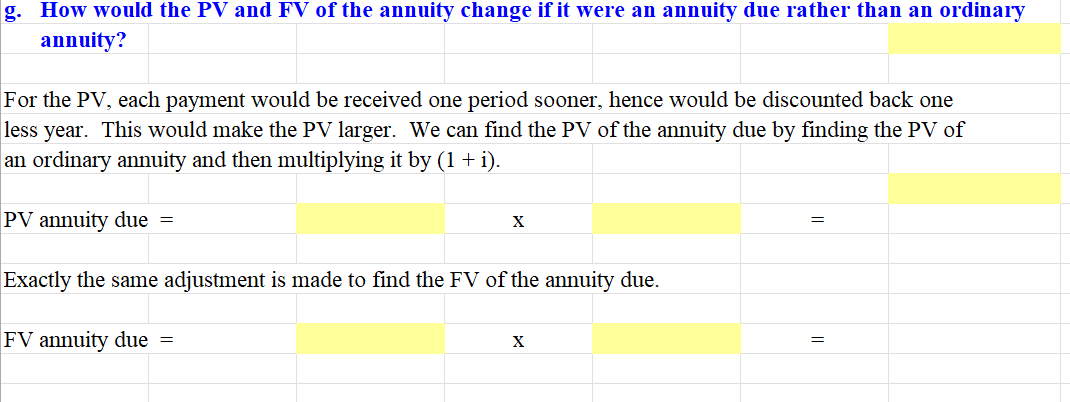

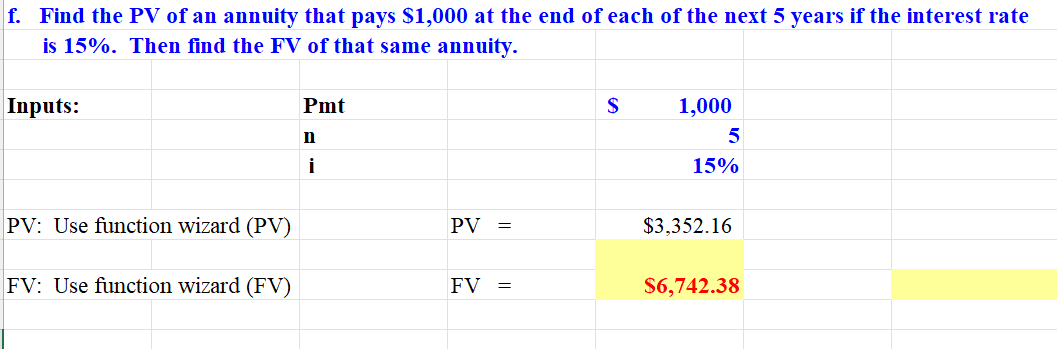

g. How would the PV and FV of the annuity change if it were an annuity due rather than an ordinary annuity? For the PV, each payment would be received one period sooner, hence would be discounted back one less year. This would make the PV larger. We can find the PV of the annuity due by finding the PV of an ordinary annuity and then multiplying it by (1+i). PV annuity due = X = Exactly the same adjustment is made to find the FV of the annuity due. FV annuity due = X = f. Find the PV of an annuity that pays $1,000 at the end of each of the next 5 years if the interest rate is 15%. Then find the FV of that same annuity. Inputs: Pmt S 1,000 5 n i 15% PV: Use function wizard (PV) PV = $3,352.16 FV: Use function wizard (FV) FV = S6,742.38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts