Question: please need to answer the from question 3 till 10 I have provided all material needed thanks 1 4G.IL 9:00 A & Read Only -

please need to answer the from question 3 till 10 I have provided all material needed thanks

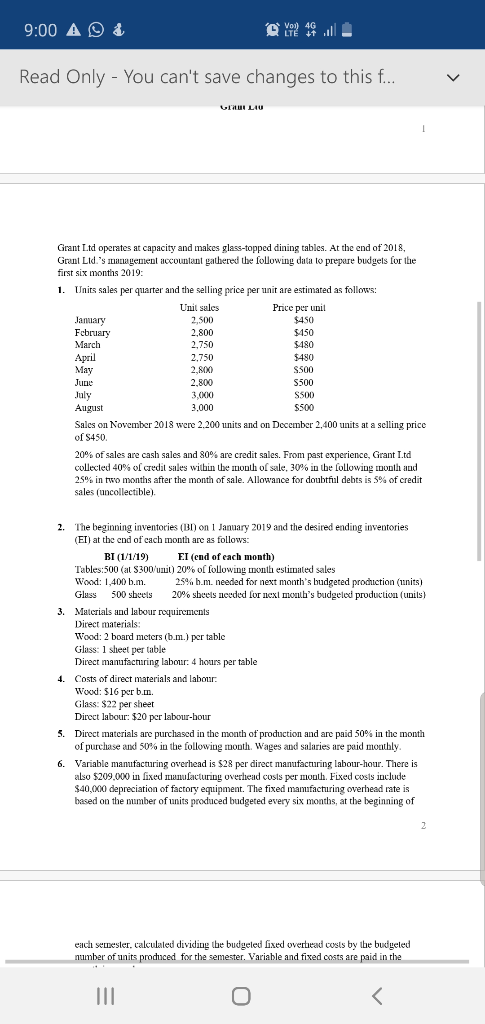

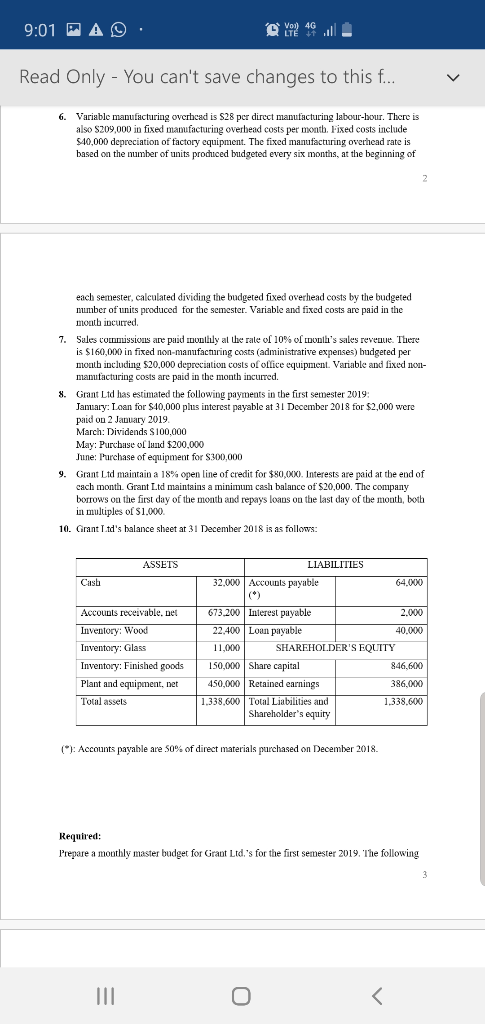

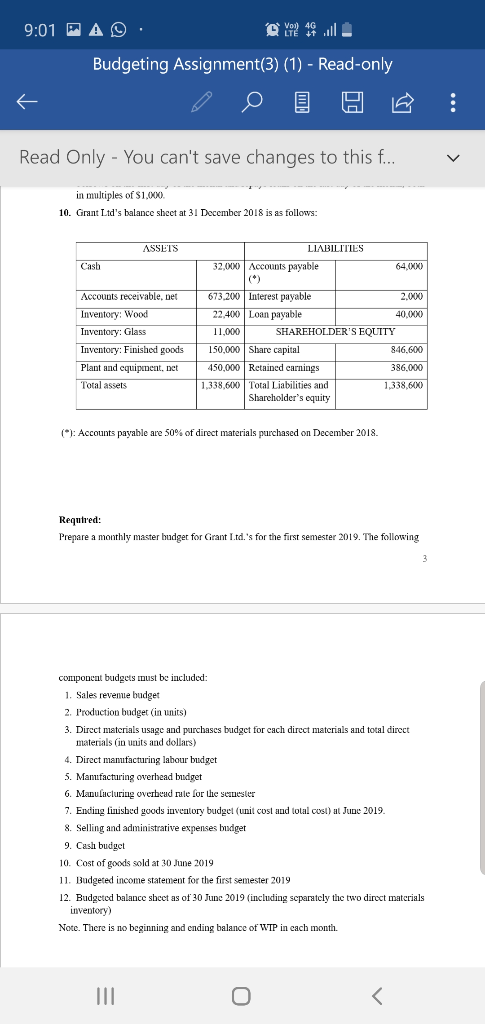

1 4G.IL 9:00 A & Read Only - You can't save changes to this f. Grant Ltd operates at capacity and makes glass-topped dining tables. At the end of 2018, Grant Ltd.'ent accountant gathered the following data lo prepare budgels for the first six months 2019: Units sales per quarter and the seing peice per unit are estimated as follows: Unit sales Price per unil $450 $450 $480 $480 S500 S500 S500 Fcbruary March 2,800 2,750 2.750 2,800 2.800 3,000 3,000 May June uly Sales on November 2018 were 2.200 units and on December 2,400 units at a selling price of S450 20% of sales are cash sales and 80% are credit sales. From past experience, Grant ltd collected 40% ofdredil sales within the month of sale, 30% in ube following month and 25% in two months after the month of sale. Allowance for doubtful debts is 5% of credit sales (uncollectible). 2 The beginning inventories (BD on 1 January 2019 and the desired ending inventories EI) at the end of cach month are as follows: BI (1/119) EI (end of each month) Tables: 500 (al $300/u1u1) 20% of following month estimated sales Wood: 1 .400 b.m. 25% h.m. needed for next month's budgeted production (units Glass 500 sheels 20% sheels needed lor nexi mont's budgeled production (unis} Matcrials and labour roquirements Direct materials: Wood: 2 board meters (b.m.) per table Glass: 1 sheet per table Direct manufacuring labour: 4 hoars per table 3. 4. Costs of direct materials and labour Woxd: S16 per b.m. Glass: $22 per sheet Direct labour: $20 per labour-hour Direct materials are purchased in the month of production and are paid 50% in the month of purchase and 50% in the following month. wages and salaries are paid monthly 5. 6. Variable manufacturing overhead is $28 per direct manufacturing labour-hour. There is also $209,00 in fixed manufacturing overhead costs per month. Fixed costs include $40,000 depreciation of factory equipment. The fixed mamufacturing overhead rate is based on the umber of units produced budgeted every six months, at the beginning of each seeter calculaled dividing the budgeled ixed overuead cosls by the budgeled umber of units procdhuced ble and fixed costs are paid in 9:01 A Read Only - You can't save changes to this f. 6. Variable manufacturing ovcrhcad is S28 per direct manufacturing labour-bour. There is also S209,000 in fixed manufacturing overbead costs per month. Fixed costs include $40,000 depreciation of factory equipment. The fixed manufacturing overhead rate is based on the number of units procuced budgeted every six months, at the beginning of each semester, calculated dividing the budgeted fixed overhead costs by the budgeted number of units produced for the semester. Variable and fixed costs are paid in the montb incutred. 7. Sales commissions are paid monthly al te rate of 10% of mont's sales revenue. There is $160,000 in fixed non-manufacturing costs (administrative expenses) budgeted per month including $20,000 depreciation costs of ollice equipme Variable and fixed manutacturing costs are paid in the month incurred. Grant Ltd has estimated tbe following payments in tbe first semester 2019: Jamary: Loan for $40,000 phus interest payable at 31 December 2018 for $2,000 were paid ou 2 Jauuary 2019 March: TDividends $100.000 May: Purchase ol land $200,000 8. Purchase of eipment for S300,000 Grant Ltd maintain a 18% open line of credit for $80,000. Interests are paid at the end of cach month. Grant Ltd maintains a minimum cash balanc of S20,000. The company borrows on the first day of the month and repays loaus on the last day of tbe mouth, both in multiples of S1.000. 9. 10. Grant T td's balance sheet at 31 December 2018 is as follows ASSETS LIABILITIES 32,000 Accounls payable Casb 64.000 Accounts receivable. net Inventory: Wood Inventory: Glass 673.200 Interest payable 2.000 22.400 Loan payable 11,000 40.000 SHAREHOLDER'S EQUITY Finished goods50,000 Share capital 846,600 386,000 1.338.600 Plant and equipment, net Total assets 450,000Retained earnings 1.338,600 Total Liabilities Shareholder's equity (*): Accounts payable are 50% of direct materials purchased on December 2018. Required: Prepare a mouthly master budget for Graut Ltd. 's for the first semester 2019. The following 9:01 A Budgeting Assignment(3) (1) - Read-only Read Only - You can't save changes to this f.. in multiples of S1,000 10. Grant Ltd's balance shect at 31 Deccmbcr 2018 is as follows ASSETS LIABILITIES Cash 32,00 Accounts payable 64,000 Accounts receivable, net Inventory: Wood Inventory: Glass Inventory: Finished goods150,000 Share capital Plant and equipment, net Total assets 673,200 Interest payable 22.400 Loan payable 11.000 2.000 40000 SHAREHOLDER'S EQUITY 846.600 386.000 1338,600 450,000 Retained carnings ,338,60Total Liabilities a Shareholder's equity (*): Accounts payable are 50% of direct materials purchased on December 2018. Required: Prenare a monthly master hudget for Grant Ltd.'s for the first semester 2019. The following componcnt budgets must be included: 1. Sales revenue budget 2. Production budget (in units) 3. Direct materials usage and purchases budget for cach direct materials and total direct materials (in uaits and dollars) 4. Direct manufacturing lahour budget 5. Manufacturing overhead budget 6. Manulacluringerbeud rale for the semester 7. Ending linisbed goods inventory budgel (unit cost and total cost) t June 2019 8. Selling and administrative expenses budget 9. Cash budgct IO. Cost of goods sold at 30 une 2019 11. Budgered income statement for the first semester 2019 12. Budgcted balance sheet as of 30 June 2019 (including scparatcly the two direct materials nventory) Notc. There is no beginning and ending balance of WIP in each month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts