Question: please need urgent answer for this question thanks It is July 30, 2013. The cheapest-to-deliver bond in a September 2012 Treasury bond futures contract is

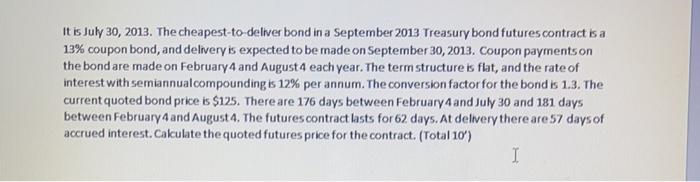

It is July 30, 2013. The cheapest-to-deliver bond in a September 2012 Treasury bond futures contract is a 13% coupon bond, and delivery is expected to be made on September 30, 2013. Coupon payments on the bond are made on February 4 and August 4 each year. The term structure is flat, and the rate of interest with semiannualcompounding is 12% per annum. The conversion factor for the bond is 1.3. The current quoted bond price is $125. There are 176 days between February 4 and July 30 and 181 days between February 4 and August 4. The futures contract lasts for 62 days. At delivery there are 57 days of accrued interest. Calculate the quoted futures price for the contract. (Total 10')

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts