Question: PLEASE NO EXCEL!! i need them both worked out by hand 12-20 A An automaker is buying some special tools for $100,000. The tools are

PLEASE NO EXCEL!! i need them both worked out by hand

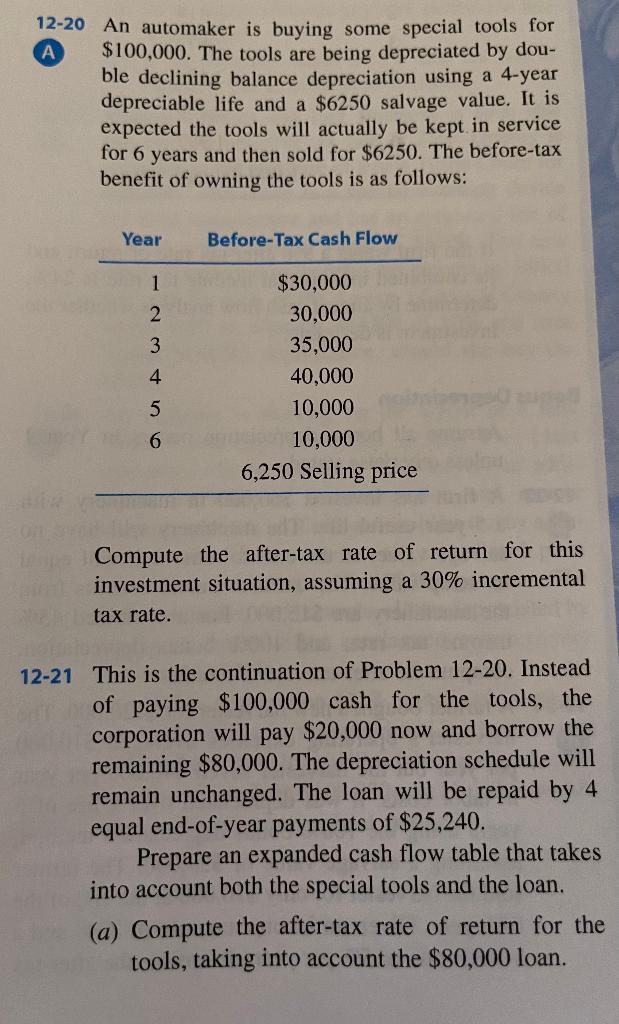

12-20 A An automaker is buying some special tools for $100,000. The tools are being depreciated by dou- ble declining balance depreciation using a 4-year depreciable life and a $6250 salvage value. It is expected the tools will actually be kept in service for 6 years and then sold for $6250. The before-tax benefit of owning the tools is as follows: Year Before-Tax Cash Flow 1 2 3 4 5 $30,000 30,000 35,000 40,000 10,000 10,000 6,250 Selling price 6 Compute the after-tax rate of return for this investment situation, assuming a 30% incremental tax rate. 12-21 This is the continuation of Problem 12-20. Instead of paying $100,000 cash for the tools, the corporation will pay $20,000 now and borrow the remaining $80,000. The depreciation schedule will remain unchanged. The loan will be repaid by 4 equal end-of-year payments of $25,240. Prepare an expanded cash flow table that takes into account both the special tools and the loan. (a) Compute the after-tax rate of return for the tools, taking into account the $80,000 loan. (6) Explain why the rate of return obtained in part (a) is different from the rate of return obtained in Problem 12-20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts