Question: Please no hand written answer Chapter No. 06 - Interest Rate Risk: The Duration Model ID: Name: Problem. 01: What is the duration of a

Please no hand written answer

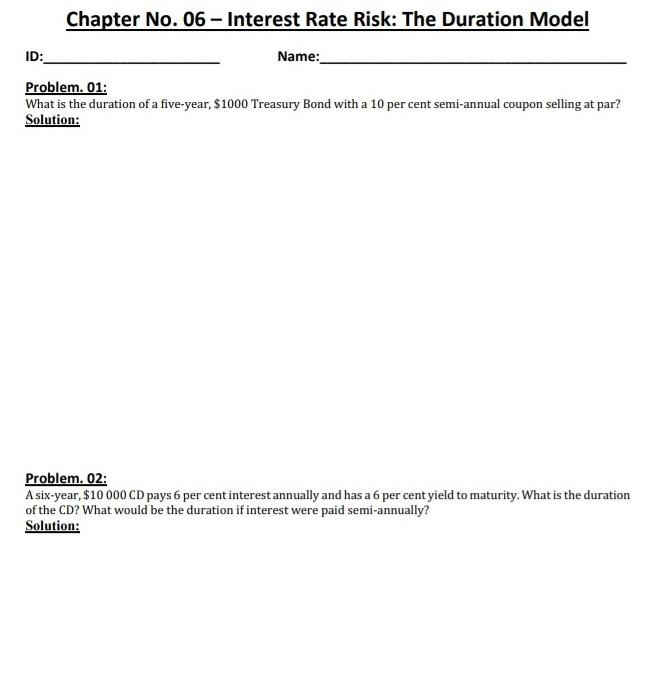

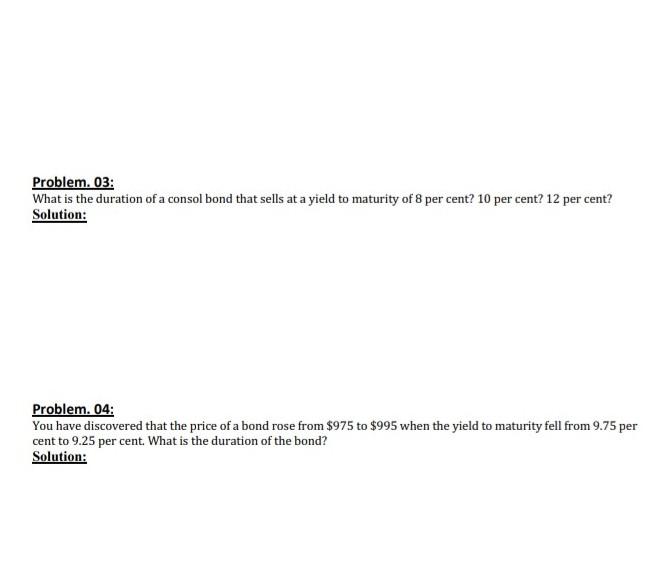

Chapter No. 06 - Interest Rate Risk: The Duration Model ID: Name: Problem. 01: What is the duration of a five-year, $1000 Treasury Bond with a 10 per cent semi-annual coupon selling at par? Solution: Problem. 02: A six-year, $10 000 CD pays 6 per cent interest annually and has a 6 per cent yield to maturity. What is the duration of the CD? What would be the duration if interest were paid semi-annually? Solution: Problem. 03: What is the duration of a consol bond that sells at a yield to maturity of 8 per cent? 10 per cent? 12 per cent? Solution: Problem. 04: You have discovered that the price of a bond rose from $975 to $995 when the yield to maturity fell from 9.75 per cent to 9.25 per cent. What is the duration of the bond? Solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts