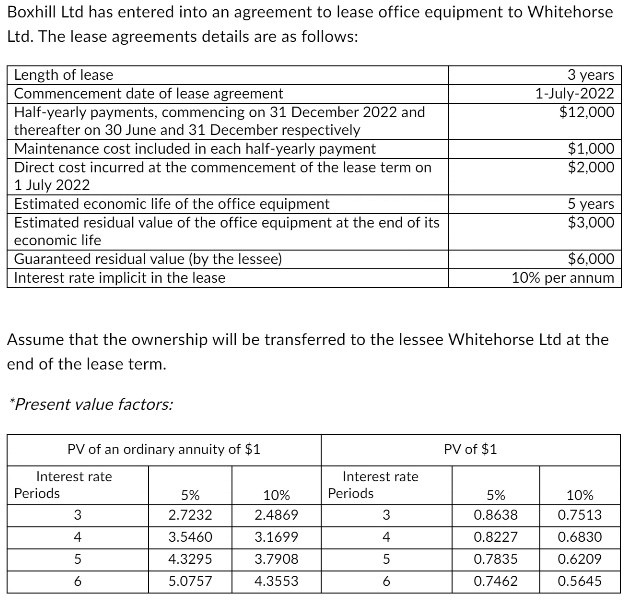

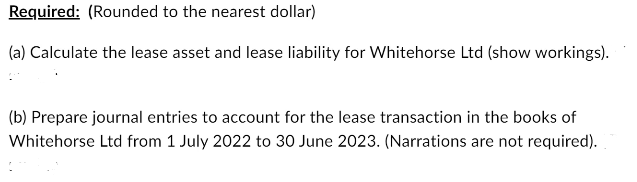

Question: Please no handwriting, just type the answer. Please do NOT use AI (ChatGPT) Boxhill Ltd has entered into an agreement to lease office equipment to

Please no handwriting, just type the answer. Please do NOT use AI (ChatGPT)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock