Question: PLEASE NOT THESE NUMBERS are wrong 13,148.79; 17,474.05 PLEASE PROVIDE THE CORRECT NUMBERS I went ahead and submitted and the answer they provided is shown

PLEASE NOT THESE NUMBERS are wrong 13,148.79; 17,474.05

PLEASE PROVIDE THE CORRECT NUMBERS

I went ahead and submitted and the answer they provided is shown below

a.

| The accounting break-even is the aftertax sum of the fixed costs and depreciation charge divided by the aftertax contribution margin (selling price minus variable cost). So, the accounting break-even level of sales is: |

| QA = [(FC + Depreciation)(1 TC)] / [(P VC)(1 TC)] |

| QA = [($380,000 + $750,000 / 6) (1 .34)] / [($35.50 6.60) (1 .34)] |

| QA = 17,474.05, or about 17,474 units |

b.

| When calculating the financial break-even point, we express the initial investment as an equivalent annual cost (EAC). Dividing the initial investment by the six-year annuity factor, discounted at 13 percent, the EAC of the initial investment is: |

| EAC = Initial Investment / PVIFA13%,6 |

| EAC = $750,000 / 3.99755 |

| EAC = $187,614.92 |

| Note that this calculation solves for the annuity payment with the initial investment as the present value of the annuity. In other words: |

| PVA = C({1 [1 / (1 + R)t]} / R) |

| $750,000 = C{[1 (1 / 1.136)] / .13} |

| C = $187,614.92 |

| Now we can calculate the financial break-even point. The financial break-even point for this project is: |

| QF = [EAC + FC(1 TC) D(tC)] / [(P VC)(1 TC)] |

| QF = [$187,614.92 + $380,000(.66) ($750,000 / $6)(.34)] / [($35.50 6.60) (.66)] |

| QF = 20,756.79, or about 20,757 units |

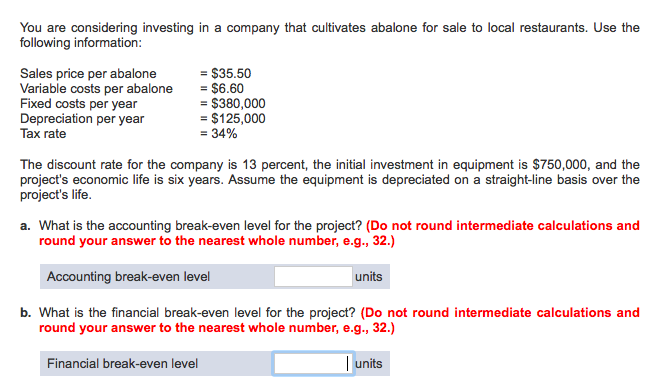

You are considering investing in a company that cultivates abalone for sale to local restaurants. Use the following information: The discount rate for the company is 13 percent, the initial investment in equipment is $750,000, and the project's economic life is six years. Assume the equipment is depreciated on a straight-line basis over the project's life. What is the accounting break-even level for the project? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Accounting break-even level units What is the financial break-even level for the project? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Financial break-even level units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts