Question: Please note I have also tried 1.687 which did not work. Compute, Disaggregate, and Interpret ROE Selected fiscal year balance sheet and income statement information

Please note I have also tried 1.687 which did not work.

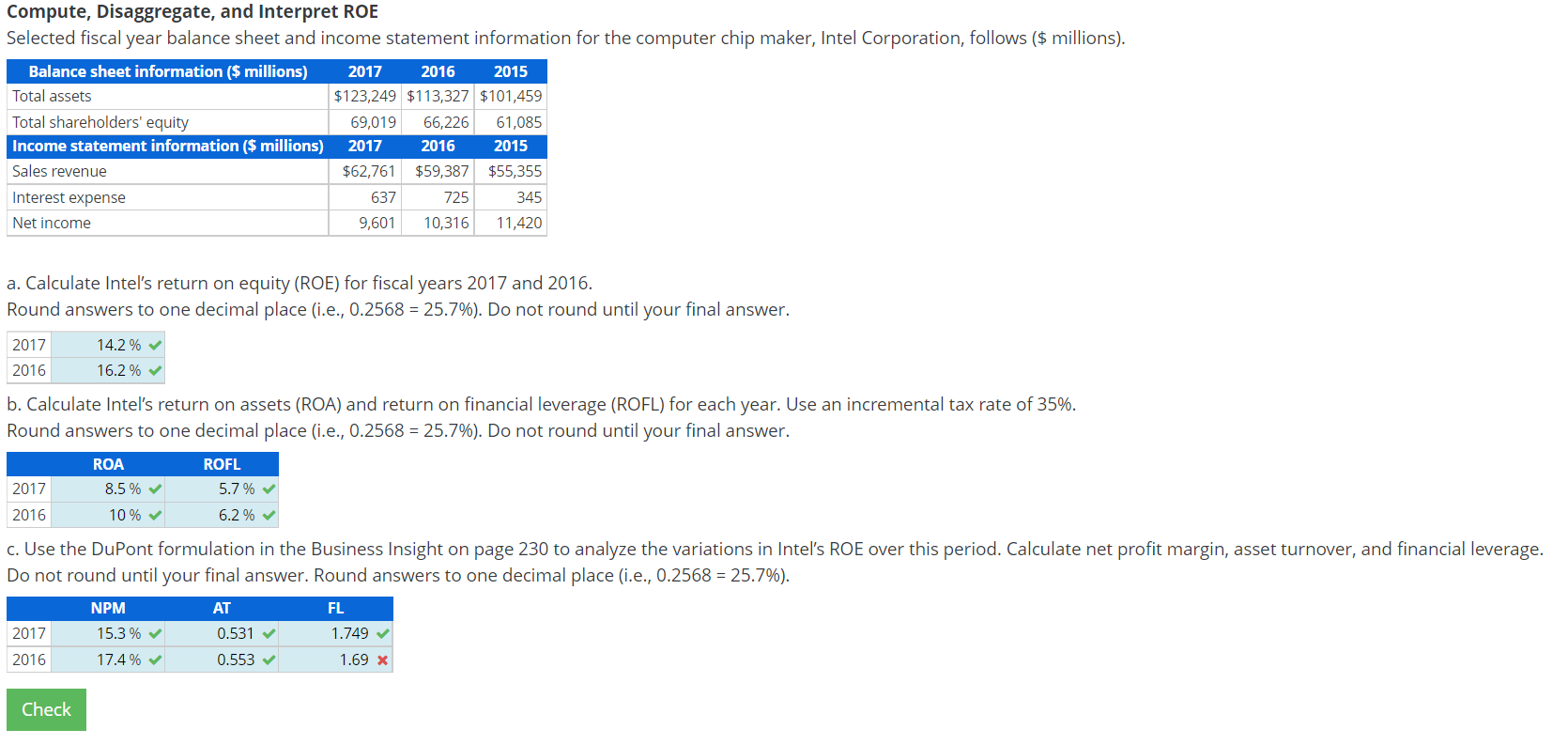

Compute, Disaggregate, and Interpret ROE Selected fiscal year balance sheet and income statement information for the computer chip maker, Intel Corporation, follows ($ millions). Balance sheet information ($ millions) 2017 2016 2015 Total assets $123,249 $113,327 $101,459 Total shareholders' equity 69,019 66,226 61,085 Income statement information ($ millions) 2017 2016 2015 Sales revenue $62,761 $59,387 $55,355 Interest expense 637 725 345 Net income 9,601 10,316 11,420 a. Calculate Intel's return on equity (ROE) for fiscal years 2017 and 2016. Round answers to one decimal place (i.e., 0.2568 = 25.7%). Do not round until your final answer. 2017 2016 14.2 % 16.2% b. Calculate Intel's return on assets (ROA) and return on financial leverage (ROFL) for each year. Use an incremental tax rate of 35%. Round answers to one decimal place (i.e., 0.2568 = 25.7%). Do not round until your final answer. 2017 ROA 8.5 % 10% ROFL 5.7 % 6.2 % 2016 c. Use the DuPont formulation in the Business Insight on page 230 to analyze the variations in Intel's ROE over this period. Calculate net profit margin, asset turnover, and financial leverage. Do not round until your final answer. Round answers to one decimal place (i.e., 0.2568 = 25.7%). NPM AT FL 2017 15.3 % 0.531 1.749 2016 17.4% 0.553 1.69 X Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts