Question: (PLEASE NOTE, I ONLY NEED THE BOTTOM PORTION OF THIS ASSIGNMENT, i HAVE EVERYTHING FROM THE GRAPH UP COMPLETED, PLEASE START WITH THE FIRST QUESTION

(PLEASE NOTE, I ONLY NEED THE BOTTOM PORTION OF THIS ASSIGNMENT, i HAVE EVERYTHING FROM THE GRAPH UP COMPLETED, PLEASE START WITH THE FIRST QUESTION UNDERNEATH THE GRAPH, AND CHANGE THE YIELD FROM 1.8% TO 1.3% IN QUESTIONS 1 and 3)!!!!!

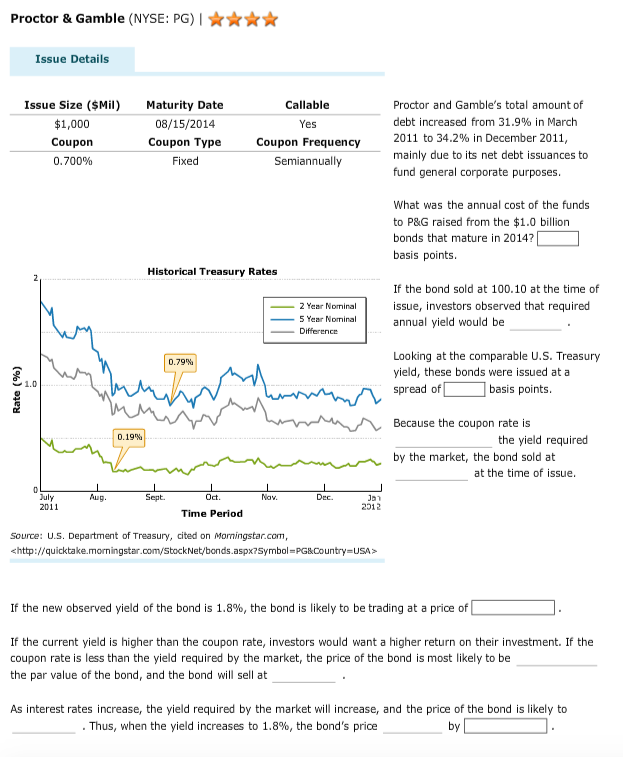

Proctor & Gamble (NYSE: PG) | Proctor & Gamble (NYSE: PG) I Issue Details Issue Size ($Mil) $1,000 Coupon 0.700% Maturity Date 08/15/2014 Coupon Type Fixed Callable Yes Coupon Frequency Semiannually Proctor and Gamble's total amount of debt increased from 31.9% in March 2011 to 34.2% in December 2011, mainly due to its net debt issuances to fund general corporate purposes What was the annual cost of the funds to P&G raised from the $1.0 billion bonds that mature in 2014? basis points Historical Treasury Rates 2 Year Nominal 5 Year Nominal Difference If the bond sold at 100.10 at the time of issue, investors observed that required annual yield would be Looking at the comparable U.S. Treasury yield, these bonds were issued at a spread of 0.79% 1.0 basis points Because the coupon rate is 0.19% the yield required by the market, the bond sold at at the time of issue uly 2011 Aug. Sept. Oct Nav. Dec. 2012 Time Period Source: U.S. Department of Treasury, cited on Morningstar.com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts