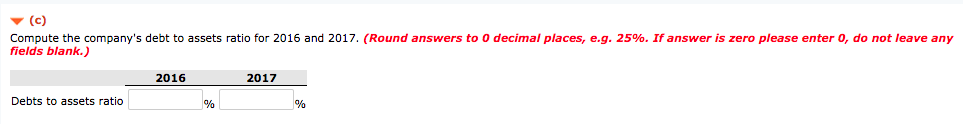

Question: PLEASE NOTE: If needed to figure out the Debts to assets ration the Return on Common Stockholders' Equity was 7.5% for 2016 & 7.1% for

PLEASE NOTE: If needed to figure out the Debts to assets ration the Return on Common Stockholders' Equity was 7.5% for 2016 & 7.1% for 2017.

PLEASE NOTE: If needed to figure out the Debts to assets ration the Return on Common Stockholders' Equity was 7.5% for 2016 & 7.1% for 2017.

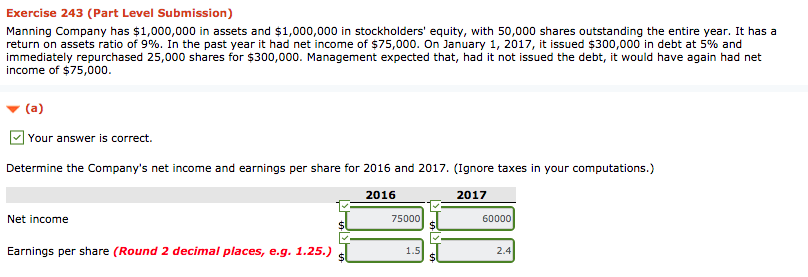

Exercise 243 (Part Level Submission) Manning Company has $1,000,000 in assets and $1,000,000 in stockholders' equity, with 50,000 shares outstanding the entire year. It has a return on assets ratio of 9%. In the past year it had net income of $75,000. On January 1, 2017, it issued $300,000 in debt at 5% and immediately repurchased 25,000 shares for $300,000. Management expected that, had it not issued the debt, it would have again had net income of $75,000 ? (a) Your answer is correct. Determine the Company's net income and earnings per share for 2016 and 2017. (Ignore taxes in your computations.) 2016 2017 Net income 98 60000 Earnings per share (Round 2 decimal places, e.g. 1.25.) 1.5 2.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts