Question: Please note: Kindly provide an interpretation for part (b) only. Part (a) is for reference. For monthly excess returns on the S&P 500 index from

Please note: Kindly provide an interpretation for part (b) only. Part (a) is for reference.

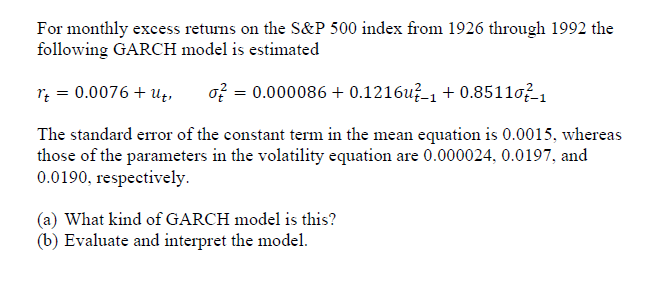

For monthly excess returns on the S&P 500 index from 1926 through 1992 the following GARCH model is estimated rt 0.0076 + ut, ?-0 t-1 The standard error of the constant term in the mean equation is 0.0015, whereas those of the parameters in the volatility equation are 0.000024, 0.0197, and 0.0190, respectively. (a) What kind of GARCH model is this? (b) Evaluate and interpret the model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts