Question: Please note: Minimum demand for X-100 is 625 and not 750, also Production times are given in minutes per unit , not minimum per unit.

Please note: Minimum demand for X-100 is 625 and not 750, also Production times are given in minutes per unit, not minimum per unit. Also, each employee works 300 hours a month.

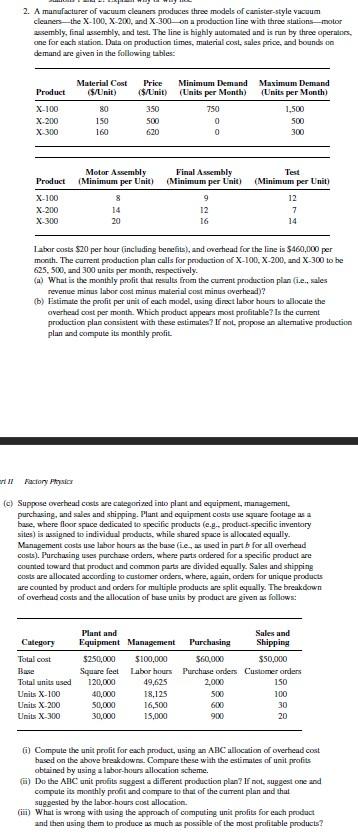

2. A manufacturer of vacuum cleaners produces three models of canister-style vacuum cleaners--the X-100, X-200, and X-300-on a production line with three stations--motor assembly, final assembly, and test. The line is highly automated and is run by three aperales, one for each station. Dala on production times, material cost sales price, and bounds on demand are given in the following tables Product X 100 X 200 X-300 Material Cost ($/Unit) 80 150 Price ($/Unit) 350 500 620 Minimum Demand Maximum Demand (Linits per Month) (Units per Month) 750 1,500 0 500 0 160 900 Test Motor Assembly (Minimum per Unit) Final Assembly (Minimum per unit) Product (Minimum per Unit) X-100 X-200 X300 8 14 20 9 12 16 12 7 14 Labor costs $20 per hour (including benefits), and overhead for the line is $460.000 per mooth. The current production plan calls for peoduction of X-100, X-200 and X-300 to be 625, 500, and 300 units per month, respectively. a) What is the monthly profit that results from the current production plan (i.e. sales revenue minus labor cost minus material cost minus overhead? (b) Estimate the profit per unit of each model, using direct labor hours to allocate the overhead cost per month. Which product appears most profitable? Is the current production plan consistent with these estimates? If not propose an altemative production plan and compute its monthly profil Il Factory s (C) Suppose overhead costs are categorized into plant and equipment, management purchasing, and sales and shipping. Plant and equipment costs use square footage as a base, where floor space dedicated to specific products (e.g-product-specific inventory sites) is assigned to individual products, while shared space is allocated equally. Management costs use labor hours is the base (ie, as used in part b for all overhead b costs). Purchasing uses purchase orders, where parts ordered for a specific product are counted toward that product and common parts are divided equally. Sales and shipping costs are allocated according to customer onders, where again, ordens for unique products we counted by product and orders for multiple products are split equally. The breakdown of ovestead costs and the allocution of base units by product are given as follows: Categor Total cost Base Total units used Units X-100 Units X-200 Units X-300 Plant and Sales and Equipment Management Purchasing Shipping $250,000 $100,000 $60,000 $50,000 Square feet Labor hours Purchase orders Customer orders 120,000 49,625 2,000 150 40,000 18.125 500 100 50,000 16,500 600 30 30,000 15,000 900 20 6) Compute the unit profit for each product, using an ABC allocation of overhead cost based on the above breakdows. Compare these with the estimates of unit profits obtained by using a labor hours allocation scheme. c) Do the ABC unit profits suggest a different production plan? If not, suggest one and compute its monthly profit and compare to that of the current plan and that suggested by the labor hours et allocation. (im) What is wrong with using the approach of computing unit profits for each product and then using them to produce as much as possible of the most profitable products

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts