Question: Please note, push back project A by two years before analysis Question 1 (25 points): An investor has two investment alternatives, Project A and Project

Please note, push back project A by two years before analysis

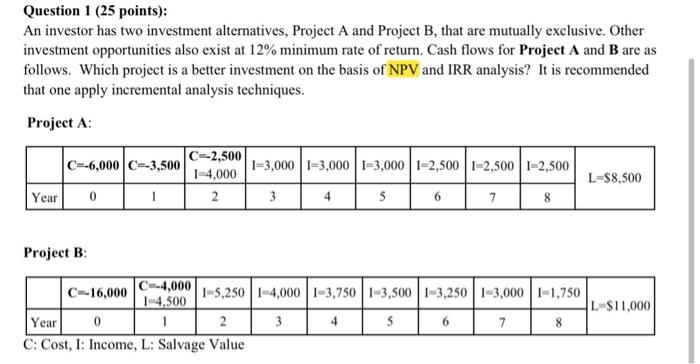

Please note, push back project A by two years before analysisQuestion 1 (25 points): An investor has two investment alternatives, Project A and Project B, that are mutually exclusive. Other investment opportunities also exist at 12% minimum rate of return. Cash flows for Project A and B are as follows. Which project is a better investment on the basis of NPV and IRR analysis? It is recommended that one apply incremental analysis techniques. Project A: 1=3,000 1=3,000 1=3,000 1=2,500 1-2,50012,500 C-2,500 C--6,000C-3,500 1-4,000 Year 0 L=$8,500 3 4 5 6 7 8 Project B: L $11,000 C-16,000 C-4,000 1-5,2501-4,000 1-3,7501-3,5001-3,250 1-3,000 1-1,750 14,500 Year 0 1 2 3 4 5 7 8 C: Cost, 1: Income, L: Salvage Value 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts