Question: Please note that ALL questions are TRUE/FALSE questions. Please READ ALL questions CAREFULLY and answer ALL questions CORRECTLY. Please DOUBLE CHECK your answer BEFORE posting

Please note that ALL questions are TRUE/FALSE questions. Please READ ALL questions CAREFULLY and answer ALL questions CORRECTLY. Please DOUBLE CHECK your answer BEFORE posting the solution. Any WRONG OR MISSING answers will be DOWNVOTED. Thank you!

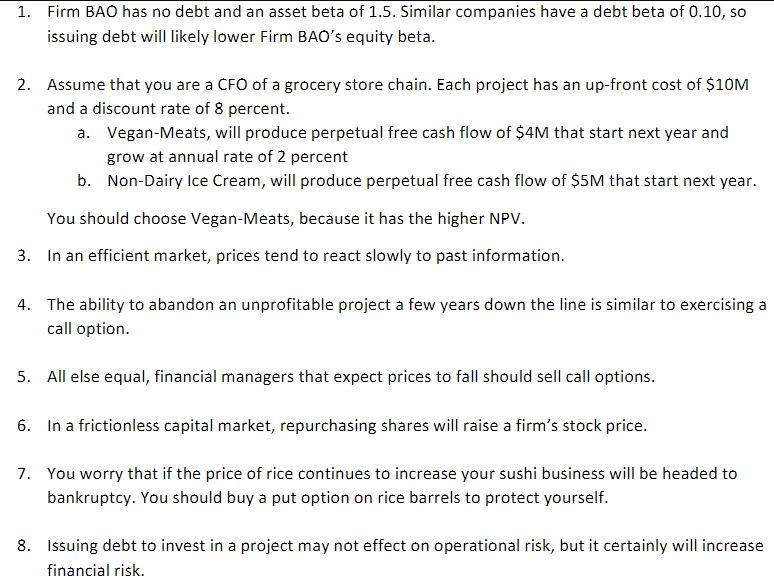

1. Firm BAO has no debt and an asset beta of 1.5. Similar companies have a debt beta of 0.10 , so issuing debt will likely lower Firm BAO's equity beta. 2. Assume that you are a CFO of a grocery store chain. Each project has an up-front cost of $10M and a discount rate of 8 percent. a. Vegan-Meats, will produce perpetual free cash flow of $4M that start next year and grow at annual rate of 2 percent b. Non-Dairy Ice Cream, will produce perpetual free cash flow of $5M that start next year. You should choose Vegan-Meats, because it has the higher NPV. 3. In an efficient market, prices tend to react slowly to past information. 4. The ability to abandon an unprofitable project a few years down the line is similar to exercising a call option. 5. All else equal, financial managers that expect prices to fall should sell call options. 6. In a frictionless capital market, repurchasing shares will raise a firm's stock price. 7. You worry that if the price of rice continues to increase your sushi business will be headed to bankruptcy. You should buy a put option on rice barrels to protect yourself. 8. Issuing debt to invest in a project may not effect on operational risk, but it certainly will increase financial risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts