Question: PLEASE NOTE THAT ANSWERED a, b and c. I only need the answer for (d) and (e). Thank you Below my answer for a, b

PLEASE NOTE THAT ANSWERED a, b and c. I only need the answer for (d) and (e). Thank you

Below my answer for a, b and c:

Answer for Question A

To compute the cost of producing units during a given month using Variable Costing, we must consider the various expenses directly tied to their production. The sum of these expenses will provide us with the unit product cost.

Selling price: $185

Direct materials: $54

Direct labor: $64.50

Manufacturing overhead: $4.50

Total Variable Cost per Unit = Direct materials + Direct labor + Manufacturing overhead

Total Variable Cost per Unit = $54 + $64.50 + $4.50

Total Variable Cost per Unit = $123

Answer for B

Variable Costing Income Statement

| Sales (14,200 x RM185) | RM2,627,000 | |

| Less: Variable expenses | ||

| Beginning Inventory (600 units x RM123) | RM73,800 | |

| Add: Variable cost of goods manufactured (13,800 units x RM123) | 1,697,400 | |

| Variable cost of goods available for sale | 1,771,200 | |

| Less: Ending Inventory (200 units x RM123) | 24,600 | |

| Total Variable cost of goods sold | 1,746,600 | |

| Gross Contribution Margin | 880,400 | |

| Less: Variable selling and administrative expense (14,200 units x RM16.50) | 234,300 | |

| Contribution Margin | 646,100 | |

| Less: Fixed Expenses | ||

| Fixed Manufacturing overhead | 195,000 | |

| Fixed Selling and administrative cost | 75,000 | |

| Total Fixed Expenses | 270,000 | |

| Net Operating Income | RM376,100 |

Answer for Question C

Variable Costing Operating Income: RM376,100

Less: Fixed Manufacturing Overhead in Net Inventory: RM5,652

Absorption Costing Operating Income: RM376,100 - RM5,652

= RM370,448

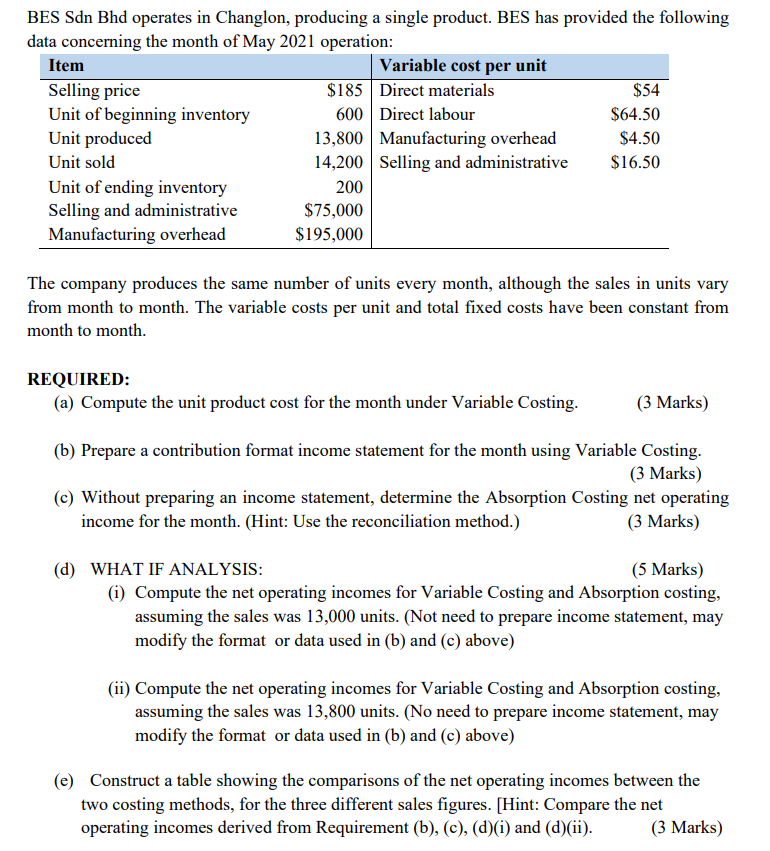

BES Sdn Bhd operates in Changlon, producing a single product. BES has provided the following data concerning the month of May 2021 operation: The company produces the same number of units every month, although the sales in units vary from month to month. The variable costs per unit and total fixed costs have been constant from month to month. REQUIRED: (a) Compute the unit product cost for the month under Variable Costing. (3 Marks) (b) Prepare a contribution format income statement for the month using Variable Costing. (3 Marks) (c) Without preparing an income statement, determine the Absorption Costing net operating income for the month. (Hint: Use the reconciliation method.) (3 Marks) (d) WHAT IF ANALYSIS: (5 Marks) (i) Compute the net operating incomes for Variable Costing and Absorption costing, assuming the sales was 13,000 units. (Not need to prepare income statement, may modify the format or data used in (b) and (c) above) (ii) Compute the net operating incomes for Variable Costing and Absorption costing, assuming the sales was 13,800 units. (No need to prepare income statement, may modify the format or data used in (b) and (c) above) (e) Construct a table showing the comparisons of the net operating incomes between the two costing methods, for the three different sales figures. [Hint: Compare the net operating incomes derived from Requirement (b), (c), (d)(i) and (d)(ii)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts