Question: Please note that exhibit 9 is second image. Calculate the total fixed costs for the active-wear opportunity. (Hint - Use the template in exhibit 9.

Please note that exhibit 9 is second image.

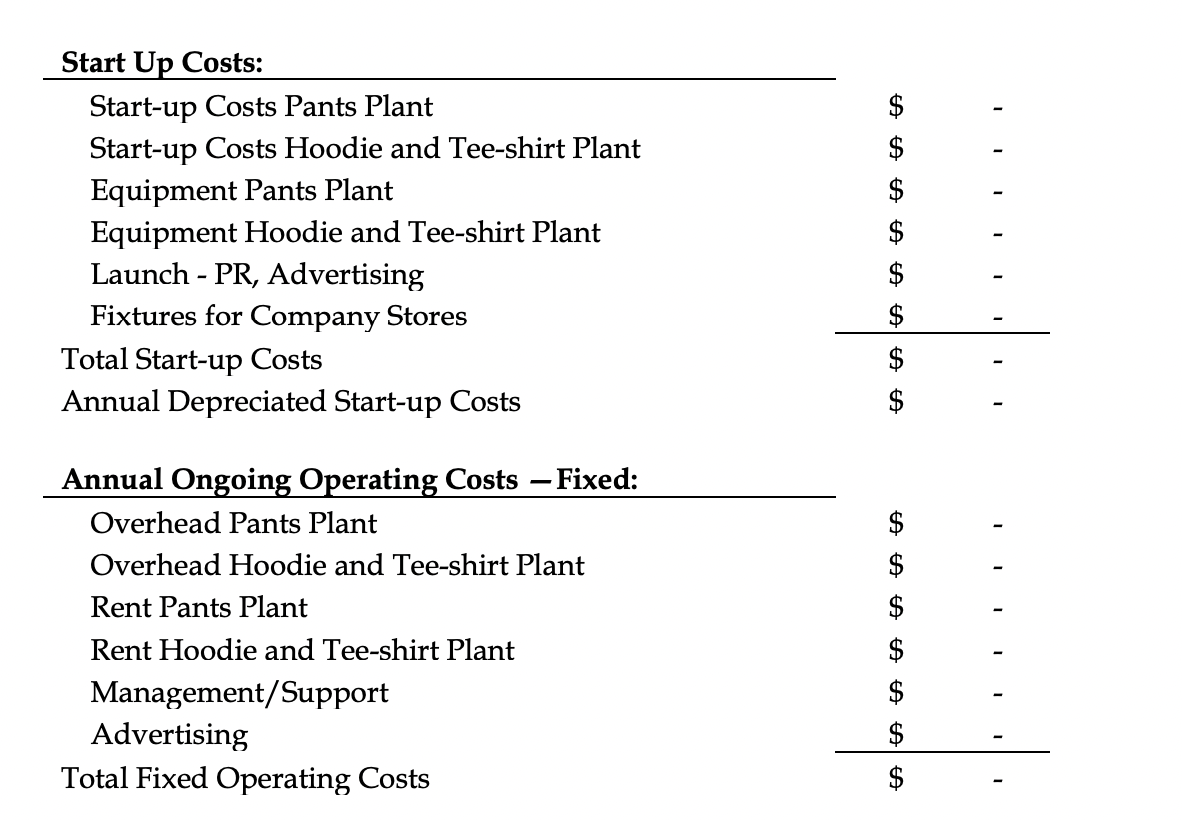

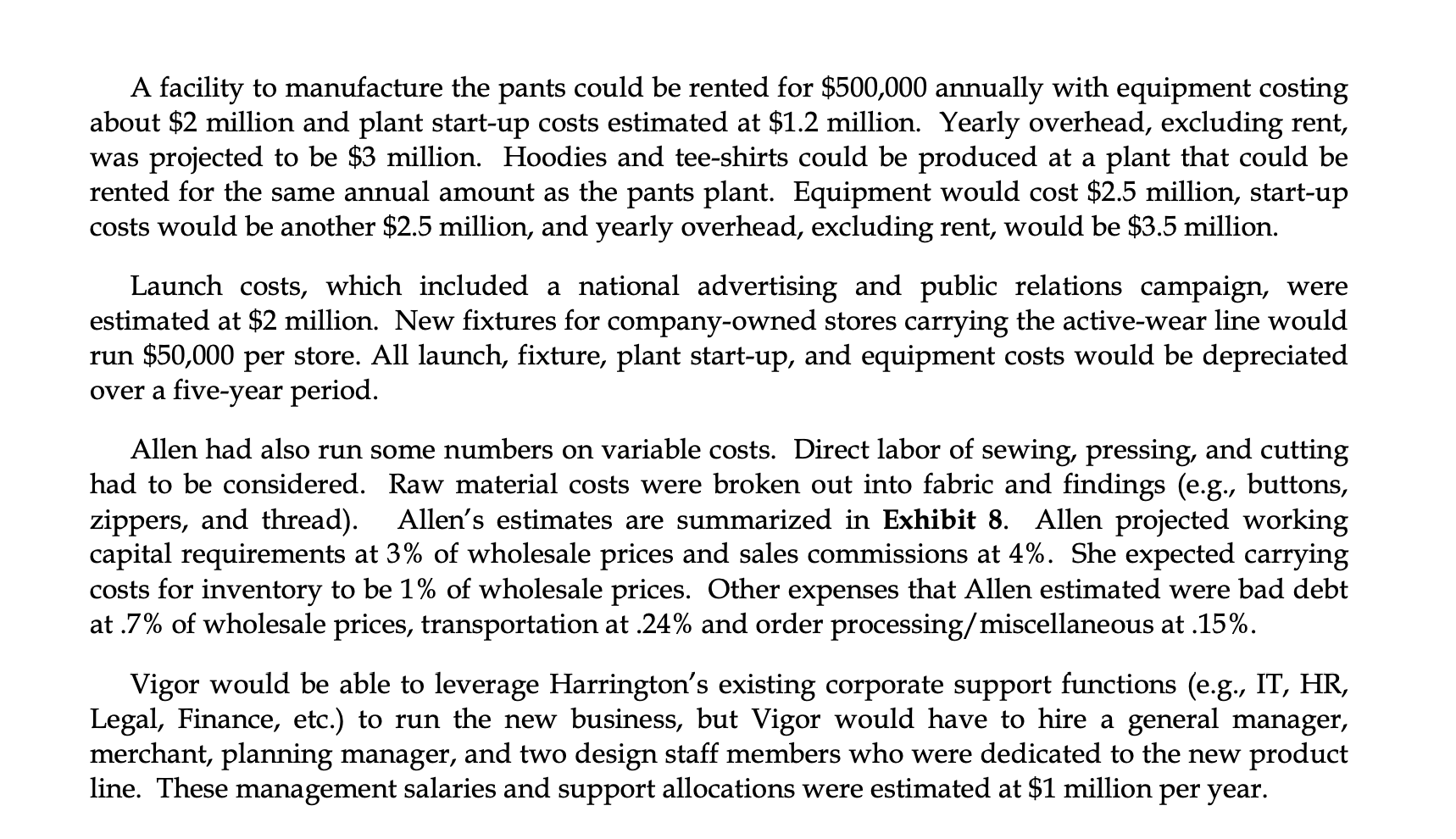

Calculate the total fixed costs for the active-wear opportunity. (Hint - Use the template in exhibit 9. Remember the Start-up costs are capitalized (see my lecture video for this term) and must be depreciated per Page 7 of the case. Add depreciated annual startup and annual operating fixed costs together). 11,500,000 $12,700,000 2,540,000 $14,040,000 \begin{tabular}{lll} Start Up Costs: & $ & \\ \hline Start-up Costs Pants Plant & $ & \\ Start-up Costs Hoodie and Tee-shirt Plant & $ & \\ Equipment Pants Plant & $ & \\ Equipment Hoodie and Tee-shirt Plant & $ & \\ Launch - PR, Advertising & $ & \\ \cline { 2 - 3 } Fixtures for Company Stores & $ & \\ Total Start-up Costs & $ & \\ Annual Depreciated Start-up Costs & $ & \\ Annual Ongoing Operating Costs - Fixed: & $ & \\ \hline Overhead Pants Plant & $ & \\ Overhead Hoodie and Tee-shirt Plant & $ & \\ Rent Pants Plant & $ & \\ Rent Hoodie and Tee-shirt Plant & $ & \\ Management/Support & $ & \end{tabular} A facility to manufacture the pants could be rented for $500,000 annually with equipment costing about $2 million and plant start-up costs estimated at $1.2 million. Yearly overhead, excluding rent, was projected to be $3 million. Hoodies and tee-shirts could be produced at a plant that could be rented for the same annual amount as the pants plant. Equipment would cost $2.5 million, start-up costs would be another $2.5 million, and yearly overhead, excluding rent, would be $3.5 million. Launch costs, which included a national advertising and public relations campaign, were estimated at $2 million. New fixtures for company-owned stores carrying the active-wear line would run $50,000 per store. All launch, fixture, plant start-up, and equipment costs would be depreciated over a five-year period. Allen had also run some numbers on variable costs. Direct labor of sewing, pressing, and cutting had to be considered. Raw material costs were broken out into fabric and findings (e.g., buttons, zippers, and thread). Allen's estimates are summarized in Exhibit 8. Allen projected working capital requirements at 3% of wholesale prices and sales commissions at 4%. She expected carrying costs for inventory to be 1% of wholesale prices. Other expenses that Allen estimated were bad debt at .7% of wholesale prices, transportation at .24% and order processing/miscellaneous at .15%. Vigor would be able to leverage Harrington's existing corporate support functions (e.g., IT, HR, Legal, Finance, etc.) to run the new business, but Vigor would have to hire a general manager, merchant, planning manager, and two design staff members who were dedicated to the new product line. These management salaries and support allocations were estimated at $1 million per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts