Question: PLEASE NOTE THAT THIS IS AT A GRAD LEVEL FINANCE CLASSE. PLESASE HELP ME WITH THE ANSERS BASED ON THE TABLES BELOW. BALANCE SHEET, PRIME

PLEASE NOTE THAT THIS IS AT A GRAD LEVEL FINANCE CLASSE. PLESASE HELP ME WITH THE ANSERS BASED ON THE TABLES BELOW. BALANCE SHEET, PRIME RATE AND CURRENCY EXCHANGE RATE. I WANTED TO KNOW IF THE INTEREST RATE AND EXCHANGE RATE MOVES IN THE SAME DIRECTION. SHOULD AUTO STAR HEDGE?

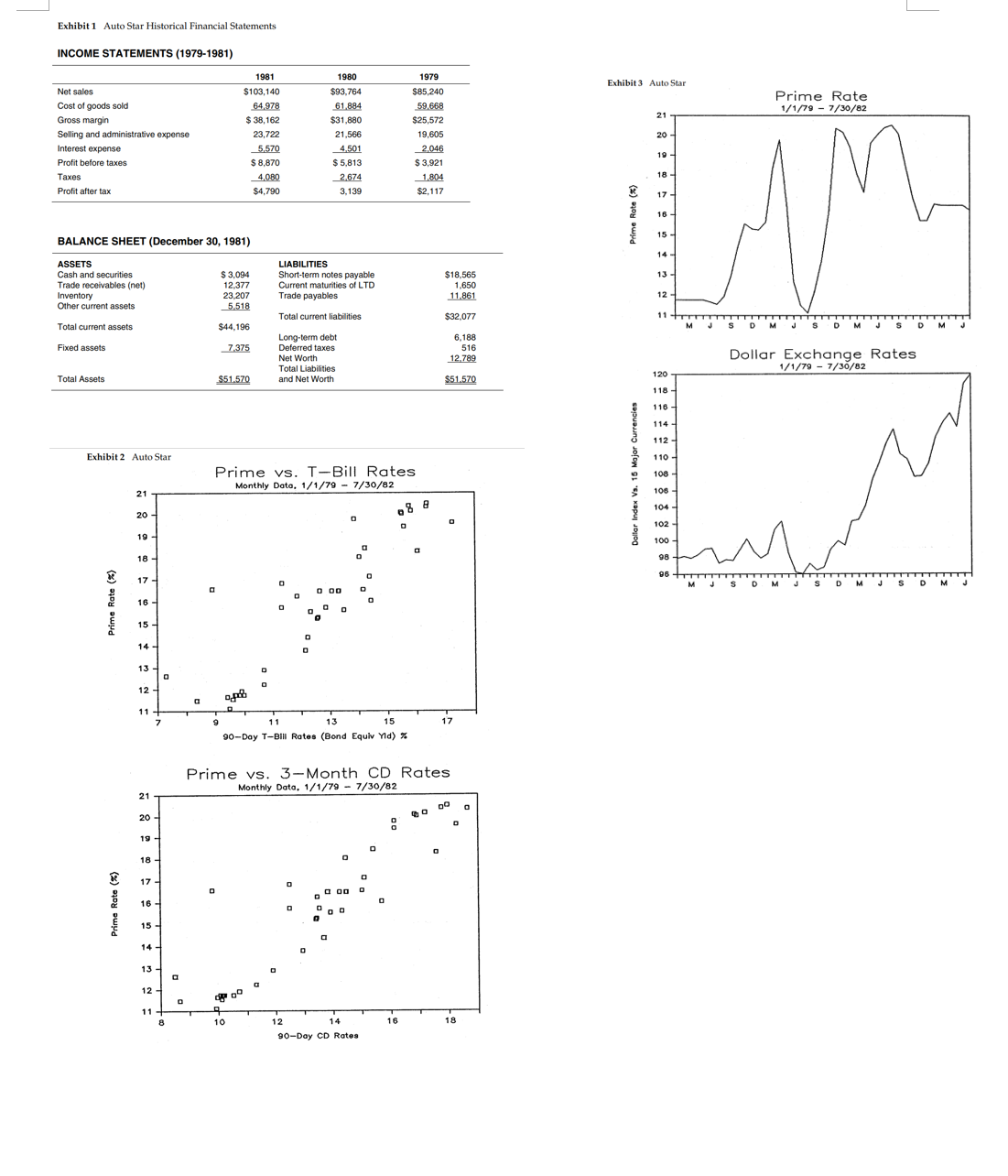

Edith Cooper, treasurer of Auto Star, a USbased importer of automobile parts, paused

before phoning Rob Rough, a corporate finance associate at Auto Star's investment bank. Edith was

calling Rob to discuss a strategy for hedging Auto Star's exposure on its primebased, variable rate

liabilities. Edith was concerned that Auto Star's extreme leverage and reliance on variable rate

financing exposed the company to an unacceptable level of financial risk, and had asked Rob to

consider a strategy for hedging Auto Star's interest costs in the financial futures markets.

Auto Star imported auto parts from both Europe and the Far East, marketing products under

its own and private labels. Auto Star's products were targeted at the doityourself" segment of the

auto repair market, and were distributed through auto parts and discount stores. Price competition in

this market segment, which was dominated by US auto parts manufacturers, was exceptionally

keen.

In preparing for her discussion with Rob, Edith had compiled a variety of data relating

movements in the prime rate to changes in other shortterm interest rates. Because futures contracts

on primebased instruments were not available, Edith realized she would have to crosshedge her

prime rate exposure using Tbill or CD futures contracts. She hoped that Rob could advise her on the

construction of such a hedge. She also wanted help in estimating the probable magnitude of variation

margin calls on an month hedge. Edith feared that Auto Star would have to secure a new line of

credit to finance margin calls on its position. Given the weakness of Auto Star's balance sheet, Edith

had been unable to secure additional credit from its lenders in recent months.

No problem," Edith thought to herself. "Once I hedge Auto Star's rate exposure, our

company's financial risk will be reduced to a level even our conservative bankers will find

acceptable!"

If you were Rob Rough, what advice would you give to Edith Cooper?

I understand the concept, but I need some numerical answers by using the balance sheet

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock