Question: Please note that this is based on Philippine Tax System Please put solution and Explanation a. how much is the income tax due for 2019

Please note that this is based on Philippine Tax System

Please put solution and Explanation

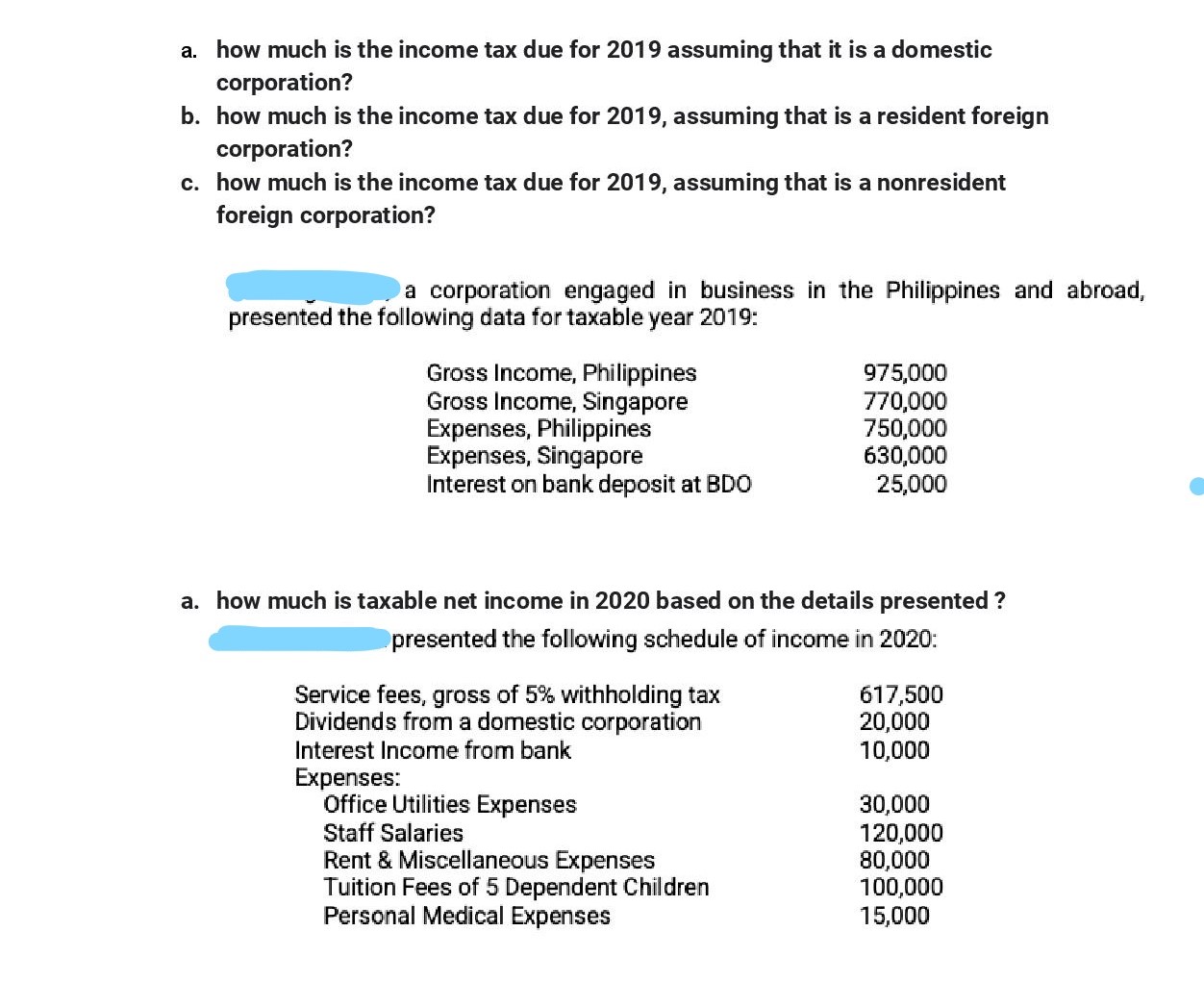

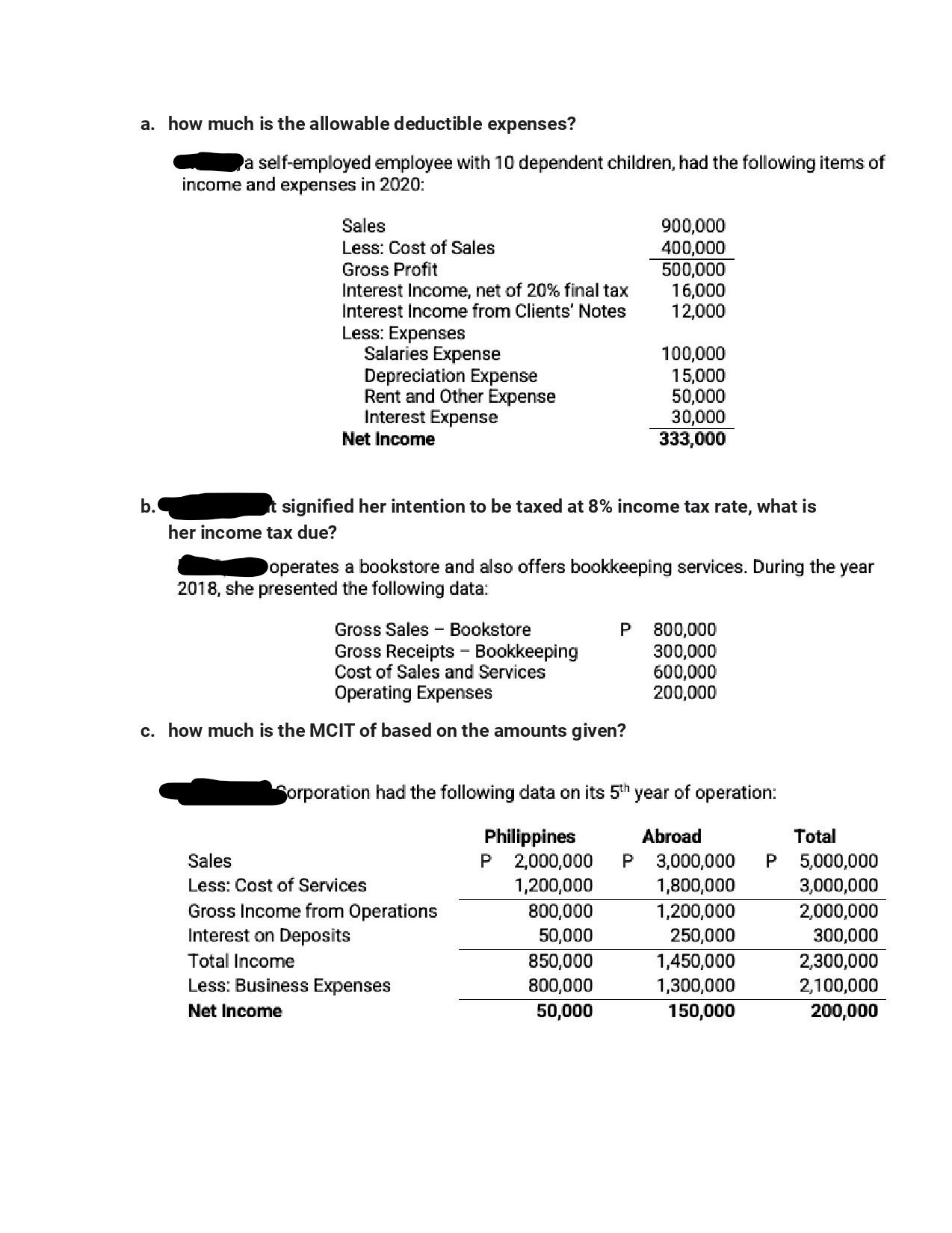

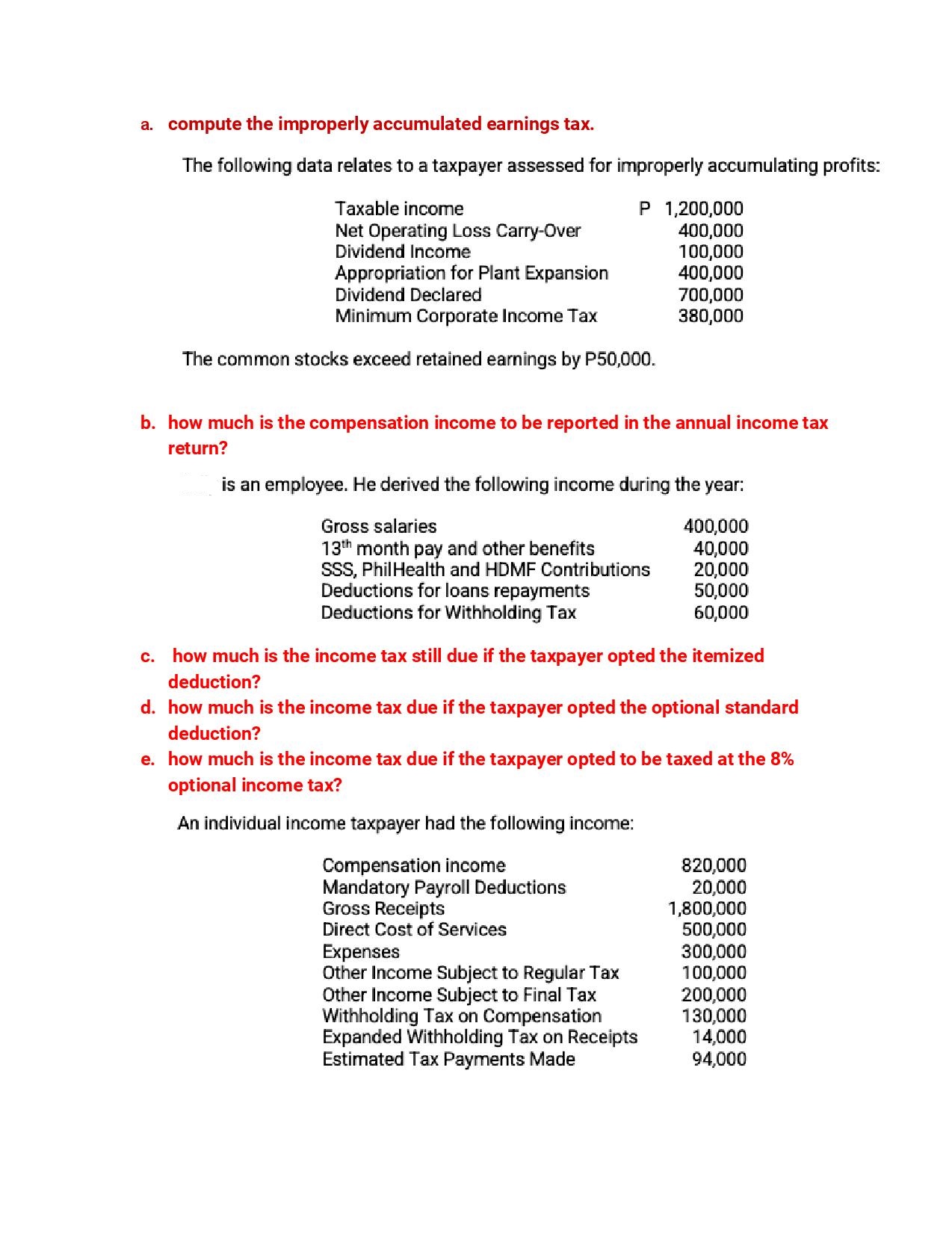

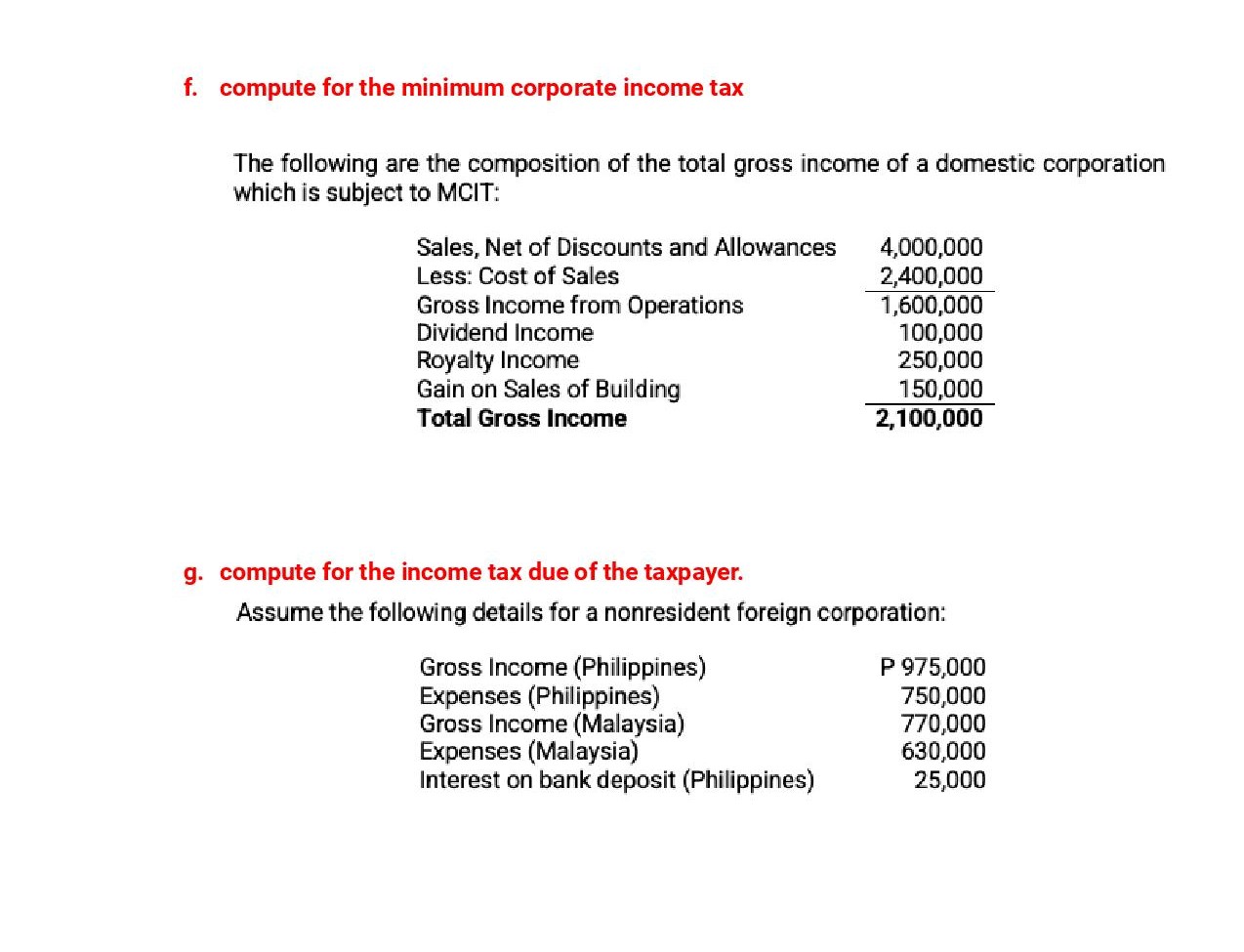

a. how much is the income tax due for 2019 assuming that it is a domestic corporation? b. how much is the income tax due for 2019. assuming that is a resident foreign corporation? c. how much is the income tax due for 2019. assuming that is a nonresident foreign corporation? "' Qa corporation engaged in business in the Philippines and abroad. presented the following data for taxableyear 2019: Gross Income. Philippines 975.000 Gross Income. Singapore 270.000 Expenses. Philippines 250.000 Expenses. Singapore 630.000 Interest on. bank deposit at 000' 25.000 a. how much is taxable net income in 2020 based on the details presented ? _ ' gispresented the following schedule of income in 2020: Service fees. gross of 53a withholding tax 012.500 Dividends from a domestic corporation 20.000 Interest Income from bank 10.000 Expenses: Office Utilities Expenses 30.000 Staff Salaries 120.000 Rent 8: Miscellaneous Expenses 00.000 Tuition Fees of 5 Dependent IChildren 100.000 Personal Medical Expenses 15.000 a. how much is the allowable deductible expenses? a self-employed employee with 10 dependent children, had the following items of income and expenses in 2020: Sales 900,000 Less: Cost of Sales 400,000 Gross Profit 500,000 Interest Income, net of 20% final tax 16,000 Interest Income from Clients' Notes 12,000 Less: Expenses Salaries Expense 100,000 Depreciation Expense 15,000 Rent and Other Expense 50,000 Interest Expense 30,000 Net Income 333,000 b. it signified her intention to be taxed at 8% income tax rate, what is her income tax due? operates a bookstore and also offers bookkeeping services. During the year 2018, she presented the following data: Gross Sales - Bookstore P 800,000 Gross Receipts - Bookkeeping 300,000 Cost of Sales and Services 600,000 Operating Expenses 200,000 c. how much is the MCIT of based on the amounts given? Sorporation had the following data on its 5th year of operation: Philippines Abroad Total Sales P 2,000,000 P 3,000,000 P 5,000,000 Less: Cost of Services 1,200,000 1,800,000 3,000,000 Gross Income from Operations 800,000 1,200,000 2,000,000 Interest on Deposits 50,000 250,000 300,000 Total Income 850,000 1,450,000 2,300,000 Less: Business Expenses 800,000 1,300,000 2,100,000 Net Income 50,000 150,000 200,000a. compute the improperly accumulated earnings tax. The following data relates to a taxpayer assessed for improperly accumulating prots: Taxable income P 1,200,000 Net Operating Loss Deny-Over 400,000 Dividend Income 100,000 Appropriation for Plant Expansion 400,000 Dividend Declared 700,000 Minimum Corporate Income Tax 380,000 The common stocks exceed retained earnings by P50,000. b. how much is the compensation income to be reported in the annual income tax return? is an empioyee. He derived the following income during the yean Gross salaries 400,000 13\"1 month pay' and other benefits 40.000 588, PhiIHeaIth and HDMF Contributions 20.000 Deductions for loans repayments 50.000 Deductions for Withholding Tax 60,000 0. how much is the income tax still due if the taxpayer opted the itemized deduction? d. how much is the income tax due if the taxpayer opted the optional standard deduction? e. how much is the income tax due if the taxpayer opted to be taxed at the 8% optional income tax? An individual income taxpayer had the following income: Compensation income 020,000 Mandatory Payro Deductions 20,000 Gross Receipts 1,800,000 Direct Cost of Services 500,000 Expenses. 300,000 Other Income Subject to Regular Tax 100,000 Other Income Subject to Final Tax 200,000 Withholding Tax on Compensation 130,000 Expanded Withholding Tax on Receipts 14,000 Estimated Tax Payments Made 94,000 f. compute for the minimum corporate income tax The following are the composition of the total gross income of a domestic corporation 1which is subject to MCIT: Sales, Net of Discounts and Allowances Less: Cost of Saies Gross Income from Operations Dividend Income Royalty Income Gain on Sales of Building Total Gross Income 9. compute for the income tax due of the taxpayer. 4,000,000 2,400,000 1,600,000 100,000 250,000 150.000 2,100,000 Assume the following details for a nonresident foreign corporation: Gross Income (Philippines) Expenses (Philippines) Gross Income (Malaysia) Expenses (Malaysia) Interest on bank deposit (Phiiippinesj P' 9735000 750,000 7?0,000 630,000 25,000