Question: please note that this is for tax year 2018 and not earlier. the tax cuts and jobs act is in effect. also please show calcultion

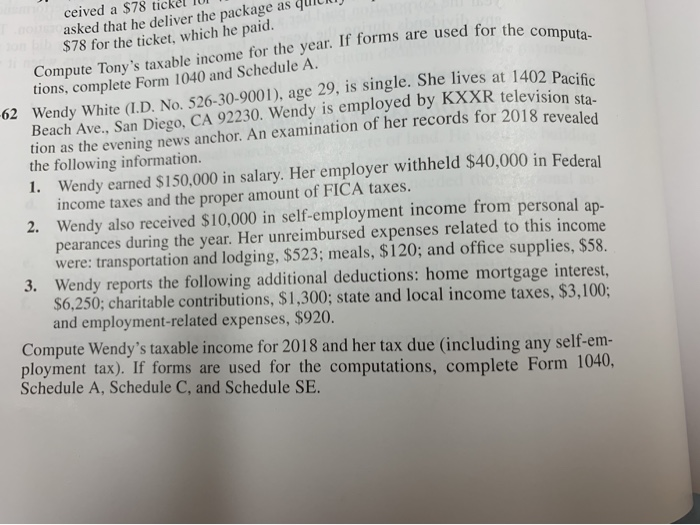

ceived a $78 tickel IUI asked that he deliver the package as quic $78 for the ticket, which he paid. Compute Tony's taxable income for the year. If forms are used for the co tions, complete Form 1040 and Schedule A. -62 Wendy White (I.D. No. 526-30-9001), age 29, is single. She lives at 1402 Pac Beach Ave., San Diego, CA 92230. Wendy is employed by KXXR television tion as the evening news anchor. An examination of her records for 2018 reveale the following information. 1. Wendy earned $150,000 in salary. Her employer withheld $40,000 in Federal income taxes and the proper amount of FICA taxes. 2. Wendy also received $10,000 in self-employment income from personal ap- pearances during the year. Her unreimbursed expenses related to this income were: transportation and lodging, $523; meals, $120; and office supplies, $58. 3. Wendy reports the following additional deductions: home mortgage interest, $6,250; charitable contributions, $1,300; state and local income taxes, $3,100; and employment-related expenses, $920. Compute Wendy's taxable income for 2018 and her tax due (including any self-em- ployment tax). If forms are used for the computations, complete Form 1040, Schedule A, Schedule C, and Schedule SE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts