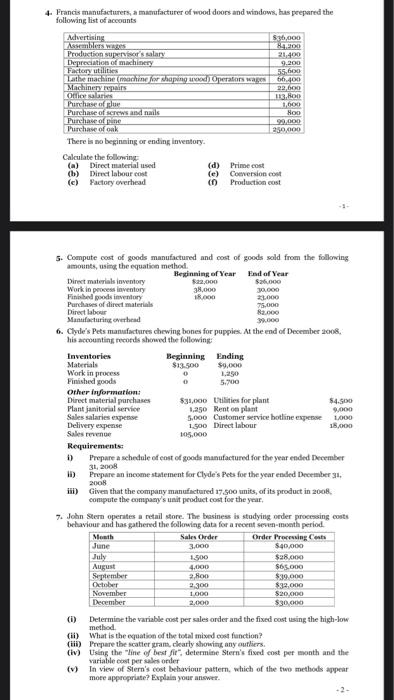

Question: Please note that this is one assignment. 4. Francis manufacturers, a matrufacturer of wood doors and windows, us prepared the following list of accounts Advertising

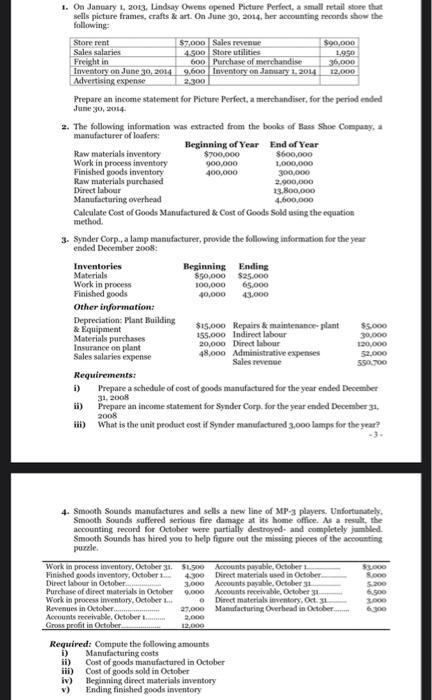

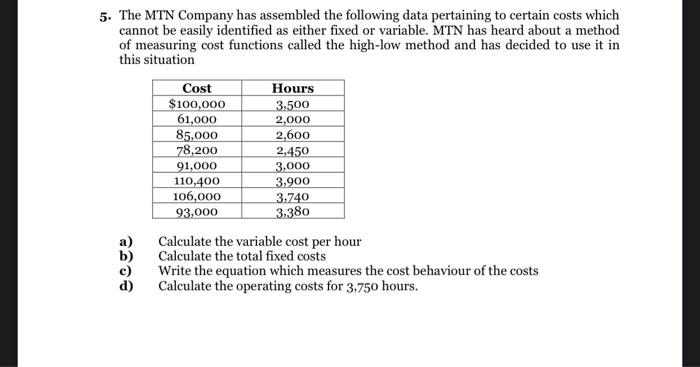

4. Francis manufacturers, a matrufacturer of wood doors and windows, us prepared the following list of accounts Advertising $35.000 Amblers was 800 Production supervisar's salary 21,400 Depreciation of machines 9.200 Factory utilities 55.600 Lathe machine machine for shaping Operations wages 61.400 Machinery repairs 22,600 Odialar 113.8 Purchase of Blue 1600 Purchase of screws and nails Hoo Purchase of pine 99.000 Turchase of onk 250,000 There is no beginning or ending inventory. Calculate the following (a) Direct materialused (d) Prime cost (b) Direct labour cost (e) Conversion con (c) Factory overhead (0 Production cost 23.000 . 5. Compute cost of goods manufactured and cost of goods sold from the following amounts, using the equation method Beginning of Year End of Year Direct materials inventory Saa000 $20,000 Work in process inventory Fixed poodinventory 38.000 30.000 Purchases of direct materials R. Direct labour Manufacturing whead 30.000 6. Clyde's Pets manufactures chewing bones for puppies. At the end of December 2008 his accounting records showed the following Inventories Beginning Ending Materials $13.500 $9,000 Work in process . 1.250 Finished goods 5.700 Other information Direct material purchases $39.000 Utilities for plant $4.500 Plantjanitorial service Sales salaries expense 1.250 Renton plant 5.000 Customer service hotline expense 1.000 Delivery expense 1.500 Direct labour 15.000 Sales revenue 105.000 Requirements: 1) Prepare a schedule of cost of goods manufactured for the year ended December 31, 2008 Prepare an income statement for Clyde's Pets for the year ended December 31, 2008 it) Given that the company manufactured 17.500 units, of its product in 2008 compute the company's unit product cost for the year, 7. John Stern operates a retail store. The basiness is studying order processing costs behaviour and has gathered the following data for a recent seven-month period Meath Sales Cheder Order Processing Costs June 3.000 $40,000 July 1.500 $28.000 August 4.400 $65.000 September 2,80p $39.000 October 2.300 $32,000 November 100 $20 December $30.000 (1) Determine the variable cost per sales order and the fixed cost using the high-low method (ii) What is the equation of the total mixed cost function? (iii) Prepare the scatterram. clearly showing any outliers. (iv) Using the line of best fit", determine Stern's fixed cost per month and the variable cost per sales order (v) In view of Siern's cost behaviour pattern, which of the two methods appear more appropriate? Explain your answer -2- 2.000 1. On January 1, 2013. Lindsay Owens opened Picture Perfect, a small retail store that sells picture frames, crafts & art. On June 30, 2014, her accounting records show the following Store rent $7,000 Sales revenue $90,000 Sales salaries 4.500 Store utilities 1.950 Freight in 600 Purchase of merchandise 36.000 Inventory on June 30, 2014 9.600 Inventory on January 1, 2014 12,000 Mdvertising expense 2,300 Prepare an income statement for Picture Perfect, a metchandiset, for the period ended June 30, 2014 2. The following information was extracted from the books of Buss She Company manufacturer of loafers Beginning of Year End of Year Raw materials inventory $700,000 $600,000 Work in process inventory 900,000 1.000.000 Finished goods inventory 400,000 300,000 Raw materials purchased 2.900,000 Direct labour 13,800,000 Manufacturing overhead 4.600,000 Calculate Cost of Goods Manufactured & Cost of Goods Sold using the equation method. 3. Synder Corp., a lamp manufacturer, provide the following information for the year ended December 2008 Inventories Beginning Ending Materials $50,000 $25.000 Work in process 100,000 65.000 Finished goods 40,000 Other information Depreciation: Plant Building & Equipment $15.000 Repairs & maintenance-plant $5.000 Materials purchases 155.000 Indirect labour 30,000 Insurance on plant 20,000 Direct labour 120.000 Sales salaries expense 48.000 Administrative expenses 52.000 Sales revenue SSA700 Requirements: i) Prepare a schedule of cost of goods manufactured for the year ended December 31, 2008 ii) Prepare an income statement for Synder Corp. for the year ended December 31, 2008 iii) What is the unit product cost if Synder manufactured 3.000 lamps for the year? -3. 4. Smooth Sounds manufactures and sells a new line of MP3 players. Unfortunately Smooth Sounds suffered serious fire damage at its home office. As a result, the accounting record for October were partially destroyed and completely jumbled Smooth Sounds has hired you to help figure out the missing pieces of the accounting puzzle Work in process inventory, October 31, $1.500 Accounts payable, October SLOO Finished goods inventory, October 4.900 Direct materials used in October Roe Direct labour in October Purchase of direct materials in October 9.000 Accounts receivable. October 31 3.000 Accounts payable October 31 6.500 Work in process inventory, October ... 0 Direct materials inventory, Oct. 31 30 Revenues in October 27,000 Manufacturing Overhead in October 6300 Amunts receivable October 2,000 Gross profit in October 12.000 Required: Compute the following amounts i) Manufacturing costs ii) Cost of goods manufactured in October iii) Cost of goods sold in October iv) Beginning direct materials inventory v) Ending finished goods inventory 5. The MTN Company has assembled the following data pertaining to certain costs which cannot be easily identified as either fixed or variable. MTN has heard about a method of measuring cost functions called the high-low method and has decided to use it in this situation Cost Hours $100,000 3,500 61,000 2,000 85,000 2,600 78,200 2,450 91,000 3,000 110,400 3,900 106,000 3.740 93,000 3,380 Calculate the variable cost per hour Calculate the total fixed costs Write the equation which measures the cost behaviour of the costs Calculate the operating costs for 3,750 hours

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts