Question: Please note that this question is worth TRIPLE value. You have collected information about 3 companies risk-factor loadings as well as their historically realized average

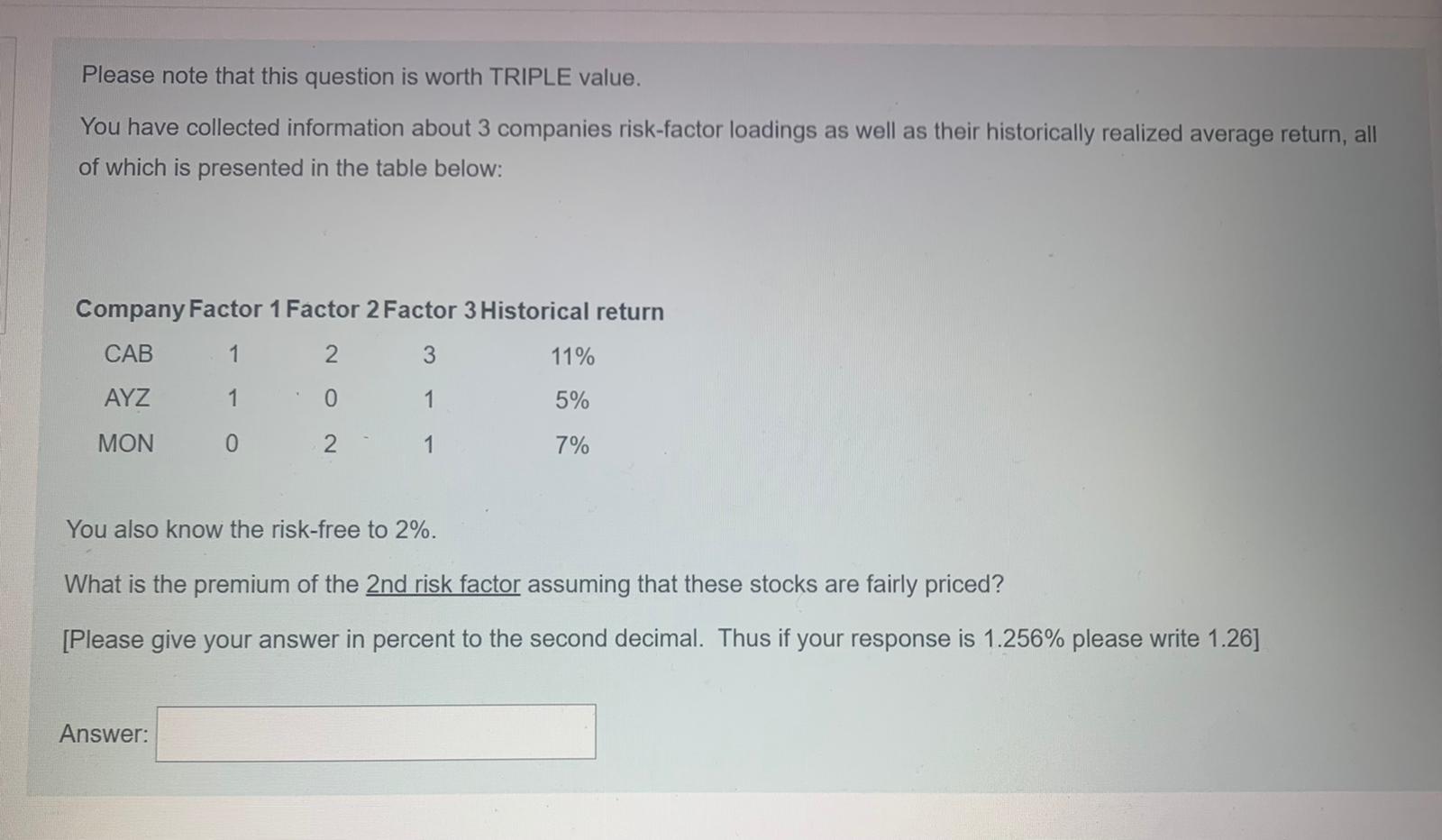

Please note that this question is worth TRIPLE value. You have collected information about 3 companies risk-factor loadings as well as their historically realized average return, all of which is presented in the table below: Company Factor 1 Factor 2 Factor 3 Historical return CAB 1 2 3 11% AYZ 1 0 1 5% MON 0 2 1 7% You also know the risk-free to 2%. What is the premium of the 2nd risk factor assuming that these stocks are fairly priced? [Please give your answer in percent to the second decimal. Thus if your response is 1.256% please write 1.26]

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock