Question: Please note the numbers may change from one question to another. A publisher sells books to Barnes & Noble at $19 each. The unit cost

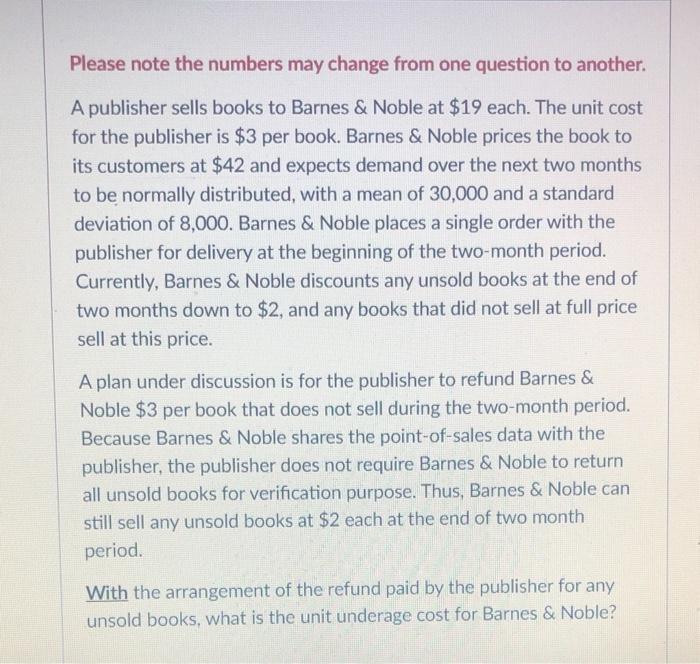

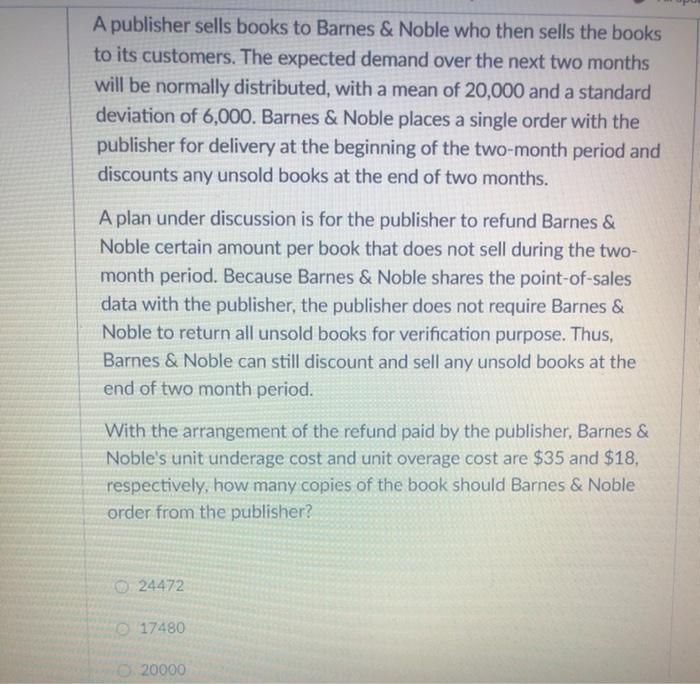

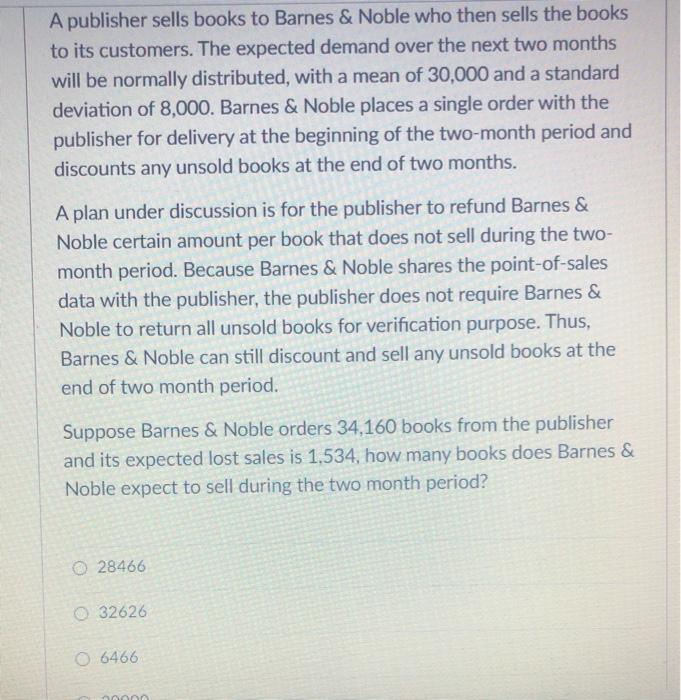

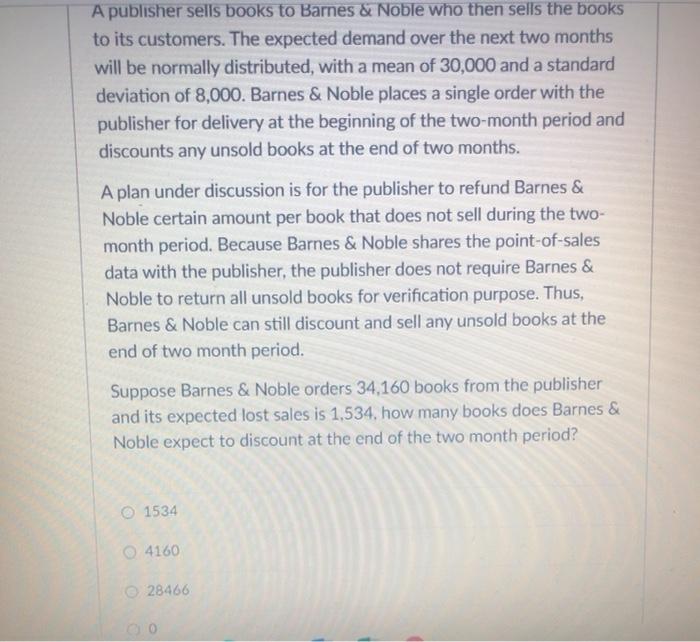

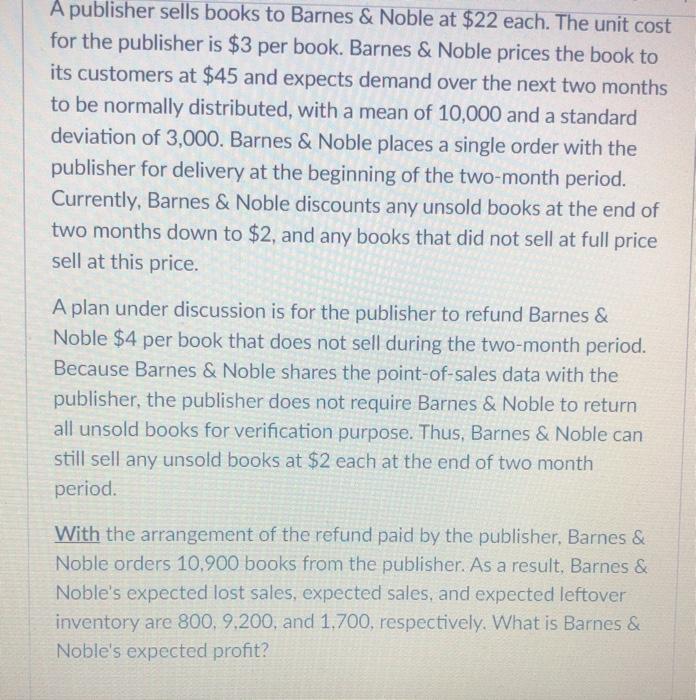

Please note the numbers may change from one question to another. A publisher sells books to Barnes & Noble at $19 each. The unit cost for the publisher is $3 per book. Barnes & Noble prices the book to its customers at $42 and expects demand over the next two months to be normally distributed, with a mean of 30,000 and a standard deviation of 8,000. Barnes & Noble places a single order with the publisher for delivery at the beginning of the two-month period. Currently, Barnes & Noble discounts any unsold books at the end of two months down to $2, and any books that did not sell at full price sell at this price. A plan under discussion is for the publisher to refund Barnes & Noble $3 per book that does not sell during the two-month period. Because Barnes & Noble shares the point-of-sales data with the publisher, the publisher does not require Barnes & Noble to return all unsold books for verification purpose. Thus, Barnes & Noble can still sell any unsold books at $2 each at the end of two month period. With the arrangement of the refund paid by the publisher for any unsold books, what is the unit underage cost for Barnes & Noble? A publisher sells books to Barnes & Noble who then sells the books to its customers. The expected demand over the next two months will be normally distributed, with a mean of 20,000 and a standard deviation of 6,000. Barnes & Noble places a single order with the publisher for delivery at the beginning of the two-month period and discounts any unsold books at the end of two months. A plan under discussion is for the publisher to refund Barnes & Noble certain amount per book that does not sell during the two- month period. Because Barnes & Noble shares the point-of-sales data with the publisher, the publisher does not require Barnes & Noble to return all unsold books for verification purpose. Thus, Barnes & Noble can still discount and sell any unsold books at the end of two month period. With the arrangement of the refund paid by the publisher, Barnes & Noble's unit underage cost and unit overage cost are $35 and $18, respectively, how many copies of the book should Barnes & Noble order from the publisher? 24472 17480 20000 A publisher sells books to Barnes & Noble who then sells the books to its customers. The expected demand over the next two months will be normally distributed, with a mean of 30,000 and a standard deviation of 8,000. Barnes & Noble places a single order with the publisher for delivery at the beginning of the two-month period and discounts any unsold books at the end of two months. A plan under discussion is for the publisher to refund Barnes & Noble certain amount per book that does not sell during the two- month period. Because Barnes & Noble shares the point-of-sales data with the publisher, the publisher does not require Barnes & Noble to return all unsold books for verification purpose. Thus, Barnes & Noble can still discount and sell any unsold books at the end of two month period. Suppose Barnes & Noble orders 34,160 books from the publisher and its expected lost sales is 1,534, how many books does Barnes & Noble expect to sell during the two month period? 28466 32626 6466 non A publisher sells books to Barnes & Noble who then sells the books to its customers. The expected demand over the next two months will be normally distributed, with a mean of 30,000 and a standard deviation of 8,000. Barnes & Noble places a single order with the publisher for delivery at the beginning of the two-month period and discounts any unsold books at the end of two months. A plan under discussion is for the publisher to refund Barnes & Noble certain amount per book that does not sell during the two- month period. Because Barnes & Noble shares the point-of-sales data with the publisher, the publisher does not require Barnes & Noble to return all unsold books for verification purpose. Thus, Barnes & Noble can still discount and sell any unsold books at the end of two month period. Suppose Barnes & Noble orders 34.160 books from the publisher and its expected lost sales is 1,534, how many books does Barnes & Noble expect to discount at the end of the two month period? 1534 4160 28466 0 A publisher sells books to Barnes & Noble at $22 each. The unit cost for the publisher is $3 per book. Barnes & Noble prices the book to its customers at $45 and expects demand over the next two months to be normally distributed, with a mean of 10,000 and a standard deviation of 3,000. Barnes & Noble places a single order with the publisher for delivery at the beginning of the two-month period. Currently, Barnes & Noble discounts any unsold books at the end of two months down to $2, and any books that did not sell at full price sell at this price. A plan under discussion is for the publisher to refund Barnes & Noble $4 per book that does not sell during the two-month period. Because Barnes & Noble shares the point-of-sales data with the publisher, the publisher does not require Barnes & Noble to return all unsold books for verification purpose. Thus, Barnes & Noble can still sell any unsold books at $2 each at the end of two month period. With the arrangement of the refund paid by the publisher, Barnes & Noble orders 10,900 books from the publisher. As a result, Barnes & Noble's expected lost sales, expected sales, and expected leftover inventory are 800, 9.200, and 1,700, respectively. What is Barnes & Noble's expected profit