Question: Please note, this is different then a previously asked question Samantha Montgomery (age 42) is employed by Canon Company and is paid an annual salary

Please note, this is different then a previously asked question

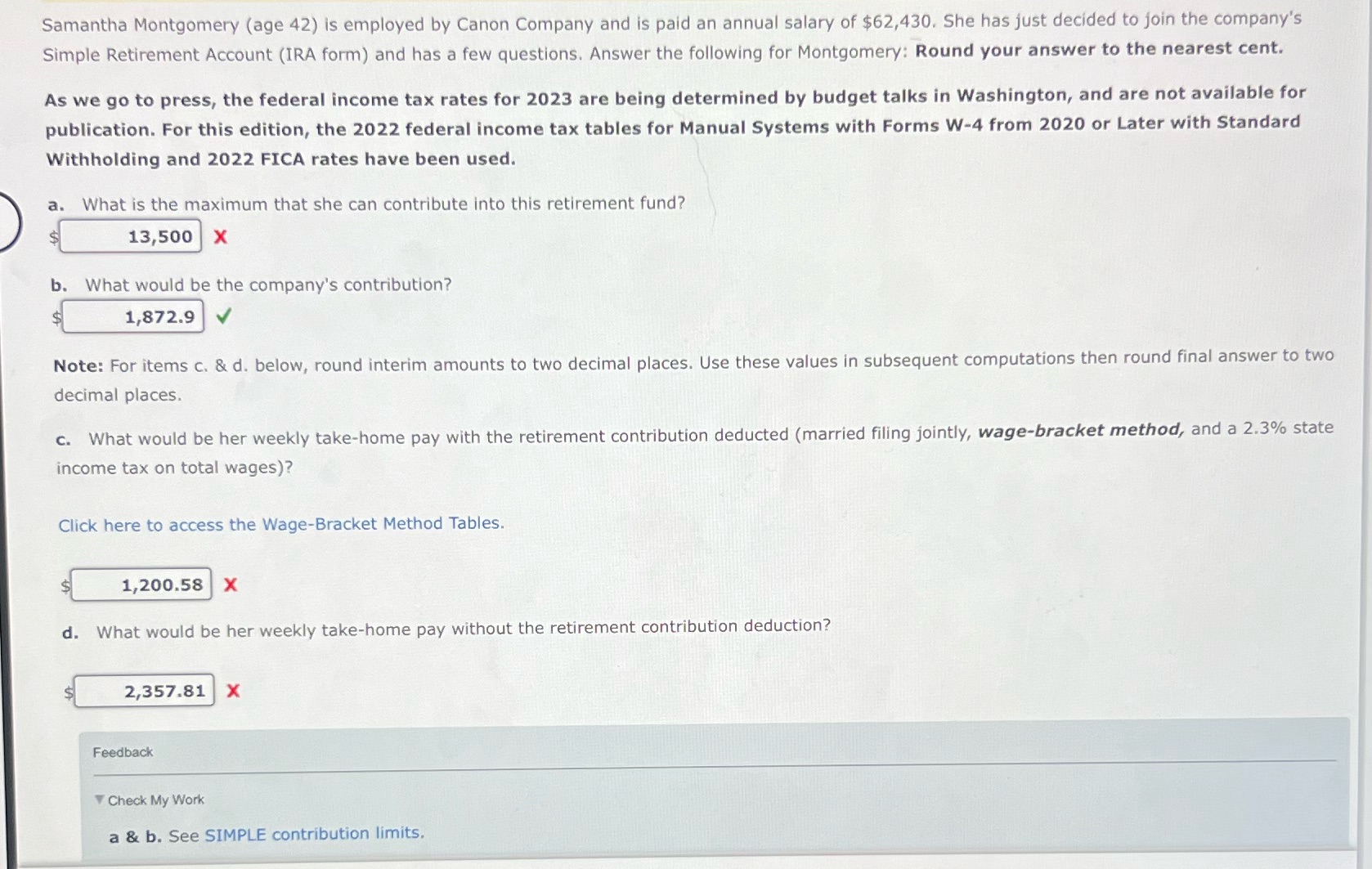

Samantha Montgomery (age 42) is employed by Canon Company and is paid an annual salary of $62,430. She has just decided to join the company's Simple Retirement Account (IRA form) and has a few questions, Answer the following for Montgomery: Round your answer to the nearest cent. As we go to press, the federal income tax rates for 2023 are being determined by budget talks in Washington, and are not available for publication. For this edition, the 2022 federal income tax tables for Manual Systems with Forms W-4 from 2020 or Later with Standard Withholding and 2022 FICA rates have been used. ) a. What is the maximum that she can contribute into this retirement fund? L 13s00] x b. What would be the company's contribution? $ 1,872.9 | v Note: For items . & d. below, round interim amounts to two decimal places. Use these values in subsequent computations then round final answer to two decimal places. c. What would be her weekly take-home pay with the retirement contribution deducted (married filing jointly, wage-bracket method, and a 2.3% state income tax on total wages)? Click here to access the Wage-Bracket Method Tables. 3 1,200.58 | X d. What would be her weekly take-home pay without the retirement contribution deduction? g 2,357.81 | X Feedback Check My Work a & b. See SIMPLE contribution limits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts