Question: PLEASE NOTE THIS IS ONE QUESTION WITH TWO DIFFERENT SUB-QUESTIONS: Required information Other Current Liabilities Read the overview below and complete the activities that follow.

PLEASE NOTE THIS IS ONE QUESTION WITH TWO DIFFERENT SUB-QUESTIONS:

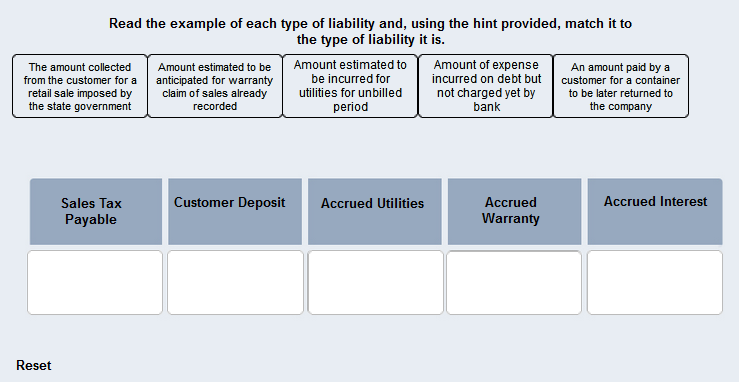

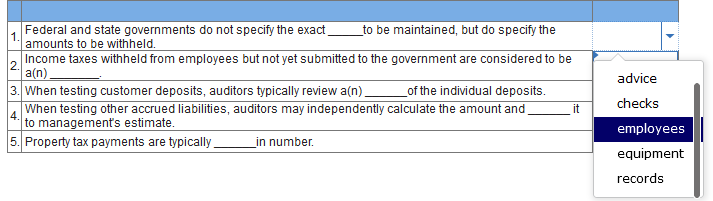

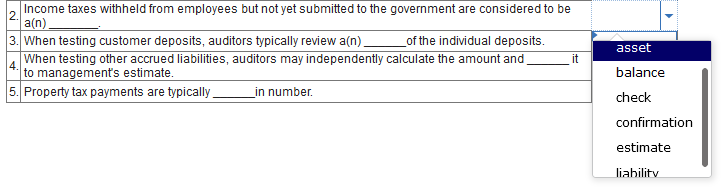

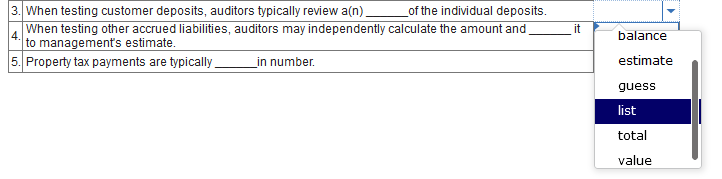

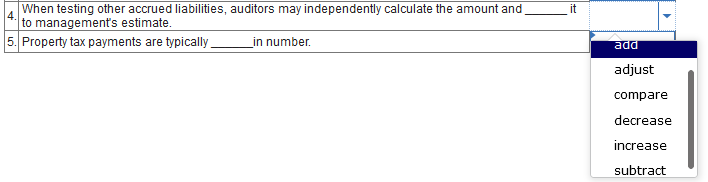

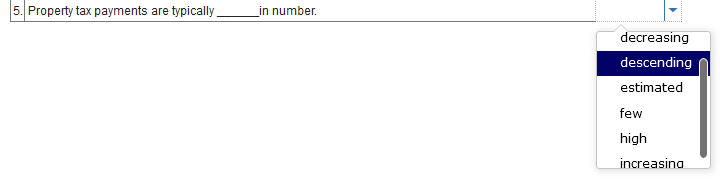

Required information Other Current Liabilities Read the overview below and complete the activities that follow. In addition to trade accounts payable, many companies have other types of current liabilities. These include amounts withheld from employees' pay, sales and other taxes payable, deposits, and other accrued liabilities. CONCEPT REVIEW: Companies have many different types of current liabilities. These can include various taxes payable (income tax, sales tax, payroll tax), accrued amounts for salary, vacation or other benefits, and estimates such as accrued utilities and warranty. To adhere to the concept of the matching principle, companies must estimate the amount of their other liabilities. Read the example of each type of liability and, using the hint provided, match it to the type of liability it is. 1. Federal and state governments do not specify the exact to be maintained, but do specify the 1. amounts to be withheld. 2. Income taxes withheld from employees but not yet submitted to the government are considered to be 3. When testing customer deposits, auditors typically review a(n) of the individual deposits. 4 When testing other accrued liabilities, auditors may independently calculate the amount and 4. to management's estimate. employees 5. Property tax payments are typically in number. equipment records 2. Income taxes withheld from employees but not yet submitted to the government are considered to be 3. When testing customer deposits, auditors typically review a(n) of the individual deposits. 4. When testing other accrued liabilities, auditors may independently calculate the amount and 4. to management's estimate. 5. Property tax payments are typically in number. check confirmation estimate liahilitv 3. When testing customer deposits, auditors typically review a(n) of the individual deposits. 4 When testing other accrued liabilities, auditors may independently calculate the amount and 4. to management's estimate. 5. Property tax payments are typically in number. estimate guess list total value 4. When testing other accrued liabilities, auditors may independently calculate the amount and it 4. to management's estimate. 5. Property tax payments are typically in number. add adjust compare decrease increase subtract 5. Property tax payments are typically in number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts