Question: PLEASE NOTE THIS QUESTION IS REFERRING TO 2023 On April 5, 2023, Kinsey places in service a new automobile that cost $67,250. He does not

PLEASE NOTE THIS QUESTION IS REFERRING TO 2023

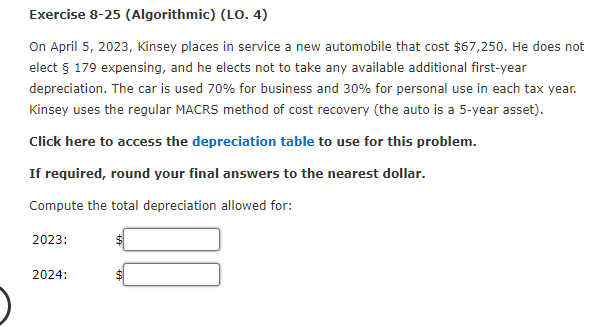

On April 5, 2023, Kinsey places in service a new automobile that cost $67,250. He does not elect 179 expensing, and he elects not to take any available additional first-year depreciation. The car is used 70% for business and 30% for personal use in each tax year. Kinsey uses the regular MACRS method of cost recovery (the auto is a 5-year asset). Click here to access the depreciation table to use for this problem. If required, round your final answers to the nearest dollar. Compute the total depreciation allowed for: \begin{tabular}{ll} 2023: & $ \\ 2024: & $ \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock