Question: Please note: This question is very similar to another question that is from 2015. The 2015 question has an additional transaction for estimated bad

Please note: This question is very similar to another question that is from 2015. The 2015 question has an additional transaction for "estimated bad debts for year" which is NOT included in this version of the question.

Please include an explanation of how you calculate the values. I want to understand how you got the answer and not just what the answer is. Thank you.

Please note: This question is very similar to another question that is from 2015. The 2015 question has an additional transaction for "estimated bad debts for year" which is NOT included in this version of the question.

Please include an explanation of how you calculate the values. I want to understand how you got the answer and not just what the answer is. Thank you.

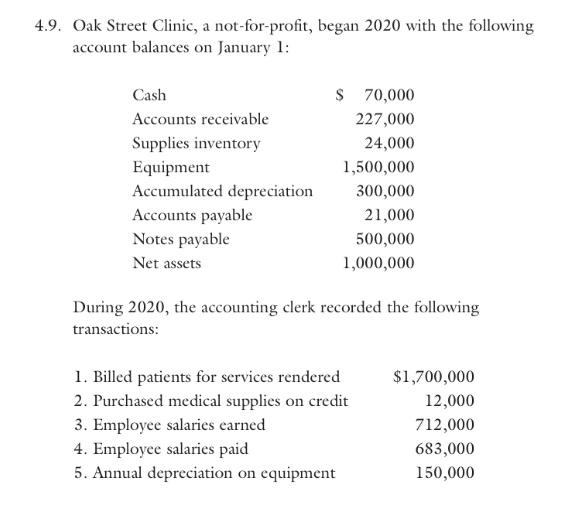

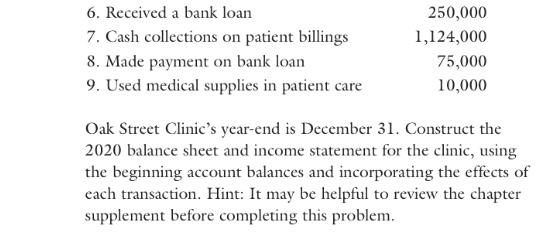

4.9. Oak Street Clinic, a not-for-profit, began 2020 with the following account balances on January 1: Cash Accounts receivable Supplies inventory Equipment Accumulated depreciation Accounts payable Notes payable Net assets $ 70,000 227,000 24,000 1,500,000 300,000 21,000 500,000 1,000,000 During 2020, the accounting clerk recorded the following transactions: 1. Billed patients for services rendered 2. Purchased medical supplies on credit 3. Employee salaries earned 4. Employee salaries paid 5. Annual depreciation on equipment $1,700,000 12,000 712,000 683,000 150,000 6. Received a bank loan 7. Cash collections on patient billings 8. Made payment on bank loan 9. Used medical supplies in patient care 250,000 1,124,000 75,000 10,000 Oak Street Clinic's year-end is December 31. Construct the 2020 balance sheet and income statement for the clinic, using the beginning account balances and incorporating the effects of each transaction. Hint: It may be helpful to review the chapter supplement before completing this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts