Question: Please note: This review serves as a guide, and is NOT a substitute for the course material we covered in class and class tutorial. Please

Please note: This review serves as a guide, and is NOT a substitute for the course material we covered in class and class tutorial. Please use this guide ONLY AFTER you have finished studying and feel ready to take the exam, and NOT before you start studying.

Conceptual Topics

CHAPTER

What are the key relationships between risk and return? Explain how historical data supports this relationship.

How do we calculate total return in dollars and percentages for an investment? How and where is each one used?

What is the difference between the arithmetic average return and the geometric average return? When should each be used?

What are the primary risks and returns associated with investing in largecompany stocks versus bonds? What about other asset classes?

How do standard deviation and variance measure investment risk? Why are they important? How can risk be measured using return variability?

What is the riskfree rate, and why is it critical in comparing risky investments? How does it relate to the concept of the risk premium?

Why is understanding the concept of compounding important in longterm investing?

What does historical data show about the returns of smallcompany stodes versus other investment types? What about other asset classes?

How can investors use historical returns to estimate future investment performance?

What is a normal distribution? How does the mean and standard deviation affect the normal distribution chart? How is a normal distribution useful to make risk and return probability assessments?

What is the relationship between expected return and actual return in investment decisions? Why do economists argue that higher risk leads to higher expected returns, but not guaranteed returns?

CHAPTER

What is topdown analysis, and how is it used to assess global economic conditions before making investment decisions?

How do economic cycles eg boom, recession impact different industries, and why are some industries more sensitive to these cycles?

What is the relationship between GDP growth and stock market valuations? How can investors use this relationship to make decisions?

How do monetary and fiscal policies affect economic activity, and how should investors respond to changes in these policies?

What is the significance of GDP as an economic indicator, and how do nominal GDP and real GDP differ in measuring growth? How does inflation affect this relationship?

How do analysts estimate the intrinsic value of a company's stock generally speaking and why is this important for fundamental analysis?

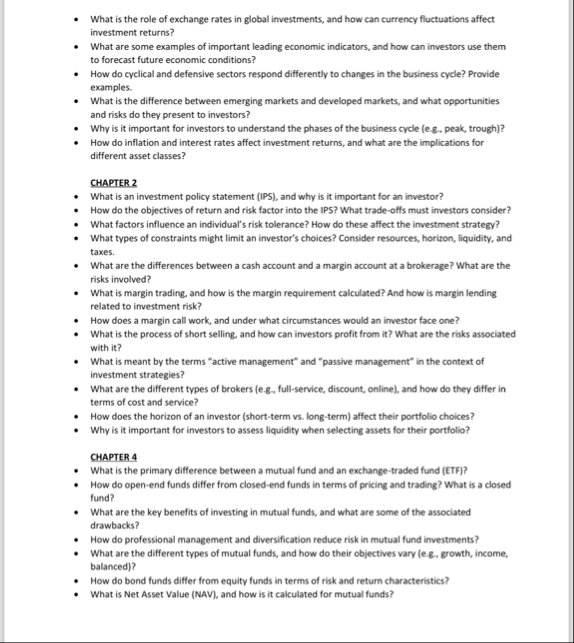

What is the role of exchange rates in global investments, and how can currency fluctuations affect investment returns?

What are some examples of important leading economic indicators, and how can investors use them to forecast future economic conditions?

How do cyclical and defensive sectors respond differently to changes in the business cycle? Provide examples.

What is the difference between emerging markets and developed markets, and what opportunities and risks do they present to investors?

Why is it important for investors to understand the phases of the business cycle eg peak, trough

How do inflation and interest rates affect investment returns, and what are the implications for different asset classes?

CHAPTER

What is an investment policy statement IPS and why is it important for an investor?

How do the objectives of return and risk factor into the IPS? What tradeoffs must investors consider?

What factors influence an individual's risk tolerance? How do these affect the investment strategy?

What types of constraints might limit an investor's choices? Consider resources, horizon, liquidity, and taxes.

What are the differences between a cash account and a margin account at a brokerage? What are the risks involved?

What is margin trading, and how is the margin requirement calculated? And how is margin lending related to investment risk?

How does a margin call work, and under what circumstances would an investor face one?

What is the process of short selling, and how can investors profit from it What are the risks associated with it

What is meant by the terms "active management" and "passive management" in the context of investment strategies?

What are the different types of brokers eg fullservice, discount, online and how do they differ in terms of cost and service?

How does the horizon of an investor shortterm vs longterm affect their portfolio choices?

Why is it important for investors to assess liquidity when selecting assets for their portfolio?

CHAPTER

What is the primary difference between a mutual fund and an exchangetraded fund ETF

How do openend funds differ from closedend funds in terms of pricing and trading? What is a closed fund?

What are the key benefits of investing in mutual funds, and what are some of the associated drawbacks?

How do professional management and diversification reduce risk in mutual fund investments?

What are the differen

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock