Question: Please note, two year holding period! Graph not necessary. Thank you! Year, end of TBond rate price paid coupon price received RoR Assumptions: 1) coupon

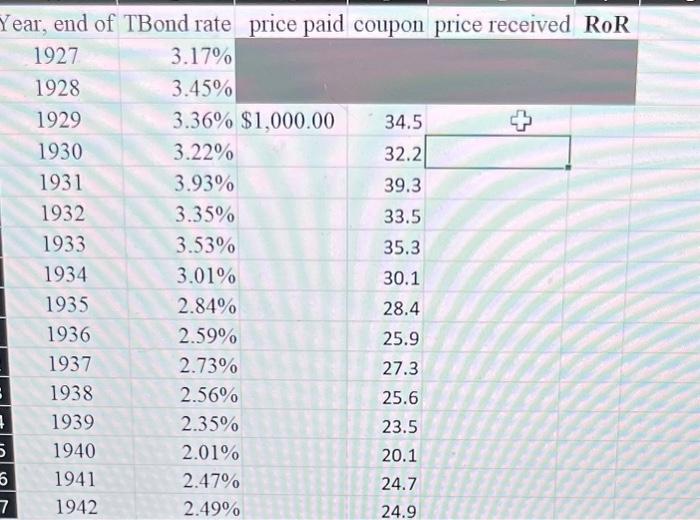

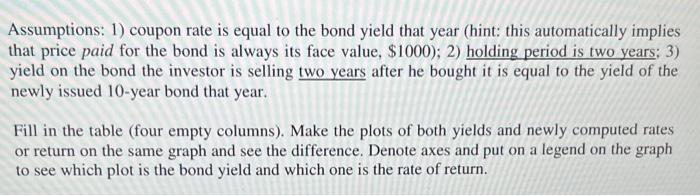

Year, end of TBond rate price paid coupon price received RoR Assumptions: 1) coupon rate is equal to the bond yield that year (hint: this automatically implies that price paid for the bond is always its face value, $1000 ); 2) holding period is two years; 3) yield on the bond the investor is selling two years after he bought it is equal to the yield of the newly issued 10 -year bond that year. Fill in the table (four empty columns). Make the plots of both yields and newly computed rates or return on the same graph and see the difference. Denote axes and put on a legend on the graph to see which plot is the bond yield and which one is the rate of return. Year, end of TBond rate price paid coupon price received RoR Assumptions: 1) coupon rate is equal to the bond yield that year (hint: this automatically implies that price paid for the bond is always its face value, $1000 ); 2) holding period is two years; 3) yield on the bond the investor is selling two years after he bought it is equal to the yield of the newly issued 10 -year bond that year. Fill in the table (four empty columns). Make the plots of both yields and newly computed rates or return on the same graph and see the difference. Denote axes and put on a legend on the graph to see which plot is the bond yield and which one is the rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts