Question: Please note what the question is asking for as these answers I was given are incorrect. Birtle Corporation reports the following statement of financial position

Please note what the question is asking for as these answers I was given are incorrect.

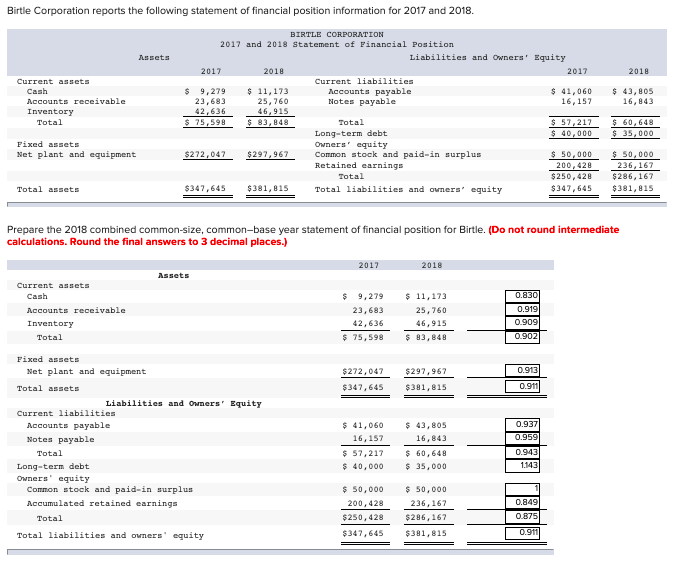

Birtle Corporation reports the following statement of financial position information for 2017 and 2018. Assets 2018 Current assets Cash Accounts receivable Inventory Total $ 43,805 16,843 BIRTLE CORPORATION 2017 and 2018 Statement of Financial Position Liabilities and Owners' Equity 2017 2018 2017 Current liabilities $ 9,279 $ 11,173 Accounts payable $ 41,060 23,683 25,760 Notes payable 16,157 42,636 46,915 $ 75,598 $ 83,848 Total $ 57,217 Long-term debt $ 40,000 Owners' equity $272,047 $299,967 Common stock and paid-in surplus $ 50,000 Retained earnings 200, 428 Total $250,428 $347,645 $381,815 Total liabilities and owners' equity $347,645 $ 60,648 $ 35,000 Fixed assets Net plant and equipment $ 50,000 236, 167 $286, 167 $381,815 Total assets Prepare the 2018 combined common-size, common-base year statement of financial position for Birtle. (Do not round intermediate calculations. Round the final answers to 3 decimal places.) 2017 2018 Assets 0,830 Current assets Cash Accounts receivable Inventory Total $ 9,279 23,683 42,636 $ 75,598 $ 11,173 25,760 46,915 $ 83, 848 0.919 0.9091 0.902 $297,967 0.913 $272,047 $347,645 $381,815 0.911 0.937 0.959 Fixed assets Net plant and equipment Total assets Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings Total Total liabilities and owners' equity $ 41,060 16,157 $ 57,217 $ 40,000 $ 43,805 16,843 $ 60,648 $ 35,000 0.943 1.143 $ 50,000 200,428 $250,428 $ 50,000 236, 167 $286, 167 0.849 0.875 0.971 $347,645 $381,815

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts