Question: Please note when using Excel function PRICE and Yield, the face value and price should be adjusted to 100 as face and price should be

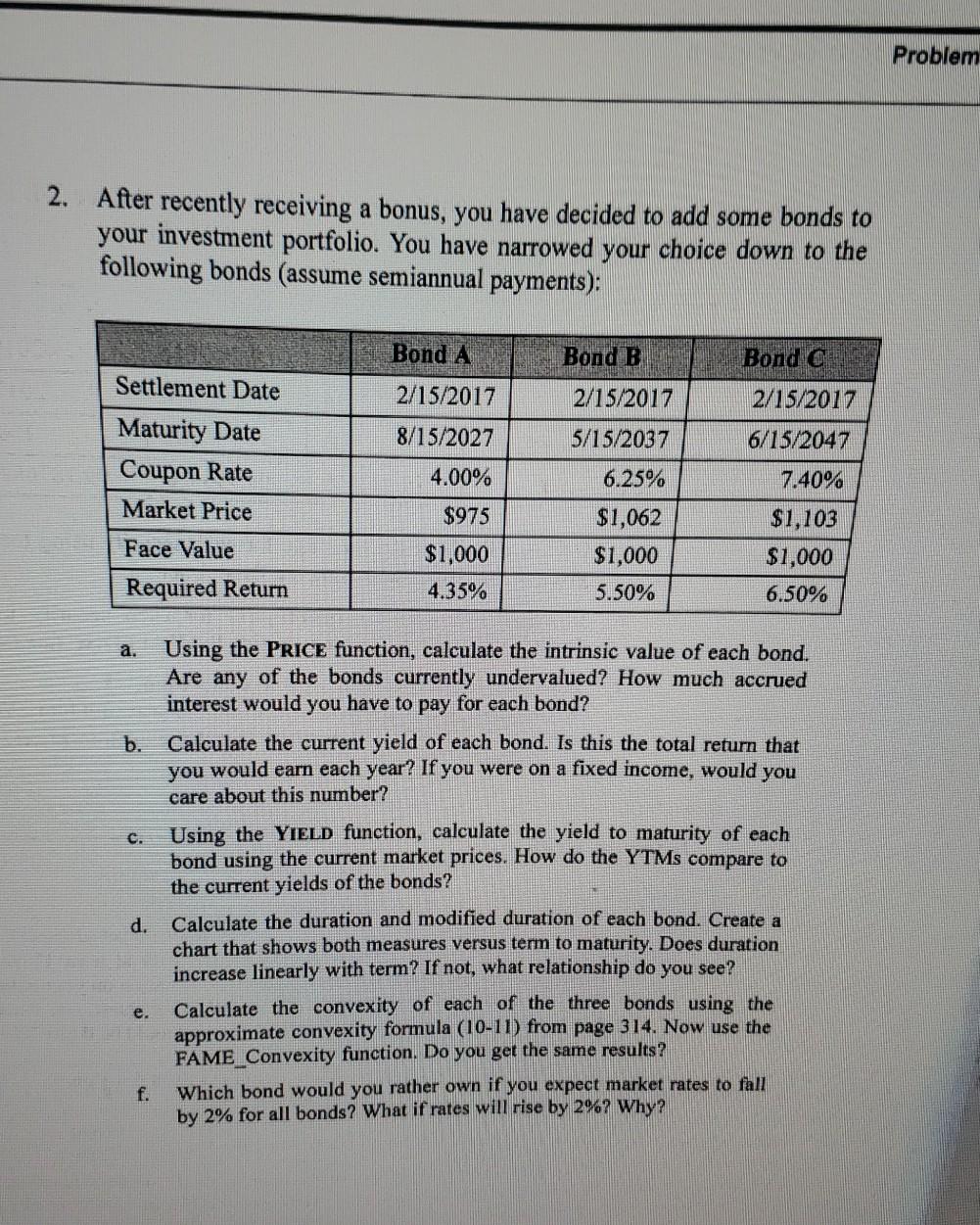

Please note when using Excel function PRICE and Yield, the face value and price should be adjusted to 100 as face and price should be adjusted to price for face-100. a. Skip accrued interest. b. Skip b C. Skip comparing yield YTM (yield to maturity) to current yield. d. Skip modified duration, skip chart, skip last part. e. Skip e. f. Do f. (Hint you want to choose the bond that gives the most % change in price when rates fall and choose the bond that gives the least % fall in price when rates rise.) Problem 2. After recently receiving a bonus, you have decided to add some bonds to your investment portfolio. You have narrowed your choice down to the following bonds (assume semiannual payments): Bond A Bond B Bond o Settlement Date 2/15/2017 2/15/2017 2/15/2017 8/15/2027 5/15/2037 6/15/2047 Maturity Date Coupon Rate Market Price 4.00% 6.25% 7.40% $975 Face Value $1,000 4.35% $1,062 $1,000 5.50% $1,103 $1,000 6.50% Required Return a. Using the PRICE function, calculate the intrinsic value of each bond. Are any of the bonds currently undervalued? How much accrued interest would you have to pay for each bond? b. Calculate the current yield of each bond. Is this the total return that you would earn each year? If you were on a fixed income, would you care about this number? c. Using the Yield function, calculate the yield to maturity of each bond using the current market prices. How do the YTMs compare to the current yields of the bonds? d. Calculate the duration and modified duration of each bond. Create a chart that shows both measures versus term to maturity. Does duration increase linearly with term? If not, what relationship do you see? Calculate the convexity of each of the three bonds using the approximate convexity formula (10-11) from page 314. Now use the FAME_Convexity function. Do you get the same results? f. Which bond would you rather own if you expect market rates to fall by 2% for all bonds? What if rates will rise by 2%? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts