Question: please Nswer correct there is two different solution on chegg . Lazare Corporation expects an EBIT of $19.750 every year forever. Lazare currently has no

please Nswer correct there is two different solution on chegg .

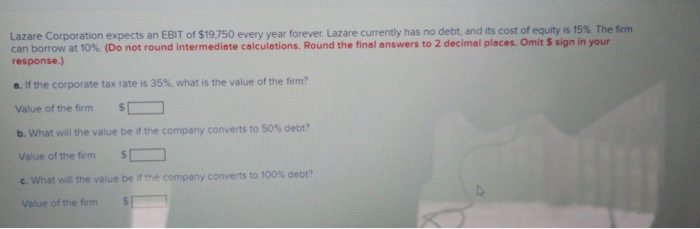

please Nswer correct there is two different solution on chegg . Lazare Corporation expects an EBIT of $19.750 every year forever. Lazare currently has no debt, and its cost of equity is 15%. The firm can borrow at 10%. (Do not round Intermediate calculations. Round the final answers to 2 decimal places. Omit 5 sign in your response.) .. If the corporate tax rate is 35%, what is the value of the form? Value of the firm SC b. What will the value be if the company converts to 50% debt? Value of the fum SC c. What will the value be if the company converts to 100% debt? Value of the form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts