Question: please offer solution with clear process demonstratesthank you b) Consider the following limit-order book of Microsoft (with stock ticker:MSFT): Book Viewer BATS MSFT Go MICROSOFT

please offer solution with clear process demonstratesthank you

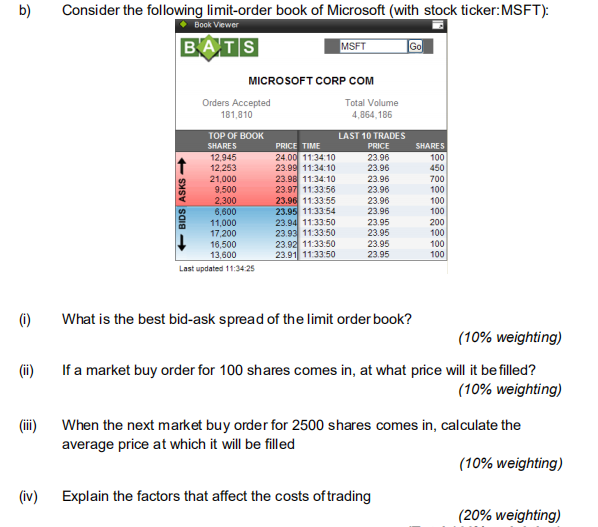

b) Consider the following limit-order book of Microsoft (with stock ticker:MSFT): Book Viewer BATS MSFT Go MICROSOFT CORP COM Orders Accepted Total Volume 181,810 4,864 186 SHARES 100 450 700 100 TOP OF BOOK SHARES 12,945 12,253 21,000 9.500 2,300 6,600 11,000 17,200 16,500 13,600 Last updated 11:34:25 +BIDS ASKS LAST 10 TRADES PRICE TIME PRICE 24.00 11:34:10 23.96 23.99 11:34:10 23.96 23.98 11:34:10 23.96 23.97 11:33:56 23.96 23.96 11:33:55 23.96 23.95 11:33:54 23.96 23.94 11:33:50 23.95 23.93 11:33:50 23.95 23.92 11:33:50 23.95 23.91 11:33:50 23.95 100 100 200 100 100 100 (0) What is the best bid-ask spread of the limit order book? (10% weighting) (ii) If a market buy order for 100 shares comes in, at what price will it be filled? (10% weighting) (iii) When the next market buy order for 2500 shares comes in, calculate the average price at which it will be filled (10% weighting) (iv) Explain the factors that affect the costs of trading (20% weighting)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts