Question: PLEASE ONLY ANSWER 5-9! PLEASE ONLY ANSWER 5-9! PLEASE ONLY ANSWER 5-9! Coco's Inc., has the following financing outstanding: Debt: 300,000 bonds with a coupon

PLEASE ONLY ANSWER 5-9!

PLEASE ONLY ANSWER 5-9!

PLEASE ONLY ANSWER 5-9!

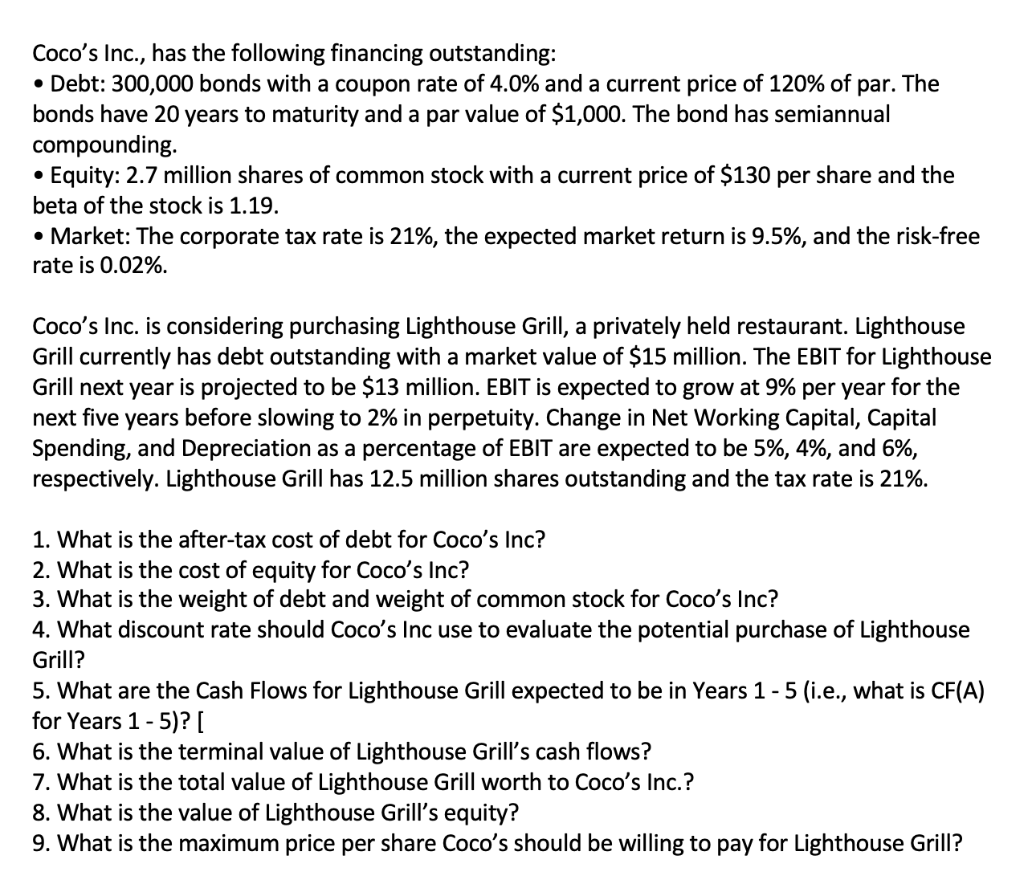

Coco's Inc., has the following financing outstanding: Debt: 300,000 bonds with a coupon rate of 4.0% and a current price of 120% of par. The bonds have 20 years to maturity and a par value of $1,000. The bond has semiannual compounding. Equity: 2.7 million shares of common stock with a current price of $130 per share and the beta of the stock is 1.19. Market: The corporate tax rate is 21%, the expected market return is 9.5%, and the risk-free rate is 0.02%. Coco's Inc. is considering purchasing Lighthouse Grill, a privately held restaurant. Lighthouse Grill currently has debt outstanding with a market value of $15 million. The EBIT for Lighthouse Grill next year is projected to be $13 million. EBIT is expected to grow at 9% per year for the next five years before slowing to 2% in perpetuity. Change in Net Working Capital, Capital Spending, and Depreciation as a percentage of EBIT are expected to be 5%, 4%, and 6%, respectively. Lighthouse Grill has 12.5 million shares outstanding and the tax rate is 21%. 1. What is the after-tax cost of debt for Coco's Inc? 2. What is the cost of equity for Coco's Inc? 3. What is the weight of debt and weight of common stock for Coco's Inc? 4. What discount rate should Coco's Inc use to evaluate the potential purchase of Lighthouse Grill? 5. What are the Cash Flows for Lighthouse Grill expected to be in Years 1 - 5 (i.e., what is CF(A) for Years 1-5)?( 6. What is the terminal value of Lighthouse Grill's cash flows? 7. What is the total value of Lighthouse Grill worth to Coco's Inc.? 8. What is the value of Lighthouse Grill's equity? 9. What is the maximum price per share Coco's should be willing to pay for Lighthouse Grill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts