Question: please only answer #9 provide full formulas (not excel). Suppose that Ackman's plan works and you have exactly $1 million available on the day you

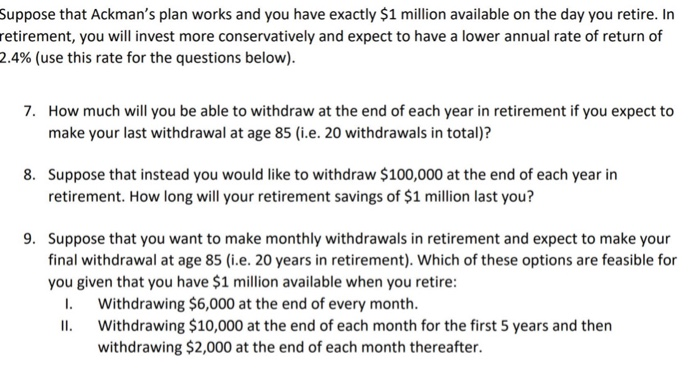

Suppose that Ackman's plan works and you have exactly $1 million available on the day you retire. In retirement, you will invest more conservatively and expect to have a lower annual rate of return of 2.4% (use this rate for the questions below). 7. How much will you be able to withdraw at the end of each year in retirement if you expect to make your last withdrawal at age 85 (i.e. 20 withdrawals total)? 8. Suppose that instead you would like to withdraw $100,000 at the end of each year in retirement. How long will your retirement savings of $1 million last you? 9. Suppose that you want to make monthly withdrawals in retirement and expect to make your final withdrawal at age 85 (i.e. 20 years in retirement). Which of these options are feasible for you given that you have $1 million available when you retire: I. Withdrawing $6,000 at the end of every month. II. Withdrawing $10,000 at the end of each month for the first 5 years and then withdrawing $2,000 at the end of each month thereafter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts