Question: please only answer b. c. d. and e. detail Chapter 11. The Basics of Capital Budgeting Your division is considering two projects. Its WACC is

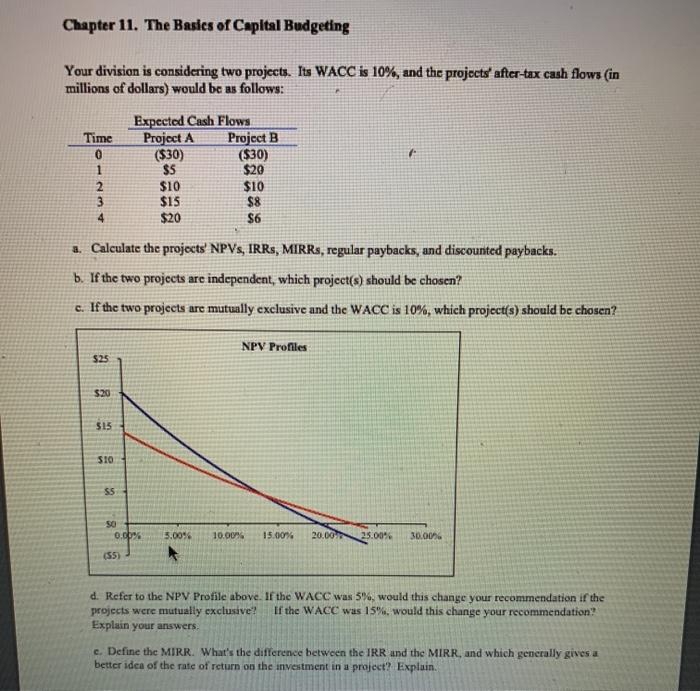

Chapter 11. The Basics of Capital Budgeting Your division is considering two projects. Its WACC is 10%, and the projects' after-tax cash flows (in millions of dollars) would be as follows: Time 0 1 2 3 4 Expected Cash Flows Project A Project B (530) ($30) $5 $20 $10 $10 $15 $8 $20 S6 2. Calculate the projects NPVs, IRRs, MIRRs, regular paybacks, and discounted paybacks. b. If the two projects are independent, which project(s) should be chosen? c. If the two projects are mutually exclusive and the WACC is 10%, which project(s) should be chosen? NPV Profiles $25 $20 $15 $10 SS 0.00% 5.0096 10.00% 15.00% 20.000 25.00% 30.00% (55) d. Refer to the NPV Profile above. If the WACC was 5%, would this change your recommendation if the projects were mutually exclusive If the WACC was 15%, would this change your recommendation Explain your answers c. Define the MIRR. What's the difference between the IRR and the MIRR, and which generally gives a better idea of the rate of return on the investment in a project? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts