Question: Please only answer conceptual questions. I do not know how to post an excel sheet for the use of calculations. Case 4: Victoria Chemical Capital

Please only answer conceptual questions. I do not know how to post an excel sheet for the use of calculations.

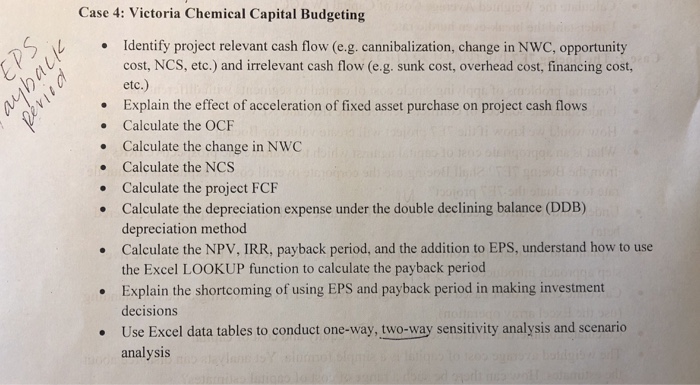

Case 4: Victoria Chemical Capital Budgeting Sy . Identify project relevant cashflow (eg cannibalization, change in NYC opportunity cost, NCS, etc.) and irrelevant cash flow (e.g. sunk cost, overhead cost, financing cost, etc.) Explain the effecet of acceleration of fixed asset purchase on project cash fows Calculate the OCF Calculate the change in NWC Calculate the NCS Calculate the project FCF Calculate the depreciation expense under the double declining balance (DDB) depreciation method Calculate the NPV, IRR, payback period, and the addition to EPS, understand how to use the Excel LOOKUP function to calculate the payback period Explain the shortcoming of using EPS and payback period in making investment decisions Use Excel data tables to conduct one-way, two-way sensitivity analysis and scenario analysis . . . . Case 4: Victoria Chemical Capital Budgeting Sy . Identify project relevant cashflow (eg cannibalization, change in NYC opportunity cost, NCS, etc.) and irrelevant cash flow (e.g. sunk cost, overhead cost, financing cost, etc.) Explain the effecet of acceleration of fixed asset purchase on project cash fows Calculate the OCF Calculate the change in NWC Calculate the NCS Calculate the project FCF Calculate the depreciation expense under the double declining balance (DDB) depreciation method Calculate the NPV, IRR, payback period, and the addition to EPS, understand how to use the Excel LOOKUP function to calculate the payback period Explain the shortcoming of using EPS and payback period in making investment decisions Use Excel data tables to conduct one-way, two-way sensitivity analysis and scenario analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts