Question: Please, Only Answer for the T-accounts. I just need the T-Accounts done. Thank you in advance! Pane in the Glass Company (Pane) is a glass

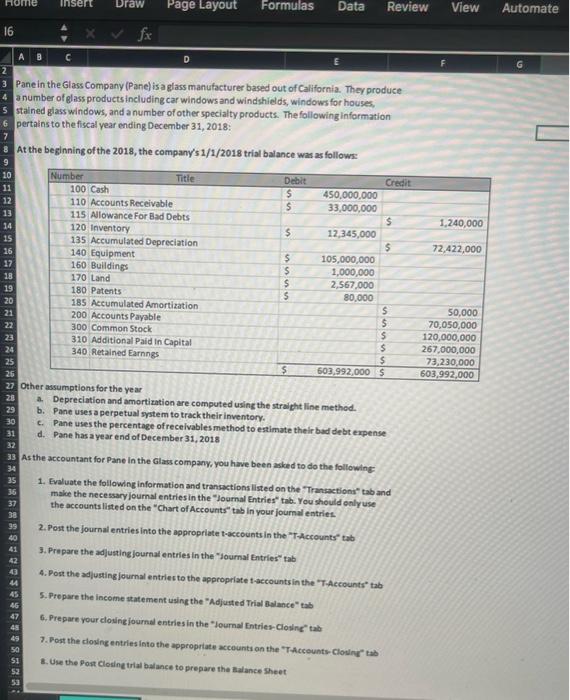

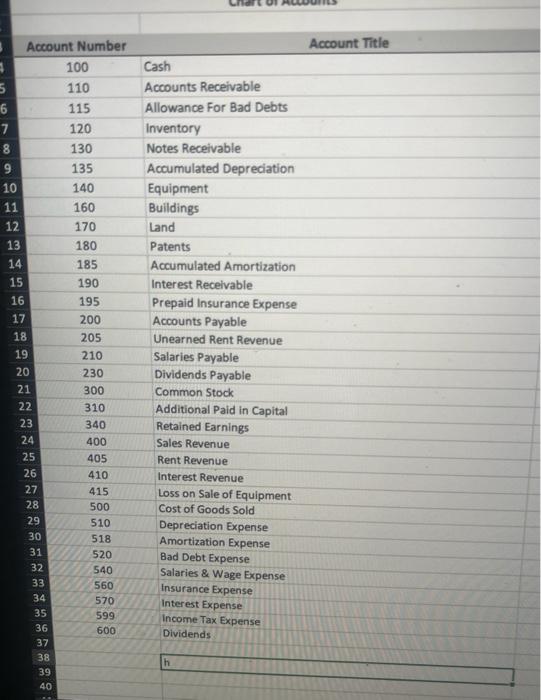

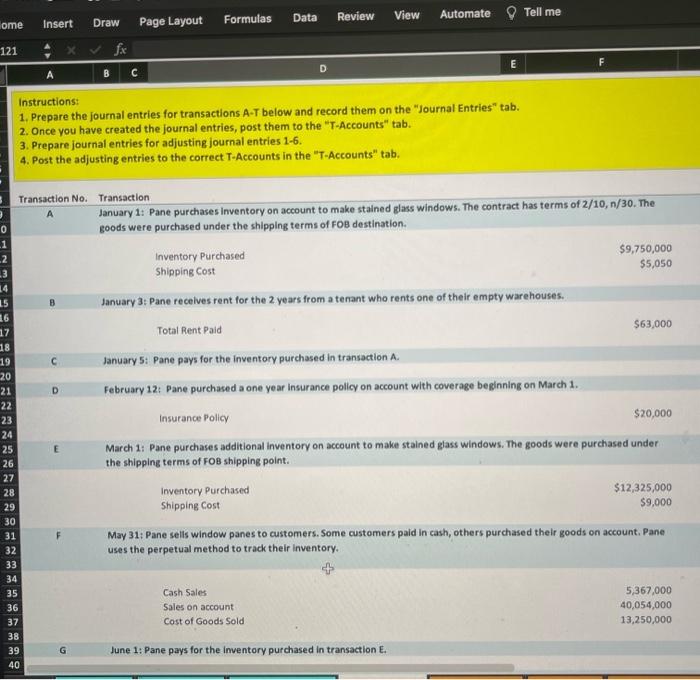

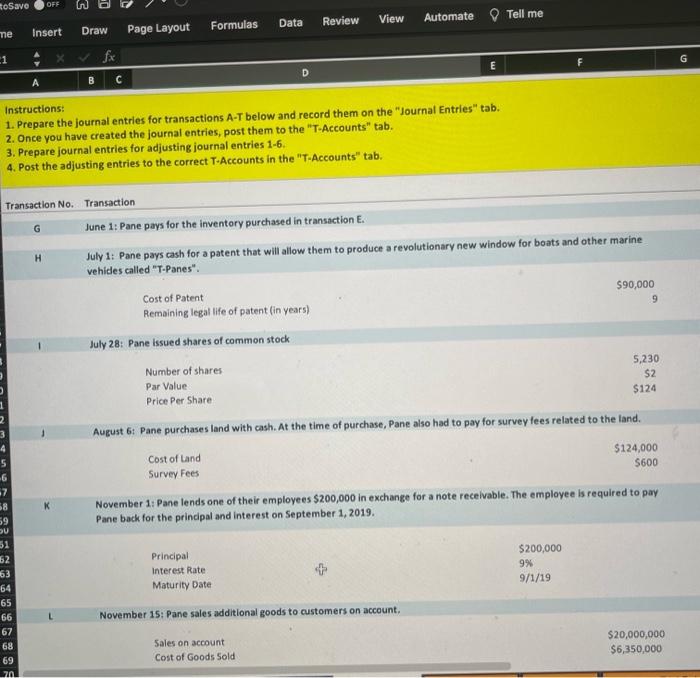

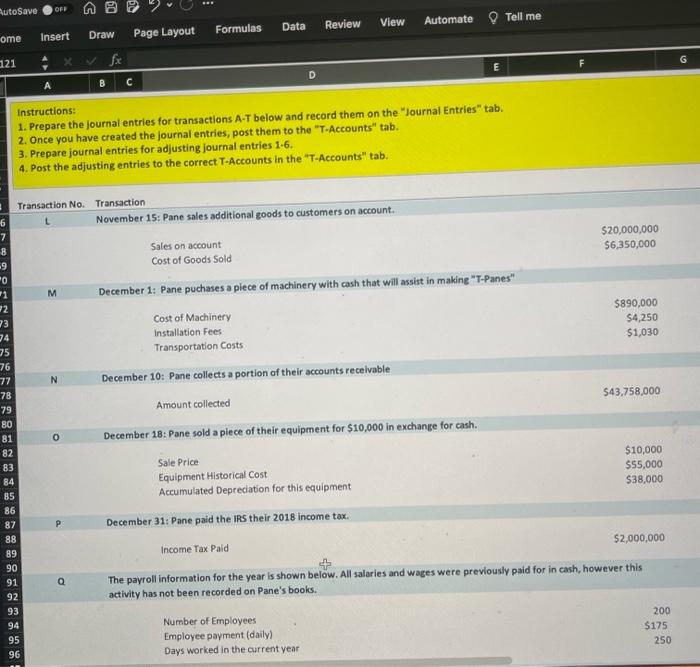

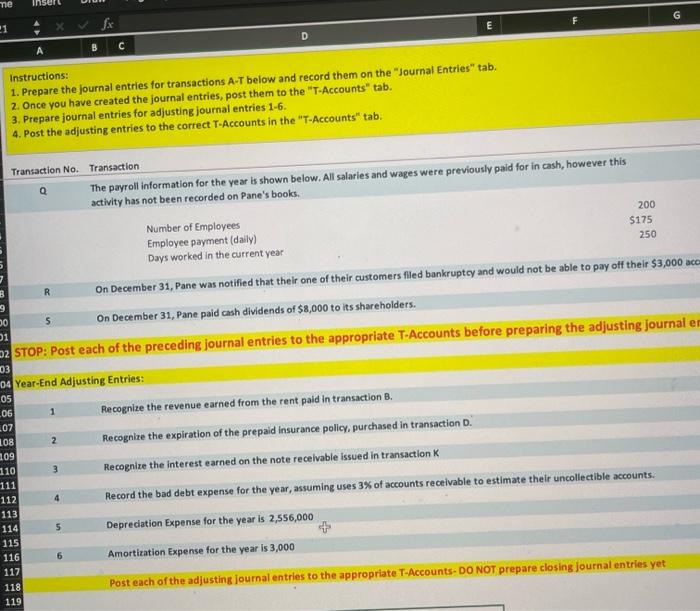

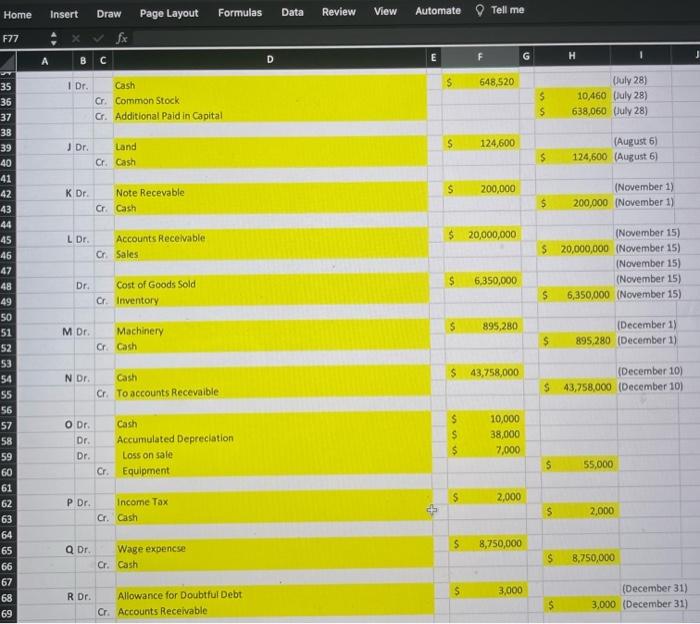

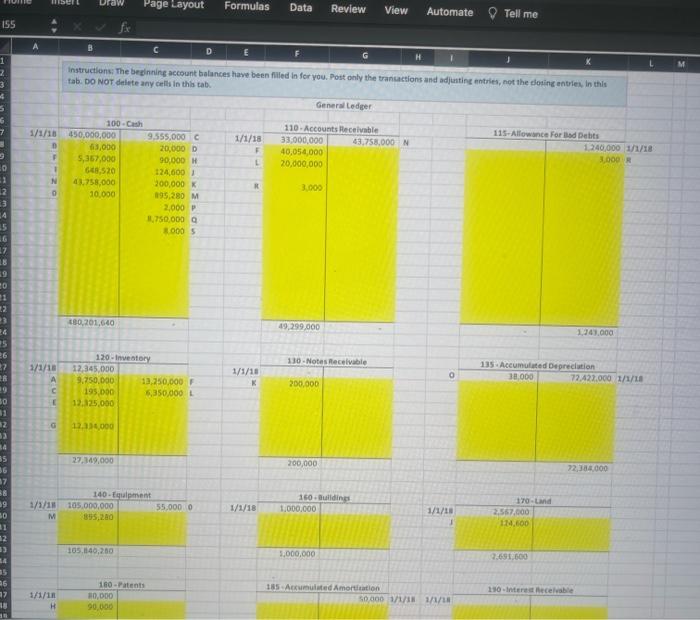

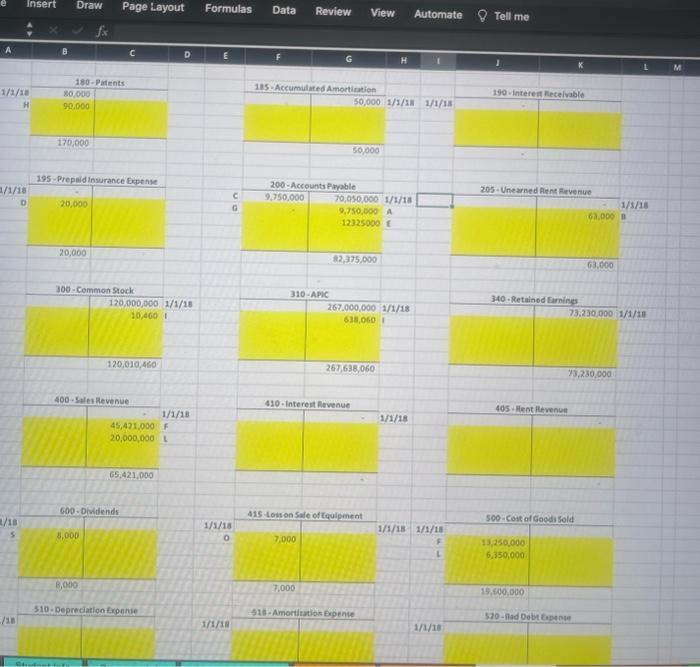

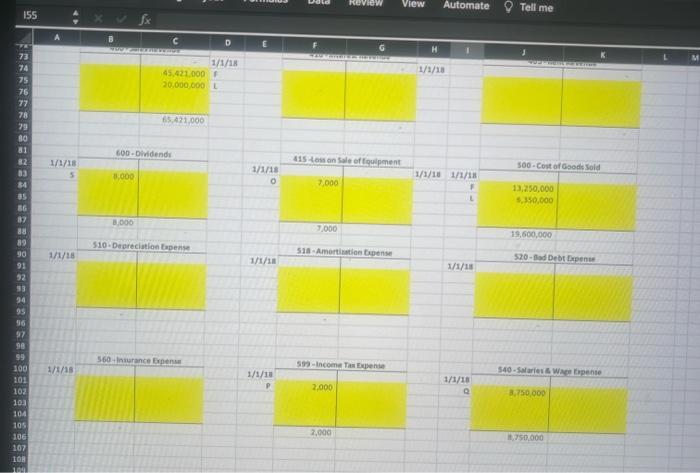

Pane in the Glass Company (Pane) is a glass manufacturer based out of California. They produce a number of glass products including car windows and windshiel ds, windows for houses, stalned giass windows, and a number of other specialty products. The following information pertains to the fiscal year ending December 31,2018 : At the beginning of the 2018, the company's 1/1/2018 trial balance was as follows: Other assumptions for the year a. Depreciation and amortization are computed using the straight line methed. b. Pane uses a perpetual system to track their inventory. c. Pane uses the percentage of receivables method to estimate their bad debt expense d. Pane has a year end of December 31,2018 As the accountant for Pane in the Glass company you have been asked to do the following 1. Evaluate the following information and transactions listed on the "Transetions" tab and make the nece ssary joum al entries in the "Journal Entries" tab. You should only use the accounts listed on the "Chart of Accounts" tab in your journal entries 2. Post the journal entries into the appropriate t-accounts in the "T-Acceunts" tab 3. Prepare the adjusting journat entries in the "Journal Entries" tab 4. Post the adjusting journal entries to the appropriate t-accountsin the "T.Accounts" tab 5. Prepare the income statement using the "Adjanted Trial Dalance" tab 6. Prepare your closinie journal entries in the "Journal Entries-Closing" tab- 7. Fost the closing entries into the appropriate acceunti on the "T Acceunts-cloulnc" tab 8. Use the Pont Closine trial balance to prepare the Aalance Sheet. Account Number Account Title Instructions: 1. Prepare the journal entries for transactions A-T below and record them on the "Journal Entries" tab. 2. Once you have created the journal entries, post them to the "T-Accounts" tab. 3. Prepare journal entries for adjusting journal entries 16. 4. Post the adjusting entries to the correct T-Accounts in the "T-Accounts" tab. Transaction No. Transaction A January 1: Pane purchases inventory on account to make stained glass windows. The contract has terms of 2/10, n/30. The goods were purchased under the shipping terms of foB destination. Inventory Purchased Shipping Cost $9,750,000$5,050 B January 3: Pane recelves rent for the 2 years from a tenant who rents one of their empty warehouses. Total Rent Paid $63,000 c. January 5: Pane pays for the inventory purchased in transaction A. D February 12: Pane purchased a one year insurance policy on account with coverage beginning on March 1. insurance Policy $20,000 E March 1: Pane purchases additional inventory on account to make stained glass windows. The goods were purchased under the shipping terms of FOB shipping point. Inventory Purchased Shipping Cost $12,325,000$9,000 F May 31: Pane sells window panes to customers. Some customers paid in cash, others purchased their goods on account. Pane uses the perpetual method to track their inventory. Cash Sales Sales on account Cost of Goods Sold 5,367,00040,054,00013,250,000 G June 1: Pane pays for the inventory purchased in transaction E. 1. Prepare the journal entries for transactions A-T below and record them on the "Journal Entries" tab. Instructions: 2. Once you have created the journal entries, post them to the "T-Accounts" tab. 3. Prepare journal entries for adjusting journal entries 1-6. 4. Post the adjusting entries to the correct T-Accounts in the "T-Accounts" tab. Transaction No. Transaction G June 1: Pane pays for the inventory purchased in transaction E. H July 1: Pane pays cash for a patent that will allow them to produce a revolutionary new window for boats and other marine vehides called "T-Panes". 590,000 Cost of Patent Remaining legal life of patent (in years) July 28: Pane issued shares of common stock Number of shares Par Value Price Per Share August 6: Pane purchases land with cash. At the time of purchase, Pane also had to pay for survey fees related to the land. 5124,000 Cost of Land 5600 Survey fees K November 1: Pane lends one of their employees $200,000 in exchange for a note receivable. The employee is required to pay Pane back for the prindipal and interest on September 1, 2019. Principal Interest Rate Maturity Date November 15: Pane sales additional goods to customers on account. Sales on account Cost of Goods Sold $20,000,000$6,350,000 Instructions: "Journal Entries" tab. 1. Prepare the journal entries for transactions A-T below and record them on the "Journal Entries" tab. Instructions: - instructlons: The beyinning account balances have been fililed in for you. Post only the trancactions and adjunting entries, not the elosing entriet, in thls tab. Do Nor delinte any celle in thla tab. Insert Draw Page Layout Formulas Data Review View Automate $ Tell me 4x=f A B : c D E F 6 1 K \begin{tabular}{r|r} 1/1/18 & 80,000 \\ \hline H & 90,000 \\ \hline & \\ \hline & 170,000 \\ \hline \end{tabular} 145. Accumuluted Amortintion 190- interent Mectivable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts