Question: please only answer (g). using excel. Stock A and Stock B produced the following returns during the past five years: a. Calculate the average rate

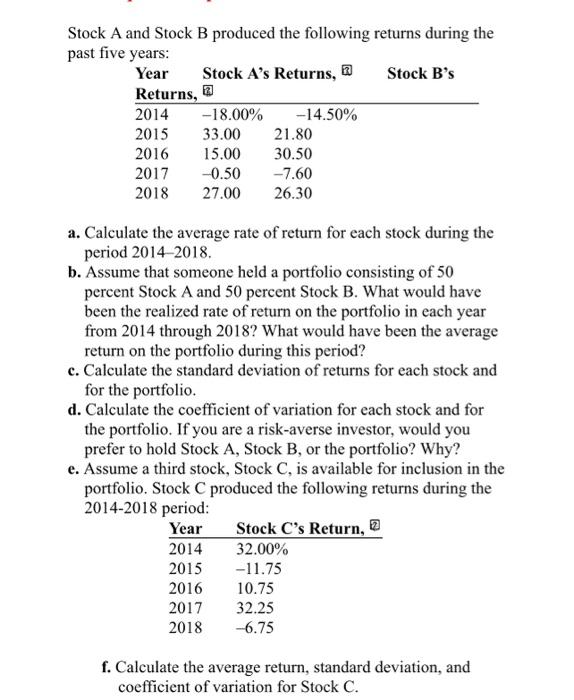

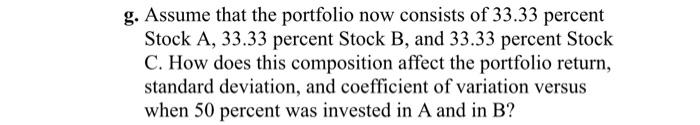

Stock A and Stock B produced the following returns during the past five years: a. Calculate the average rate of return for each stock during the period 2014-2018. b. Assume that someone held a portfolio consisting of 50 percent Stock A and 50 percent Stock B. What would have been the realized rate of return on the portfolio in each year from 2014 through 2018 ? What would have been the average return on the portfolio during this period? c. Calculate the standard deviation of returns for each stock and for the portfolio. d. Calculate the coefficient of variation for each stock and for the portfolio. If you are a risk-averse investor, would you prefer to hold Stock A, Stock B, or the portfolio? Why? e. Assume a third stock, Stock C, is available for inclusion in the portfolio. Stock C produced the following returns during the 2014-2018 period: f. Calculate the average return, standard deviation, and coefficient of variation for Stock C. g. Assume that the portfolio now consists of 33.33 percent Stock A, 33.33 percent Stock B, and 33.33 percent Stock C. How does this composition affect the portfolio return, standard deviation, and coefficient of variation versus when 50 percent was invested in A and in B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts