Question: Please only answer if you are certain on how to solve this. Nearly all of my previous questions have been answered incorrectly which is a

Please only answer if you are certain on how to solve this. Nearly all of my previous questions have been answered incorrectly which is a waste of a subscription fee. Thank you

Please only answer if you are certain on how to solve this. Nearly all of my previous questions have been answered incorrectly which is a waste of a subscription fee. Thank you

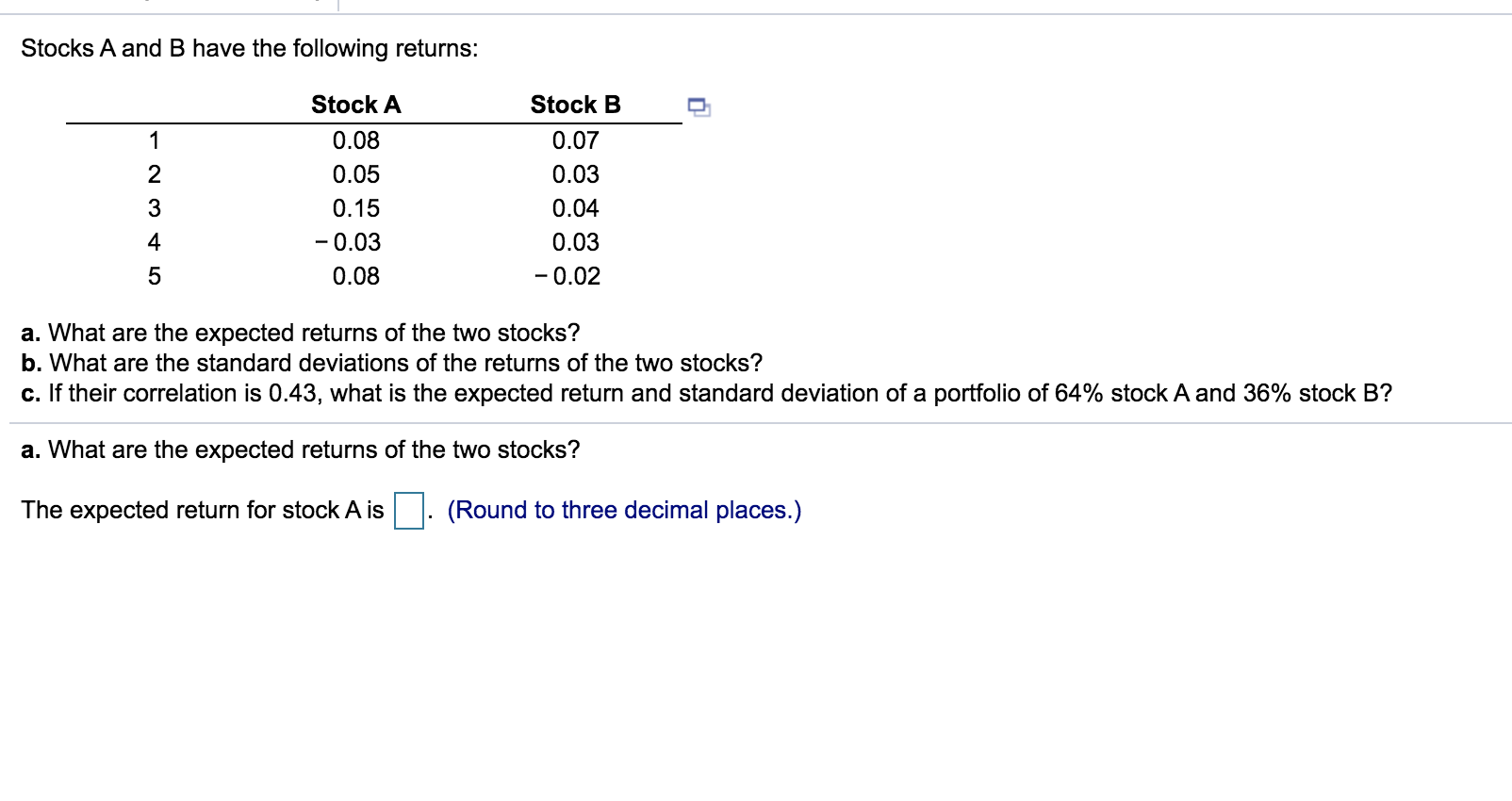

Stocks A and B have the following returns: Stock A 0.08 0.05 0.15 -0.03 0.08 Stock B 0.07 0.03 0.04 0.03 -0.02 a. What are the expected returns of the two stocks? b. What are the standard deviations of the returns of the two stocks? c. If their correlation is 0.43, what is the expected return and standard deviation of a portfolio of 64% stock A and 36% stock B? a. What are the expected returns of the two stocks? The expected return for stock A is . (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts