Question: Please only answer if you are sure do not waste my question, i only need the empty boxes Prepare journal entries to record income taves

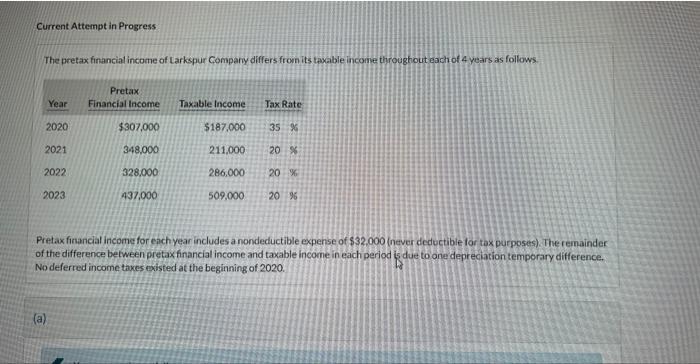

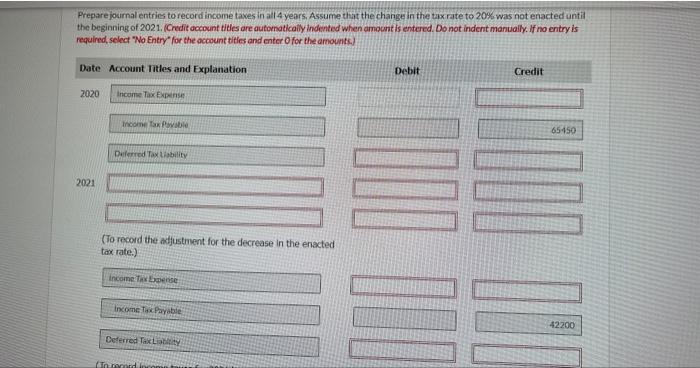

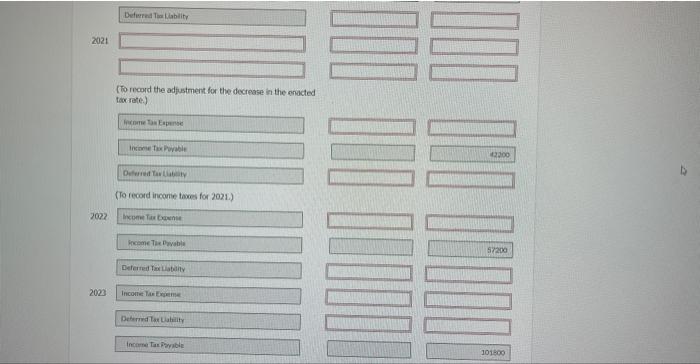

Prepare journal entries to record income taves in all 4 years, Assume that the change in the tax rate to 20% was not enacted until the beginning of 2021. (Credit account tilies are automaticaily indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titis and enter O for the arnounts.) Deferrat Tarability 2021 (To record the adfustment for the decrease in the enacted takrate) lisione taxhorie Defered tarkabity (To record inconis tawe for 2021.) 2027 Fxome Tie towene Frome The Privaly Defered Tacilataity \( 2 0 2 3 \longdiv { \text { Inconse Tar Exeme } } \) Deterind Lex Latility income Tax Provible Current Attempt in Progress The pretax financial income of Larkspur Company differs from its twable income throughout eachof 4 vears as follows. Pretax financial income for esch year includes a nondeductible expense of $32,000 (never deductible for tax purposes). The remainder of the difference between pretax financial income and taxable income in each period is due to ane depreciation temporary difference. No deferred income taxes existed at the beginning of 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts