Question: Please only answer if you know how to do it thank you. The corporate income tax table currently in effect is: Taxable income is greater

Please only answer if you know how to do it thank you.

Please only answer if you know how to do it thank you.

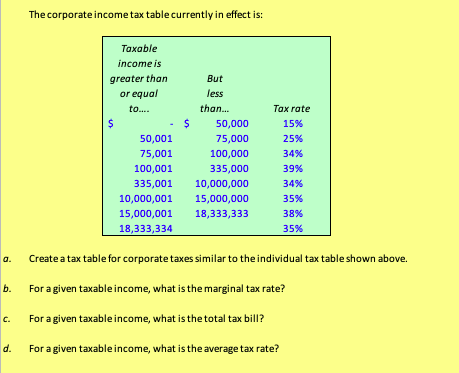

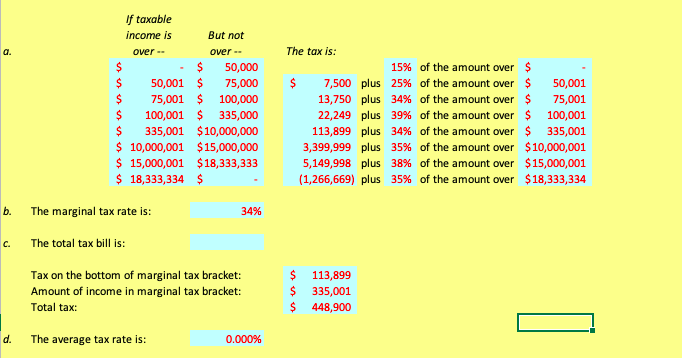

The corporate income tax table currently in effect is: Taxable income is greater than or equal But less than... $50,000 75,000 100,000 335,000 335,001 10,000,000 10,000,001 15,000,000 15,000,001 18,333,333 Tax rate 15% 25% 34% 39% 34% 35% 38% 35% 50,001 75,001 100,001 18,333,334 a. Create a tax table for corporate taxes similar to the individual tax table shown above. b. For a given taxable income, what is the marginal tax rate? c. For a given taxable income, what is the total tax bill? d. For a given taxable income, what is the average tax rate? f taxable income is But not a. over over The tax is $ 50,000 50,001$ 75,000 15% of the amount over $ $ $75,001 100,000 $100,001 $ 335,000 $335,001 $10,000,000 $ 10,000,001 $15,000,000 $ 15,000,001 $18,333,333 $18,333,334 $ $ 7,500 plus 25% ofthe amount over $ 50,001 13,750 plus 34% ofthe amount over $ 75,001 22,249 plus 39% of the amount over $ 100,001 113,899 plus 34% ofthe amount over $ 335,001 3,399,999 plus 35% of the amount over $10,000,001 5,149,998 plus 38% of the amount over $15,000,001 (1,266,669) plus 35% ofthe amount over $18,333,334 b. The marginal tax rate is: 34% c. The total tax bill is Tax on the bottom of marginal tax bracket: Amount of income in marginal tax bracket: Total tax: $113,899 $335,001 $448,900 d. The average tax rate is: 0.000%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts