Question: Please only answer multiple Choice questions. Q 4 Q 5 andQ 6 Q 4 Using the 'new' / fair value method for valuing non -

Please only answer multiple Choice questions. Q Q andQ

Q Using the 'new' fair value method for valuing noncontrolling interests, what is the value of noncontrolling interests at December the date of acquisition

Q Using the 'old' proportionate share method for valuing noncontrolling interests, what is the value of goodwill at January Q Using the 'new' fair value method for valuing noncontrolling interests, what is the value of goodwill at January

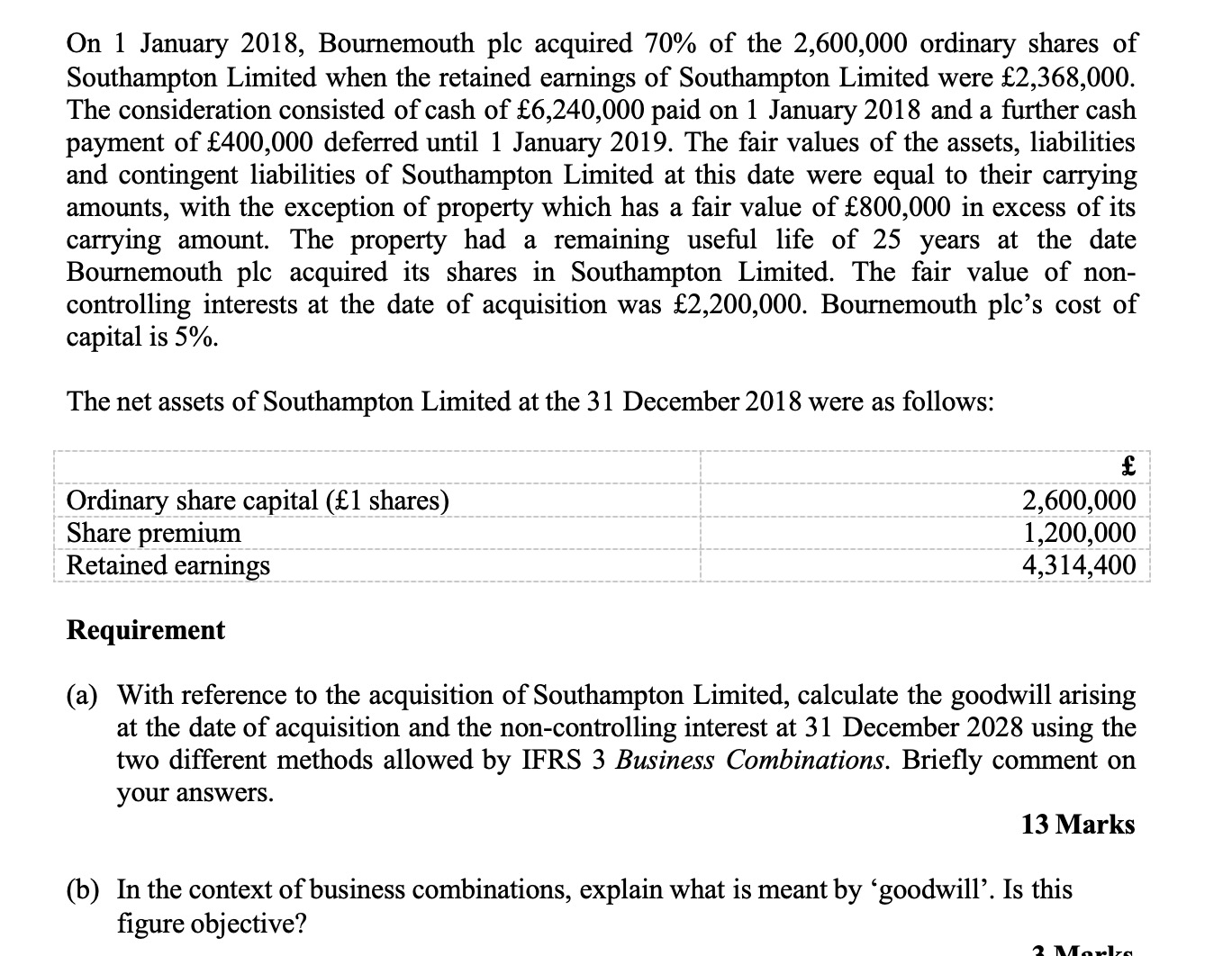

On January Bournemouth ple acquired of the ordinary shares of Southampton Limited when the retained earnings of Southampton Limited were The consideration consisted of cash of paid on January and a further cash payment of deferred until January The fair values of the assets, liabilities and contingent liabilities of Southampton Limited at this date were equal to their carrying amounts, with the exception of property which has a fair value of in excess of its carrying amount. The property had a remaining useful life of years at the date Bournemouth plc acquired its shares in Southampton Limited. The fair value of noncontrolling interests at the date of acquisition was Bournemouth plcs cost of capital is

The net assets of Southampton Limited at the December were as follows:

tablefOrdinary share capital sharesShare premium,Retained earnings,

Requirement

a With reference to the acquisition of Southampton Limited, calculate the goodwill arising at the date of acquisition and the noncontrolling interest at December using the two different methods allowed by IFRS Business Combinations. Briefly comment on your answers.

Marks

b In the context of business combinations, explain what is meant by 'goodwill'. Is this figure objective?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock