Question: please only answer , not explanation Question 1 V What is Tom's total amount of gross income if: 1) he earned $100 in wages; 2)

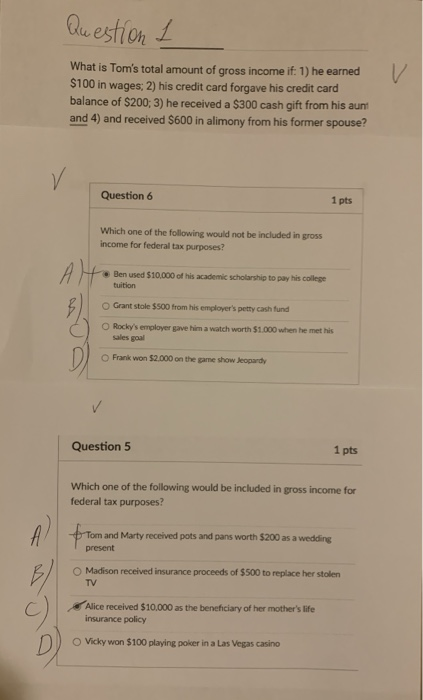

Question 1 V What is Tom's total amount of gross income if: 1) he earned $100 in wages; 2) his credit card forgave his credit card balance of $200; 3) he received a $300 cash gift from his aunt and 4) and received $600 in alimony from his former spouse? Question 6 1 pts Which one of the following would not be included in gross income for federal tax purposes? Ben used $10,000 of his academic scholarship to pay his college tuition Grant stale $500 from his employer's petty cash fund Rocky's employer gave him a watch worth $1.000 when he met his sales goal Frank won $2.000 on the game show Jeopardy Question 5 1 pts Which one of the following would be included in gross income for federal tax purposes? Tom and Marty received pots and pans worth $200 as a wedding present Madison received insurance proceeds of $500 to replace her stolen TV Alice received $10.000 as the beneficiary of her mother's life insurance policy D Vicky won $100 playing poker in a Las Vegas casino

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts