Question: PLEASE ONLY ANSWER PART E Limitless Ltd. is planning to buy a new warehouse to store its production output. The investment would require 500,000 to

PLEASE ONLY ANSWER PART E

PLEASE ONLY ANSWER PART E

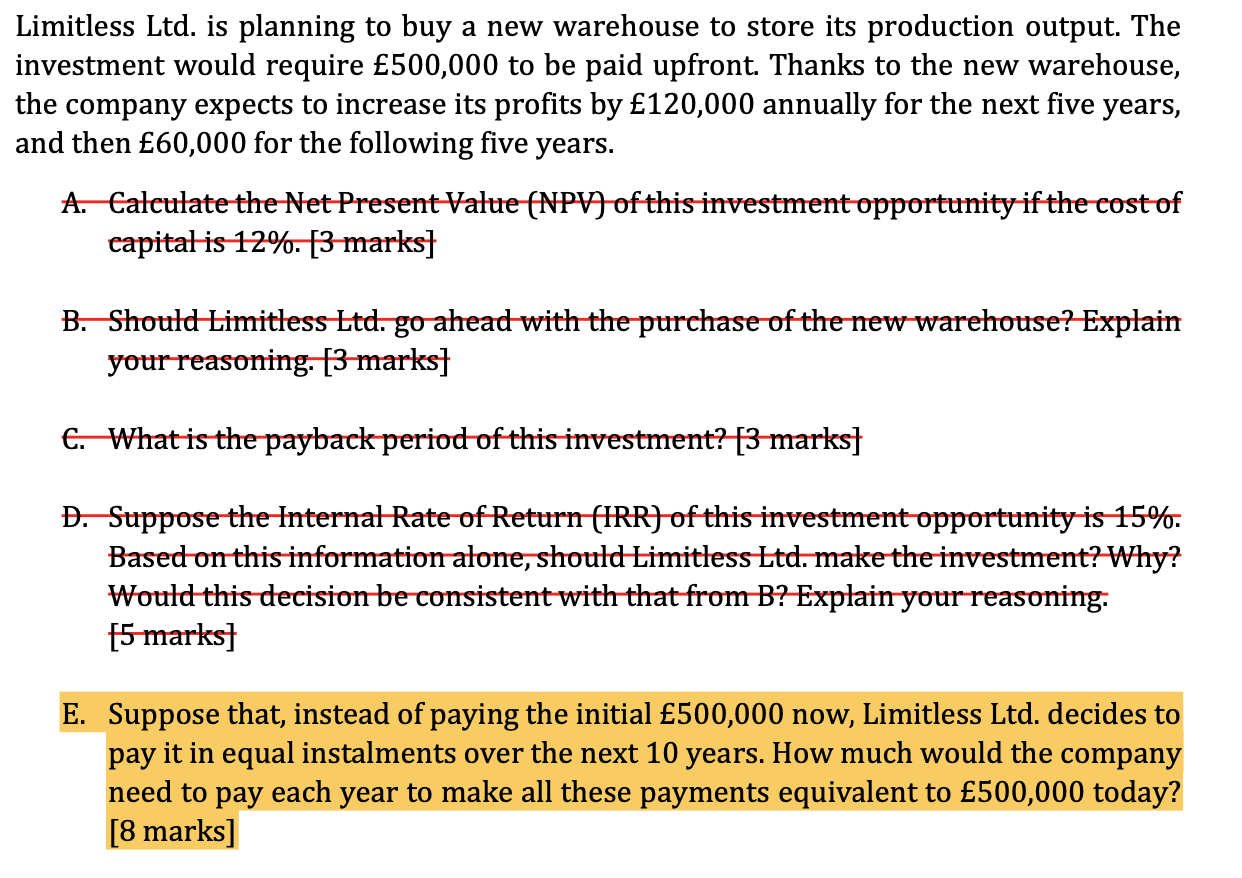

Limitless Ltd. is planning to buy a new warehouse to store its production output. The investment would require 500,000 to be paid upfront. Thanks to the new warehouse, the company expects to increase its profits by 120,000 annually for the next five years, and then 60,000 for the following five years. A. Calculate the Net Present Value (NPV) of this investment opportunity if the cost of eapital is 12%. [3 marks] B. Should Limitless Ltd. go ahead with the purchase of the new warehouse? Explain your reasoning. [3 marks] C. What is the payback period of this investment? [3 marks] D. Suppose the Internal Rate of Return (IRR) of this investment opportunity is 15%. Based on this information alone, should Limitless Ltd. make the investment? Why? Would this decision be consistent with that from B? Explain your reasoning: [5 marks] E. Suppose that, instead of paying the initial 500,000 now, Limitless Ltd. decides to pay it in equal instalments over the next 10 years. How much would the company need to pay each year to make all these payments equivalent to 500,000 today? [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts