Question: PLEASE ONLY ANSWER PART G (THE VERY LAST PORTION G1,G2,G3) On January 1,2024 , Waterway Ltd. issued bonds with a maturity value of $5.65 million

PLEASE ONLY ANSWER PART G (THE VERY LAST PORTION G1,G2,G3)

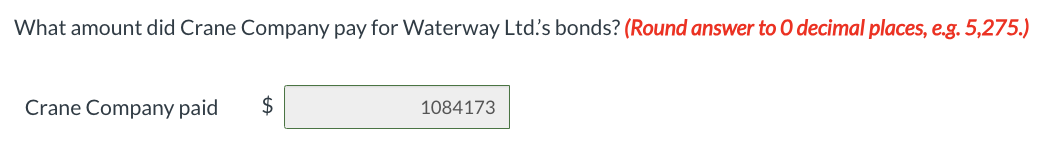

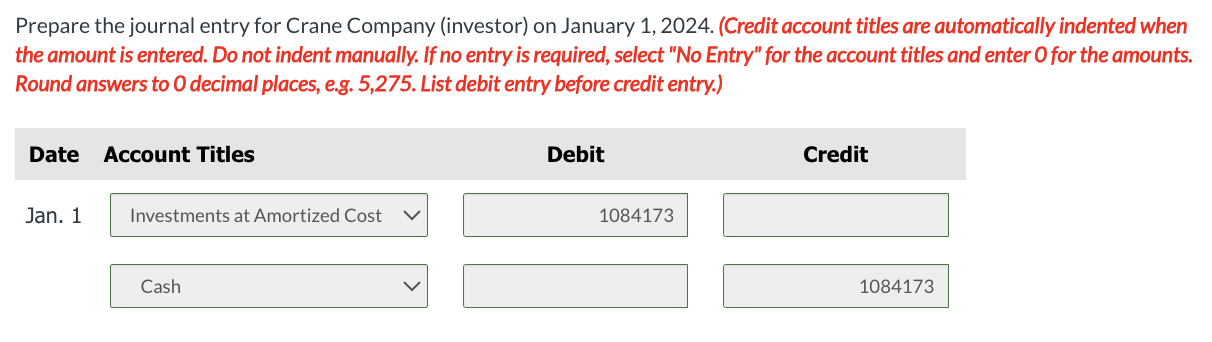

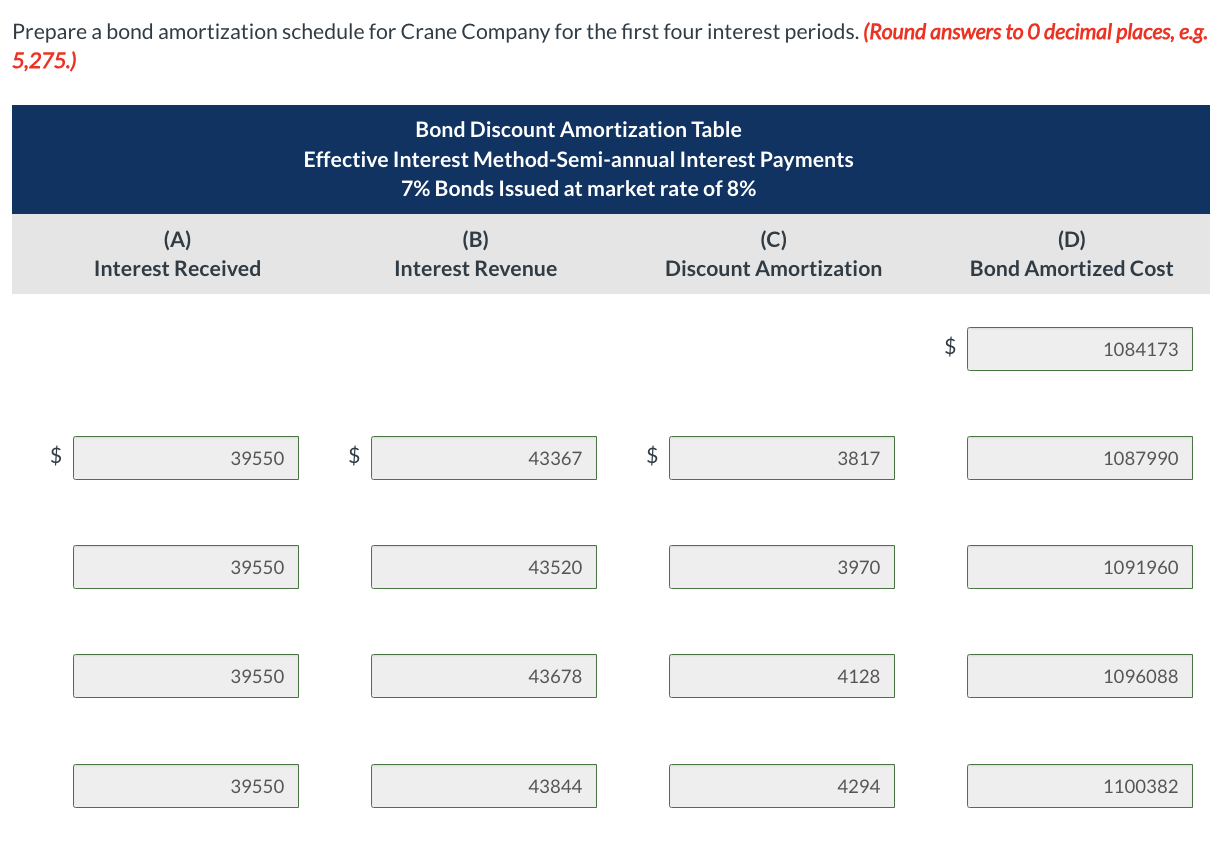

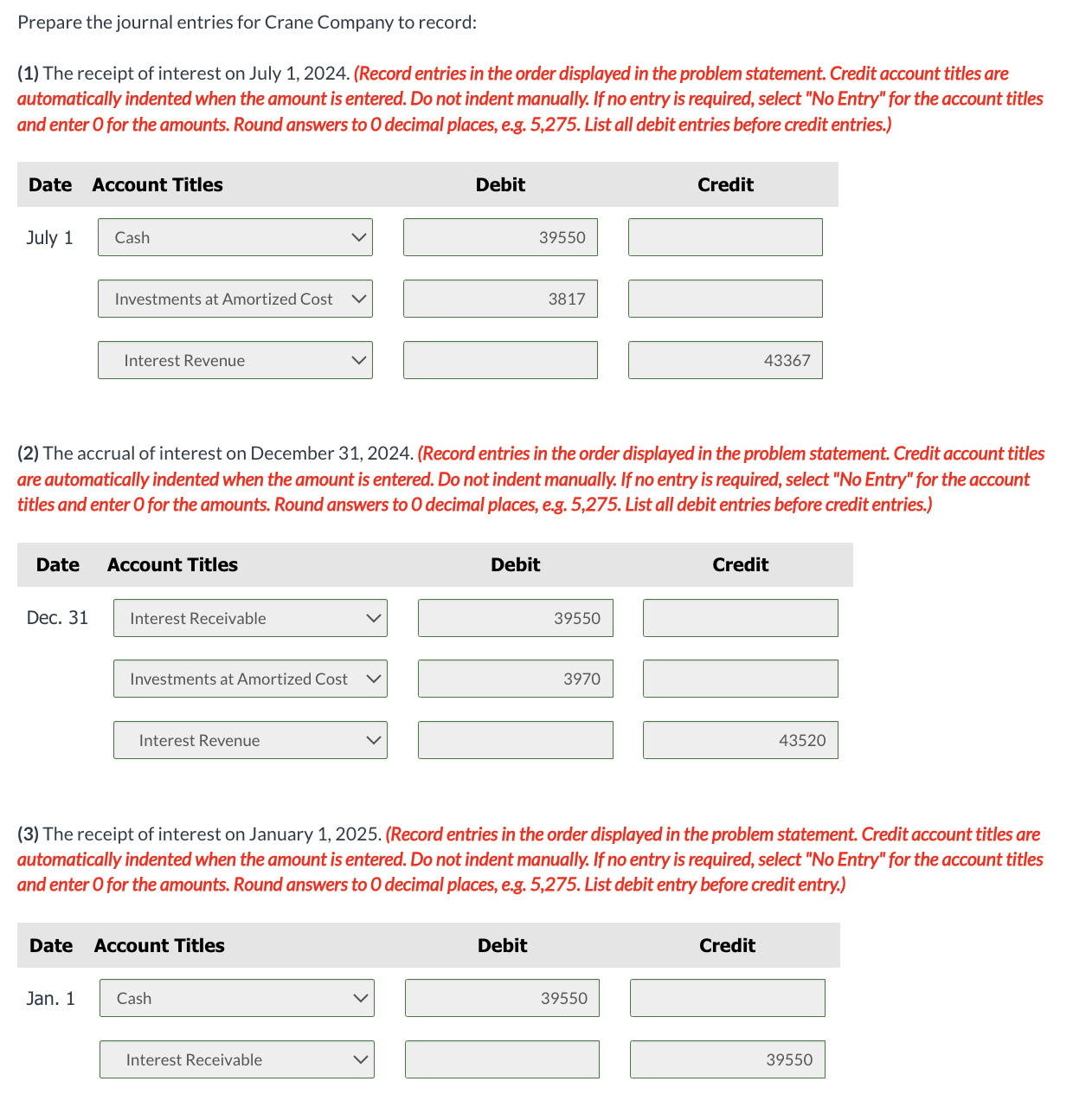

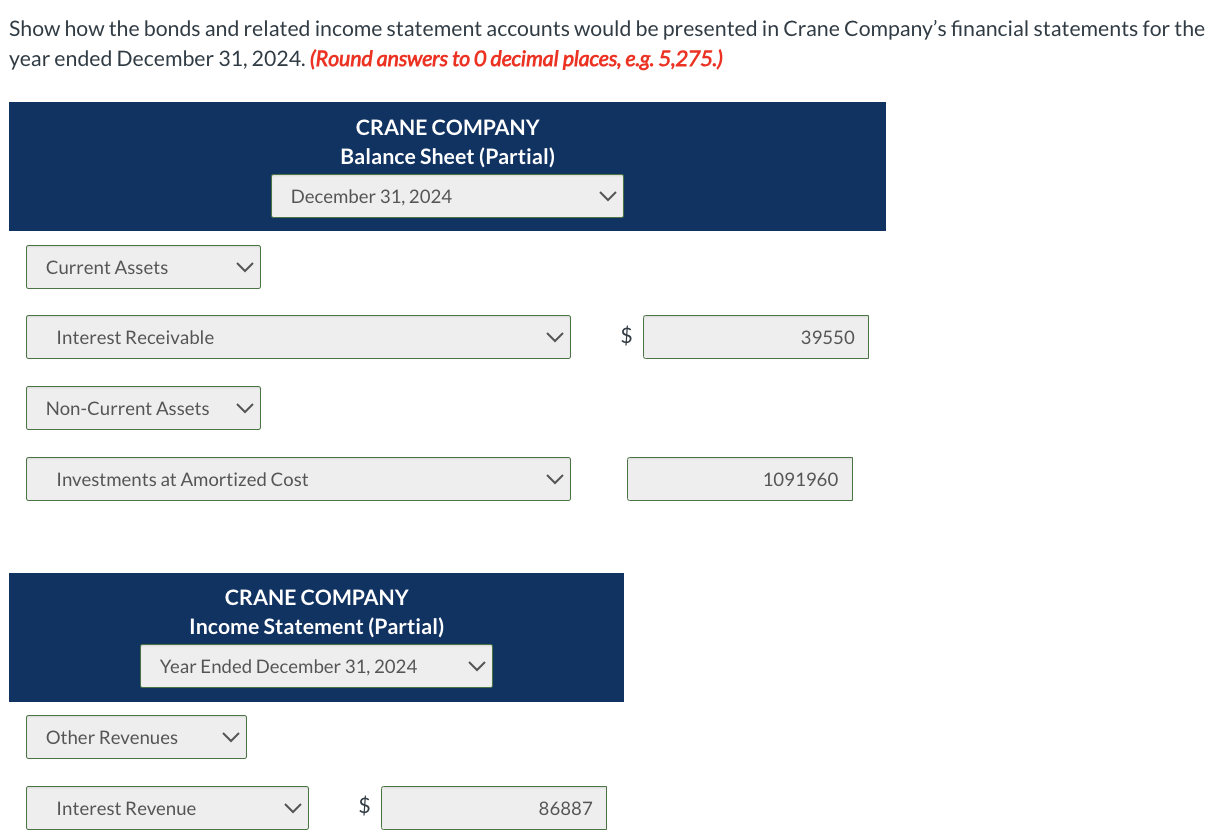

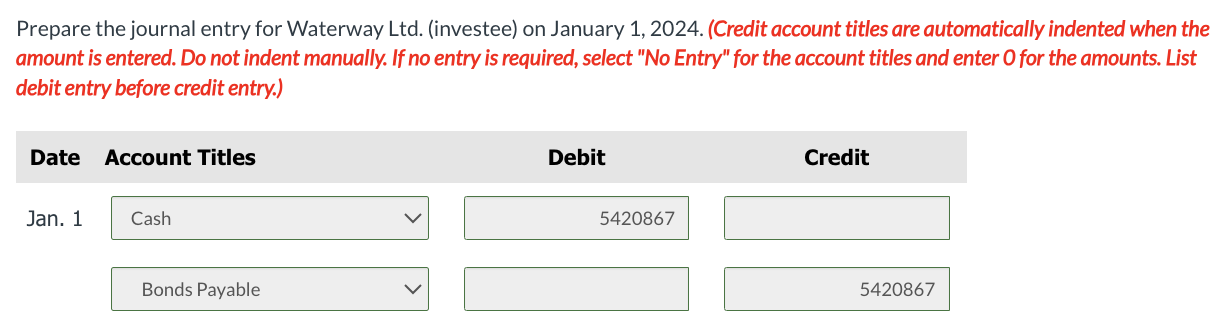

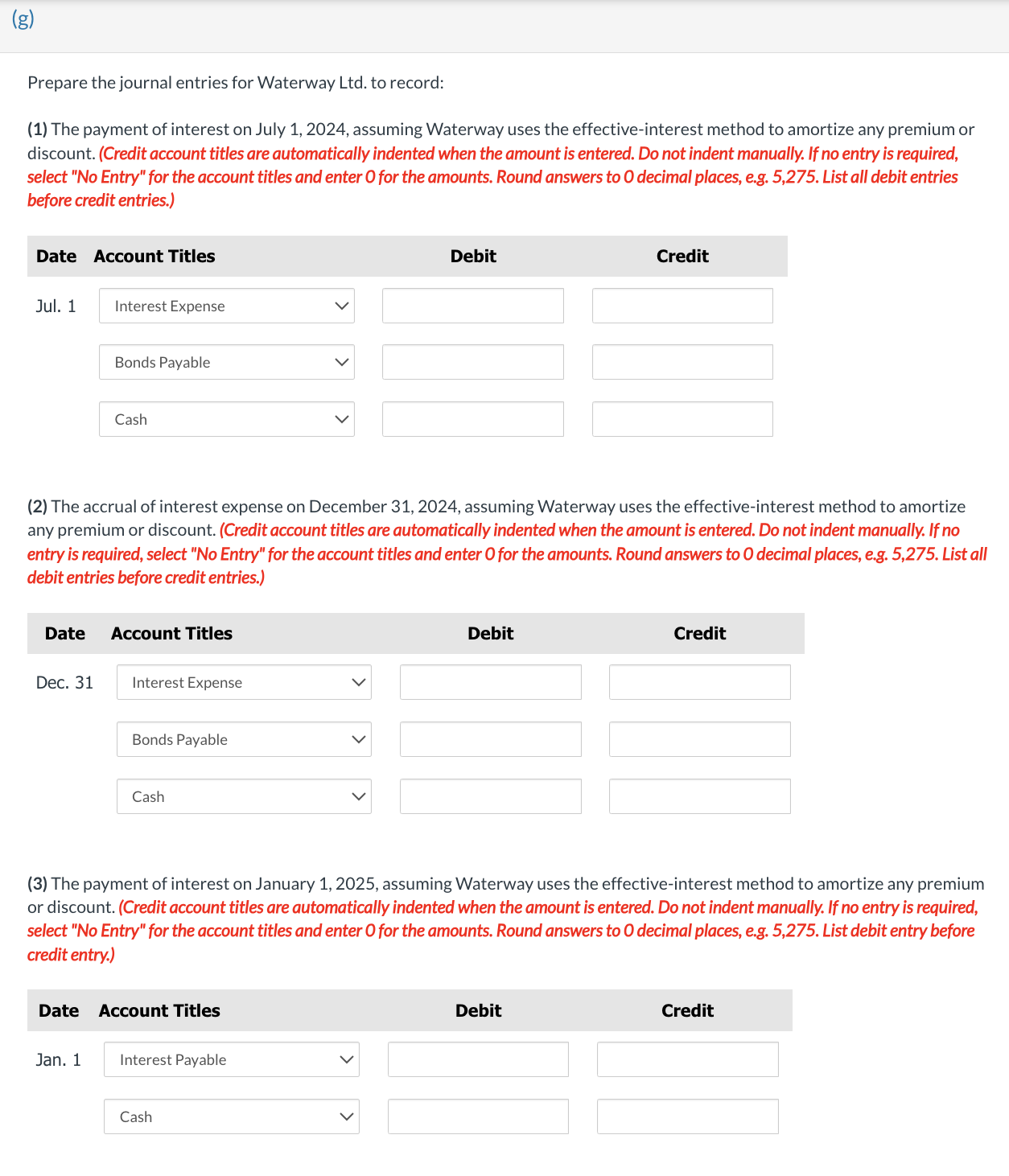

On January 1,2024 , Waterway Ltd. issued bonds with a maturity value of $5.65 million for $5,420,867, when the market rate of interest was 8%. The bonds have a contractual interest rate of 7% and mature on January 1,2029 . Interest on the bonds is payable semi-annually on July 1 and January 1 of each year. On January 1, 2024, Crane Company, a public company, purchased Waterway Ltd. bonds with a maturity value of \$1.13 million to earn interest. On December 31, 2024, the bonds were trading at 99. Both companies' year end is December 31. Click here to view the factor table. Present Value of 1 Click here to view the factor table. Present Value of an Annuity of 1 What amount did Crane Company pay for Waterway Ltd's bonds? (Round answer to 0 decimal places, e.g. 5,275.) Crane Company paid $ Prepare the journal entry for Crane Company (investor) on January 1, 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, e.g. 5,275. List debit entry before credit entry.) Prepare a bond amortization schedule for Crane Company for the first four interest periods. (Round answers to 0 decimal places, e.g. 5,275.) Prepare a bond amortization schedule for Crane Company for the first four interest periods. (Round answers to 0 decimal places, e.g. 5,275. Prepare the journal entries for Crane Company to record: (1) The receipt of interest on July 1, 2024. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. List all debit entries before credit entries.) (2) The accrual of interest on December 31, 2024. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. List all debit entries before credit entries.) (3) The receipt of interest on January 1, 2025. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. List debit entry before credit entry.) Show how the bonds and related income statement accounts would be presented in Crane Company's financial statements for the year ended December 31, 2024. (Round answers to 0 decimal places, e.g. 5,275.) Prepare the journal entry for Waterway Ltd. (investee) on January 1, 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Prepare the journal entries for Waterway Ltd. to record: (1) The payment of interest on July 1, 2024, assuming Waterway uses the effective-interest method to amortize any premium or discount. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, e.g. 5,275. List all debit entries before credit entries.) (2) The accrual of interest expense on December 31, 2024, assuming Waterway uses the effective-interest method to amortize any premium or discount. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. List all debit entries before credit entries.) (3) The payment of interest on January 1, 2025, assuming Waterway uses the effective-interest method to amortize any premium or discount. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. List debit entry before credit entry.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts