Question: PLEASE ONLY ANSWER QUESTION 2, INFORMATION IN QUESTION 1 IS REQUIRED TO ANSWER QUESTION 2. THANK YOU Question 2 (30 points): Same as question 1,

PLEASE ONLY ANSWER QUESTION 2, INFORMATION IN QUESTION 1 IS REQUIRED TO ANSWER QUESTION 2. THANK YOU

PLEASE ONLY ANSWER QUESTION 2, INFORMATION IN QUESTION 1 IS REQUIRED TO ANSWER QUESTION 2. THANK YOU

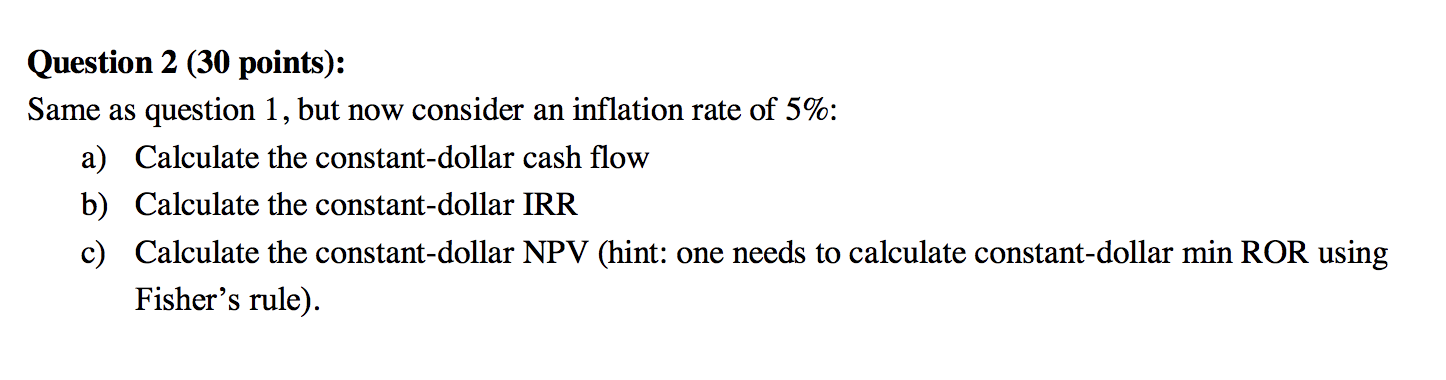

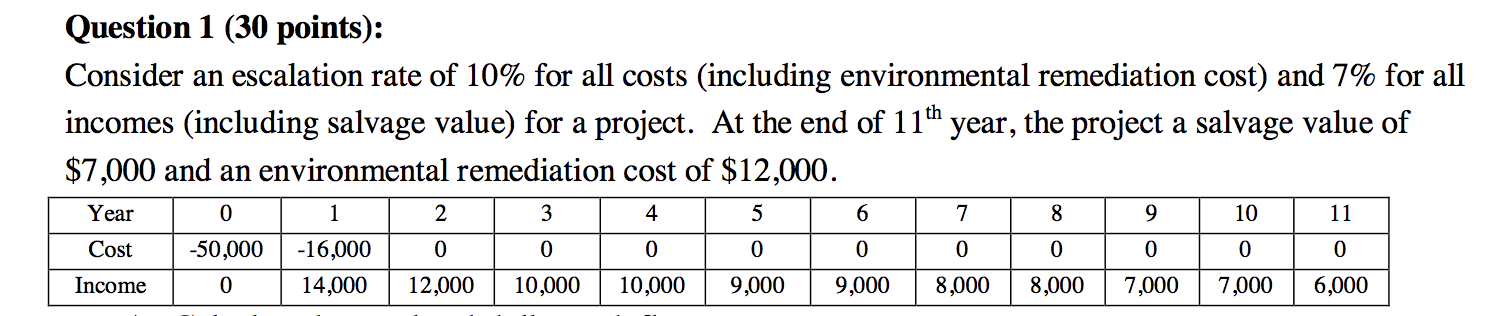

Question 2 (30 points): Same as question 1, but now consider an inflation rate of 5%: a) Calculate the constant-dollar cash flow b) Calculate the constant-dollar IRR c) Calculate the constant-dollar NPV (hint: one needs to calculate constant-dollar min ROR using Fisher's rule). Question 1 (30 points): Consider an escalation rate of 10% for all costs (including environmental remediation cost) and 7% for all incomes (including salvage value) for a project. At the end of 11th year, the project a salvage value of $7,000 and an environmental remediation cost of $12,000. Year 0 1 2 3 4 5 6 7 8 9 10 11 Cost -16,000 0 0 0 0 0 0 0 0 0 -50,000 0 Income 14,000 12,000 10,000 10,000 9,000 9,000 8,000 8,000 7,000 7,000 6,000 Question 2 (30 points): Same as question 1, but now consider an inflation rate of 5%: a) Calculate the constant-dollar cash flow b) Calculate the constant-dollar IRR c) Calculate the constant-dollar NPV (hint: one needs to calculate constant-dollar min ROR using Fisher's rule). Question 1 (30 points): Consider an escalation rate of 10% for all costs (including environmental remediation cost) and 7% for all incomes (including salvage value) for a project. At the end of 11th year, the project a salvage value of $7,000 and an environmental remediation cost of $12,000. Year 0 1 2 3 4 5 6 7 8 9 10 11 Cost -16,000 0 0 0 0 0 0 0 0 0 -50,000 0 Income 14,000 12,000 10,000 10,000 9,000 9,000 8,000 8,000 7,000 7,000 6,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts