Question: Please only answer question #5 and show detailed work. Use the following information regarding two mutually exclusive projects to answer the following five questions: Option

Please only answer question #5 and show detailed work.

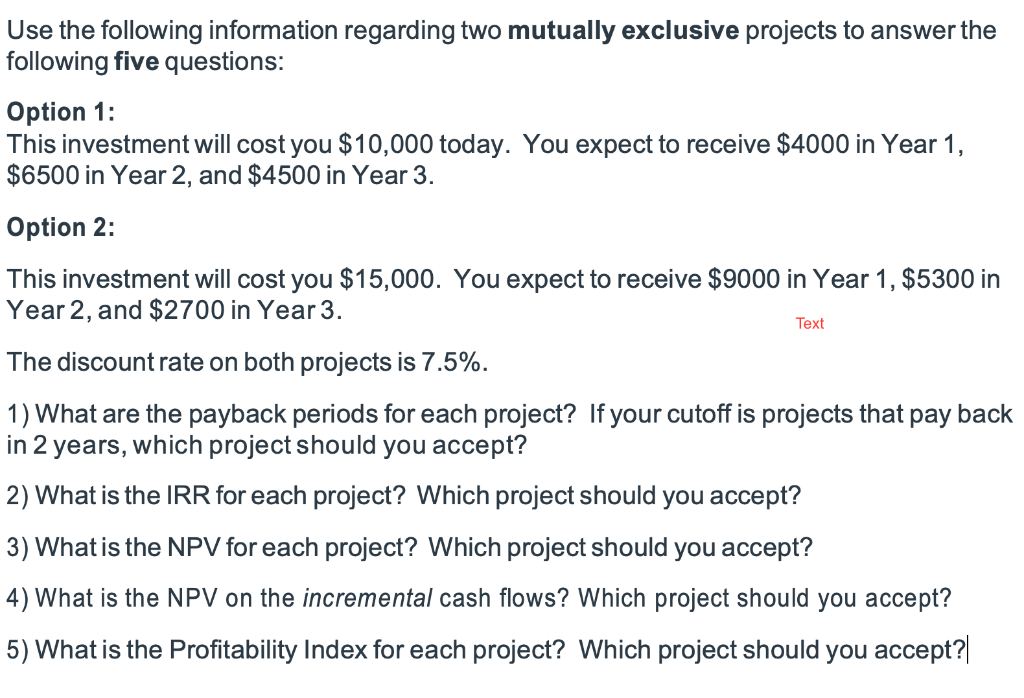

Use the following information regarding two mutually exclusive projects to answer the following five questions: Option 1: This investment will cost you $10,000 today. You expect to receive $4000 in Year 1, $6500 in Year 2, and $4500 in Year 3. Option 2: This investment will cost you $15,000. You expect to receive $9000 in Year 1, $5300 in Year 2, and $2700 in Year 3. Text The discount rate on both projects is 7.5%. 1) What are the payback periods for each project? If your cutoff is projects that pay back in 2 years, which project should you accept? 2) What is the IRR for each project? Which project should you accept? 3) What is the NPV for each project? Which project should you accept? 4) What is the NPV on the incremental cash flows? Which project should you accept? 5) What is the Profitability Index for each project? Which project should you accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts