Question: Please only answer the following two questions using the data below: From Scenario 2, what are your recommendations on the investment project? Explain your reasoning.

Please only answer the following two questions using the data below:

- From Scenario 2, what are your recommendations on the investment project? Explain your reasoning.

- From Scenario 2, what are your recommendations for investment in the new technology?

King Fisher Aviation is ready to grow and is considering investing in new technologies. As the financial manager for King Fisher Aviation, you are asked to provide some critical information on company bonds, present and future values, and cash flow in order to make some tough decisions and appropriate recommendations to the Chief Executive Officer (CEO).

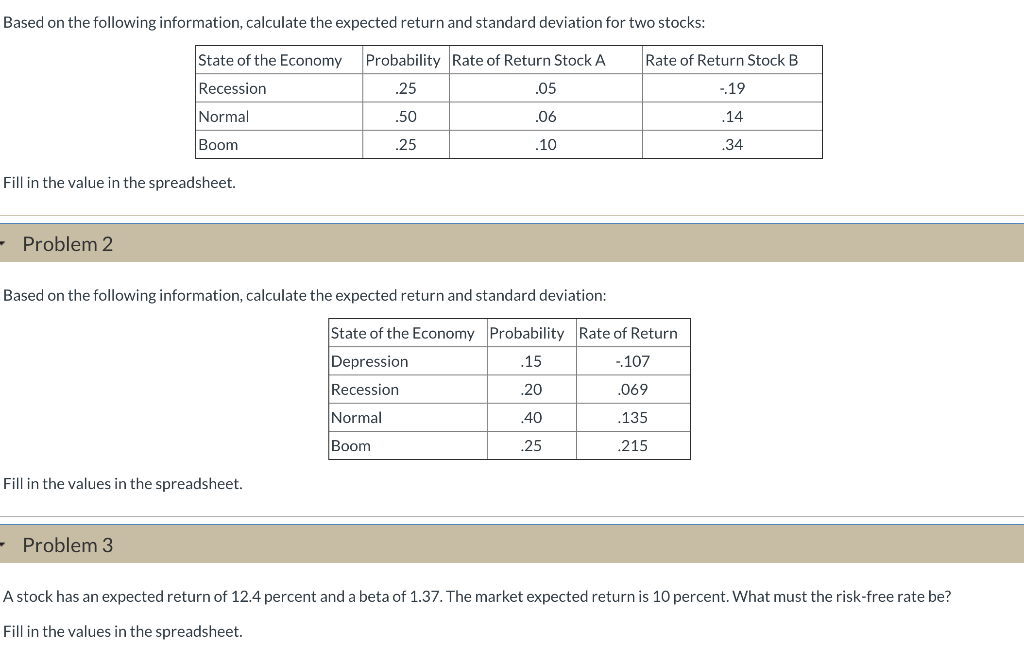

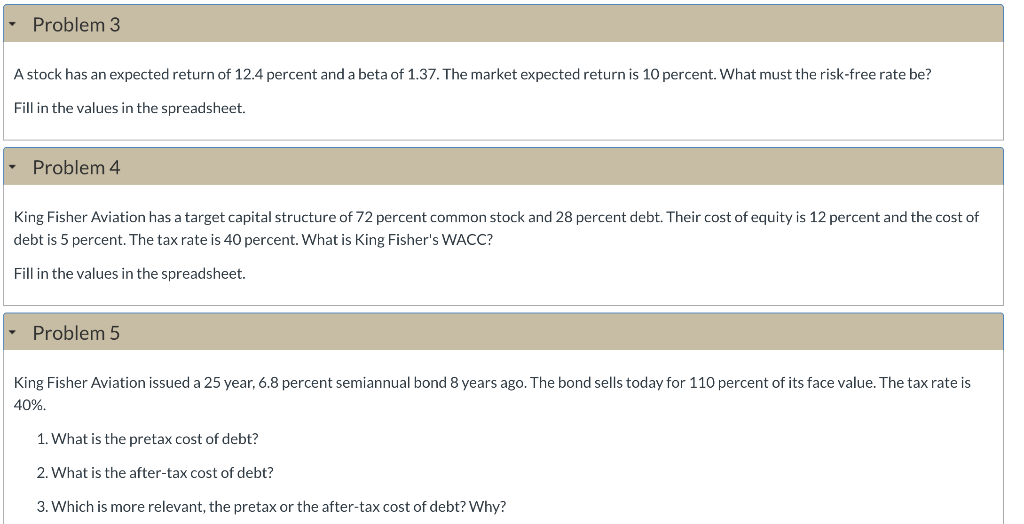

Based on the following information, calculate the expected return and standard deviation for two stocks: Probability Rate of Return Stock A Rate of Return Stock B State of the Economy Recession Normal .25 .05 -19 .06 .14 .50 .25 Boom .10 .34 Fill in the value in the spreadsheet. - Problem 2 Based on the following information, calculate the expected return and standard deviation: State of the Economy Probability Rate of Return Depression .15 -107 Recession .20 .069 Normal 40 .135 Boom .25 .215 Fill in the values in the spreadsheet. - Problem 3 A stock has an expected return of 12.4 percent and a beta of 1.37. The market expected return is 10 percent. What must the risk-free rate be? Fill in the values in the spreadsheet. - Problem 3 A stock has an expected return of 12.4 percent and a beta of 1.37. The market expected return is 10 percent. What must the risk-free rate be? Fill in the values in the spreadsheet. - Problem 4 King Fisher Aviation has a target capital structure of 72 percent common stock and 28 percent debt. Their cost of equity is 12 percent and the cost of debt is 5 percent. The tax rate is 40 percent. What is King Fisher's WACC? Fill in the values in the spreadsheet. - Problem 5 King Fisher Aviation issued a 25 year, 6.8 percent semiannual bond 8 years ago. The bond sells today for 110 percent of its face value. The tax rate is 40% 1. What is the pretax cost of debt? 2. What is the after-tax cost of debt? 3. Which is more relevant, the pretax or the after-tax cost of debt? Why? Based on the following information, calculate the expected return and standard deviation for two stocks: Probability Rate of Return Stock A Rate of Return Stock B State of the Economy Recession Normal .25 .05 -19 .06 .14 .50 .25 Boom .10 .34 Fill in the value in the spreadsheet. - Problem 2 Based on the following information, calculate the expected return and standard deviation: State of the Economy Probability Rate of Return Depression .15 -107 Recession .20 .069 Normal 40 .135 Boom .25 .215 Fill in the values in the spreadsheet. - Problem 3 A stock has an expected return of 12.4 percent and a beta of 1.37. The market expected return is 10 percent. What must the risk-free rate be? Fill in the values in the spreadsheet. - Problem 3 A stock has an expected return of 12.4 percent and a beta of 1.37. The market expected return is 10 percent. What must the risk-free rate be? Fill in the values in the spreadsheet. - Problem 4 King Fisher Aviation has a target capital structure of 72 percent common stock and 28 percent debt. Their cost of equity is 12 percent and the cost of debt is 5 percent. The tax rate is 40 percent. What is King Fisher's WACC? Fill in the values in the spreadsheet. - Problem 5 King Fisher Aviation issued a 25 year, 6.8 percent semiannual bond 8 years ago. The bond sells today for 110 percent of its face value. The tax rate is 40% 1. What is the pretax cost of debt? 2. What is the after-tax cost of debt? 3. Which is more relevant, the pretax or the after-tax cost of debt? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts