Question: ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ Please only answer the instructions above based on the 2 cases below, thank you for your help. _______________________________________________________________________________________________________________________________ Case 1: Compute the NPV of

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Please only answer the instructions above based on the 2 cases below, thank you for your help.

_______________________________________________________________________________________________________________________________

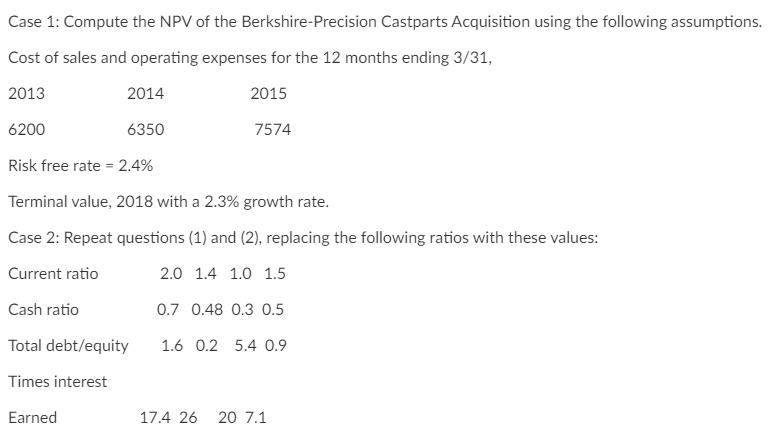

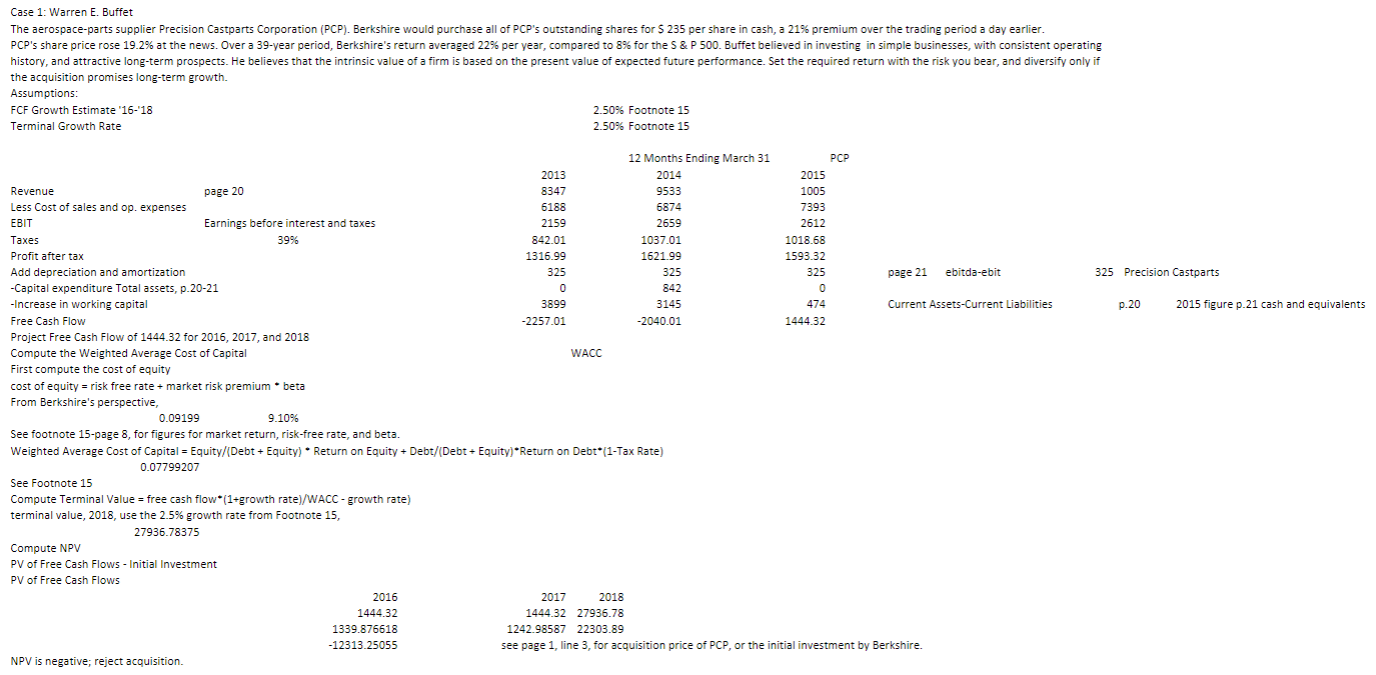

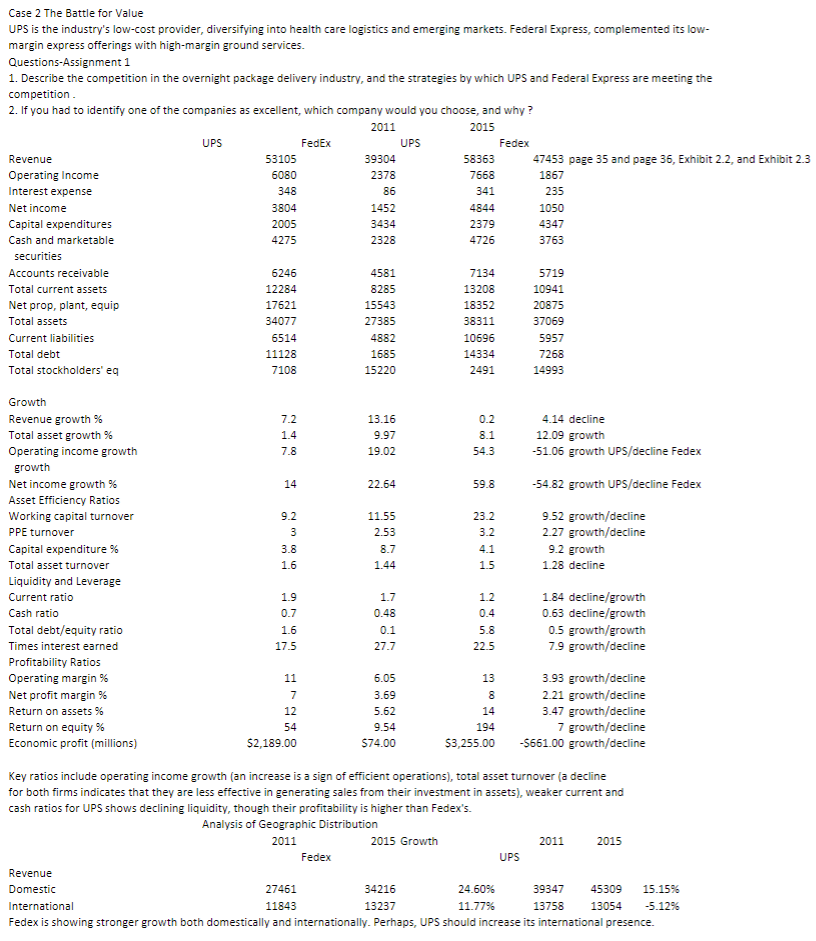

Case 1: Compute the NPV of the Berkshire-Precision Castparts Acquisition using the following assumptions. Cost of sales and operating expenses for the 12 months ending 3/31, Risk free rate =2.4% Terminal value, 2018 with a 2.3% growth rate. Case 2: Repeat questions (1) and (2), replacing the following ratios with these values: Case 1: Warren E. Buffet Case 2 The Battle for Value UPS is the industry's low-cost provider, diversifying into health care logistics and emerging markets. Federal Express, complemented its lowmargin express offerings with high-margin ground services. Questions-Assignment 1 1 Descrihe the comnetition in the overnight narkade deliverv inductrv and the strategies hu which IIPS and Federal Fxarecs are meetind the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts